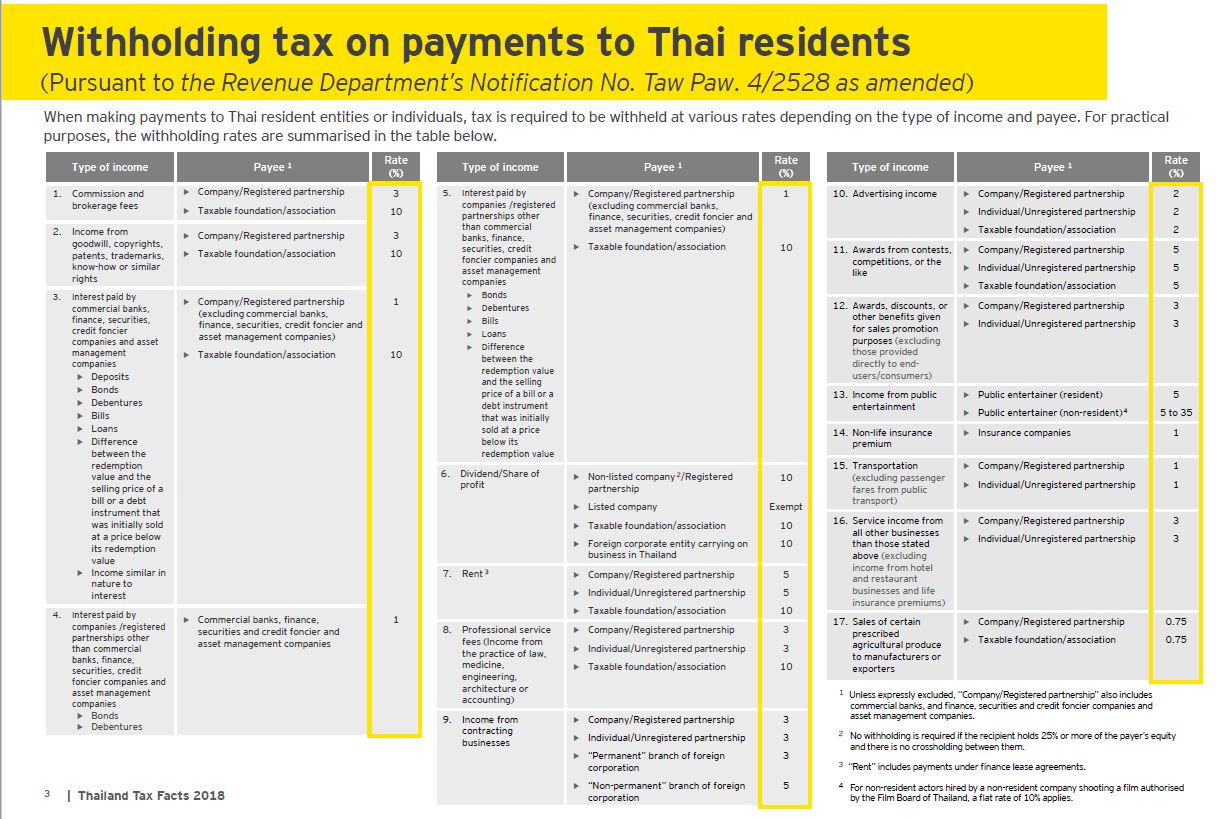

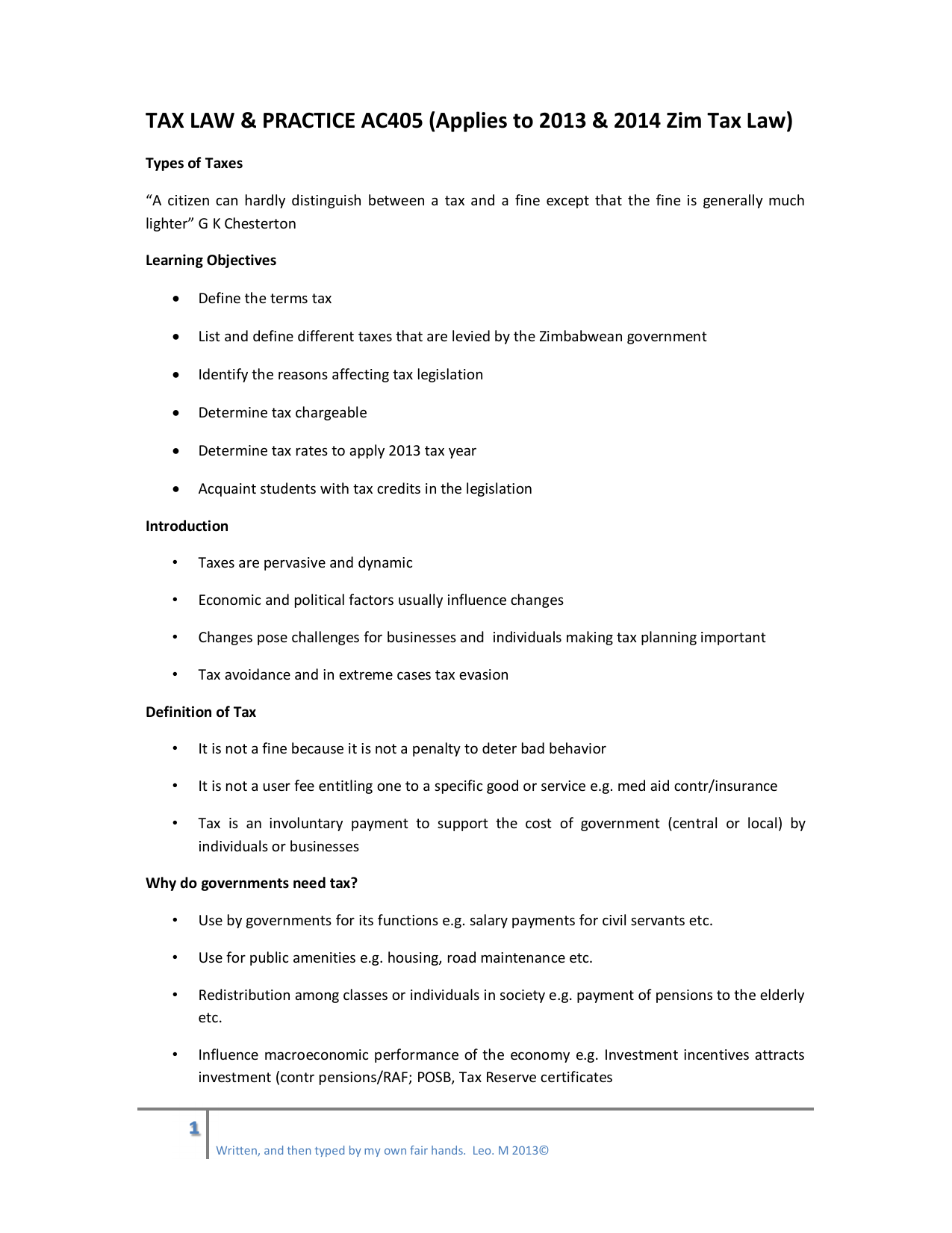

Get our comprehensive guide to Zimbabwean tax covering. It is a government requirement for the payer of income to withhold or deduct tax from the payment income accruing to the payee and remit that tax to Zimbabwe Revenue Authority ZIMRA.

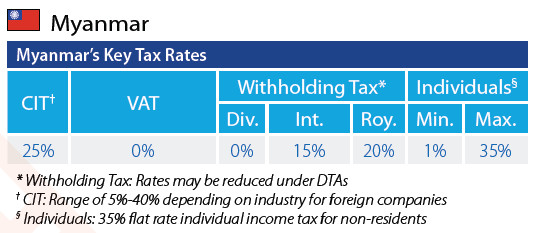

Asiapedia Key Tax Rates In Myanmar Dezan Shira Associates

One of a suite of free online calculators provided by the team at iCalculator.

Withholding tax rates in zimbabwe. Dividends from companies listed on the Zimbabwe Stock Exchange have a rate of 10. Tax planning and tax minimising strategies. NRST is payable at a rate of 15 unless treaty relief is available.

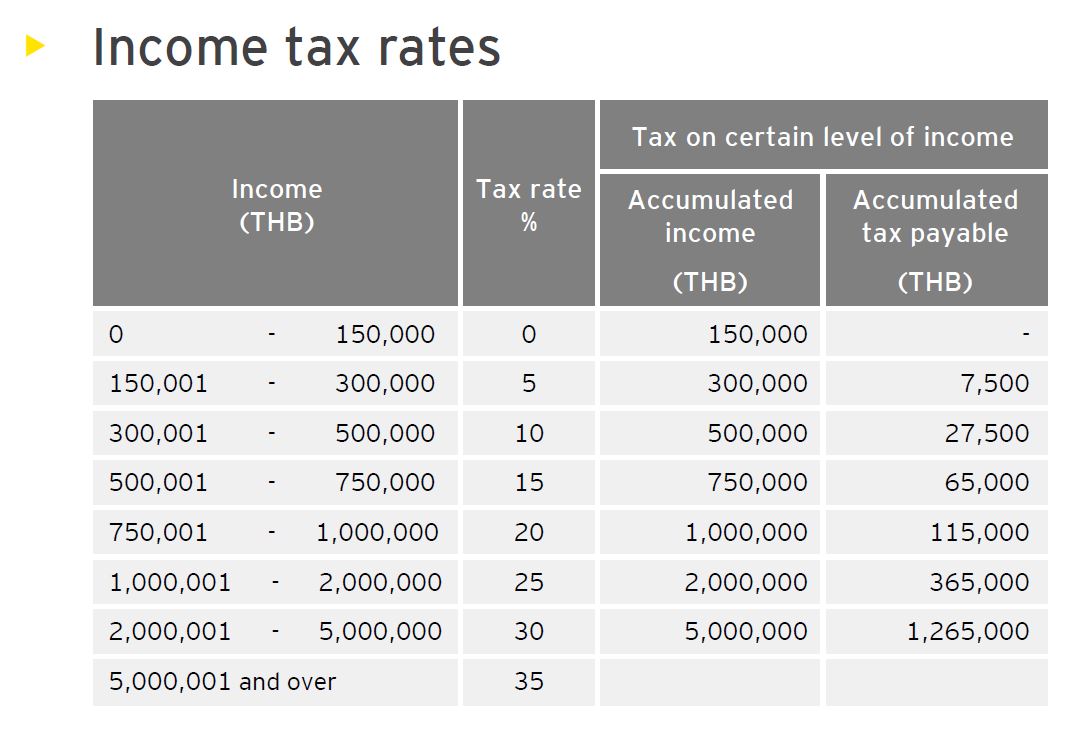

Withholding tax and its returns. No Presumptive Tax will be levied on importations. A company is resident in Zimbabwe if its central management and control is situated in the country.

A non-listed company is required to apply a withholding tax rate of 15 of the dividend. August to December 2020 PAYE RTGS Tax Tables. Amendments of specified amounts invarious tax provisions.

Exemptions to this tax are POSB Tax Reserve certificates 4 Government six years bonds Building Society Class C shares and interest earned on foreign currency denominated account. VAT tax and its returns. Aug -Dec 2020 Tax Tables RTGSpdf.

Some transactions are taxed at a rate of 145 effective 1 January 2020. Who is a non-executive director. Withholding tax WHT also known as retention tax is an effective tool to combat tax evasion and facilitate easy collection of tax in Zimbabwe.

See how we can help improve your knowledge of Math Physics Tax Engineering and more. A 15 withholding tax is imposed on branches for any payment made in respect of head office charges. Whose supplies of satellite broadcasting services or electronic commerce platforms are more than USD500 000.

Procedures and requirements needed for each tax head. Aug -Dec 2020 Tax Tables USDpdf. The tax guide helps you know your obligations as a business.

Dividends declared by a Zimbabwean company to a non-resident holding company will be subject to non-resident shareholders tax NRST a WHT. Employee tax PAYE and its returns. In cases where payment of the supply is made in instalments the tax shall be withheld on the output tax on each instalment.

Input tax deductions may be claimed subject to certain provisions. Jan -Jul 2020 Tax Tables USDpdf. The rate of Value Added Withholding Tax shall be two thirds of the Output Tax.

What are the obligations of the Value Added Withholding Tax Agents. Tax Tables USD 2020 Jan - Jul. The adjustment of the tax bands so that taxation begins at ZWD 10001 per month and the top rate of 40 applies for income exceeding ZWD 250000 per month as follows.

Tax clearance is required when bidding for tenders. Previously 15 or 0 while other transactions are exempt from VAT. A supplementary budget was presented which proposed to increase government spending by 140 from ZW77 billion to ZW186 billion.

Income tax and its returns. Deductibility of mining royalties effective 010120. Tax rate and payment modalities Section 22J of the Finance Act Chapter 2304 stipulates the rate of the withholding tax on directors fees as.

Review the 2020 Zimbabwe income tax rates and thresholds to allow calculation of salary after tax in 2020 when factoring in health insurance contributions pension contributions and other salary taxes in Zimbabwe. Withholding Tax on local payments It is proposed to amend the definition of Payee for local withholding tax purposes to further exclude a non-resident person. Advice on VAT implications of specific transactions related to corporate operations should be obtained prior to execution of transactions.

Interest paid from a source within Zimbabwe or payable by a person who is ordinarily resident in Zimbabwe to a non resident is charged withholding tax at 10. Changes to rate of Capital Gains Tax and Capital Gains Withholding Tax. A marginal reduction of the VAT standard tax rate from 15 to 145.

Where a Zimbabwe Stock Exchange-listed company pays a dividend to an individual the amount of withholding tax is 10 of the dividend this is to be paid to ZIMRA by the dividend issuer. Up to ZWD 10000 - 0 ZWD 10001 up to 30000 - 20 ZWD 30001 up to 60000 - 25. Did you know that in terms of Section 80 of the Income Tax Act Chapter 2306 a 10 percent withholding tax is deductible from all amounts payable to.

Moreover the amount of fees charged by the head office to. Withholding tax on non-executive directors fees to be final and not subject to a claimable tax credit Conditions to be introduced for venture capitalists to qualify for an income tax exemption Concerning VAT and indirect taxes. 10 Withholding Tax is deducted when payments are made for goods and services supplied.

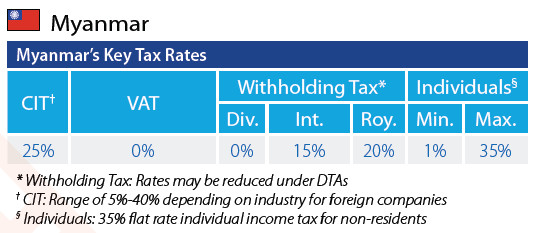

Real Estate Taxation In Thailand Thai Property Group

Chapter 6 Tax Incentives To Use Or Not To Use In Unleashing Growth And Strengthening Resilience In The Caribbean

Withholding Tax Rates Burs Withholding Tax Rates Burs Pdf Pdf4pro

2 Tax Coming To Foreign Currency Transactions Startupbiz Zimbabwe

Zimbabwe Revenue Authority Ppt Download

Pdf Informal Sector Taxes And Equity Evidence From Presumptive Taxation In Zimbabwe

Zimbabwe Tax System Value Added Tax Tax Avoidance

Zimbabwe November 2013 Southern African Development

Zimbabwe Revenue Authority Ppt Download

Zimbabwe Revenue Authority Ppt Download

Zimbabwe Revenue Authority Ppt Download

Zimbabwe Revenue Authority Ppt Download

Tax Training Taxation Of Government Ministries 26 May 2016 At Ksg Ppt Download

Withholding Tax Rates Burs Withholding Tax Rates Burs Pdf Pdf4pro

Withholding Tax Rates Burs Withholding Tax Rates Burs Pdf Pdf4pro

Real Estate Taxation In Thailand Thai Property Group

Withholding Tax Rates Burs Withholding Tax Rates Burs Pdf Pdf4pro

Withholding Tax Rates Burs Withholding Tax Rates Burs Pdf Pdf4pro

![[Download] Whatsapp DP Images ✅ Whatsapp Profile Pictures](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiA91BRwYG5DedFYpMdoyylxsS7zbFCp-nDvQYbuzuYq2c7v8fMoiLnw3VXyV-YRCvIGY1X8nIX3nAxfSIrwHCYDZ0C83ldFP3GkIz5MvoeNzH3OXRlfIaDUPEihdaox8BsF71CNfcOp6fn/w680/whatsapp+dp+%25281%2529.jpg)

![[Download] Kiara Advani Images ( ͡◉ ͜ʖ ͡◉)](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjtddeFOE7-u6iQJSDuyR1y3cVV0Q42mVStdcv9uhHNoImH20LndvwKvNr_ohUxLyLkY-dzlglSxmoH-8HmogVd4oOzmhPleHANfajwSHgqhforffJ6yPQy5bN56dd_aTfnskpoDW3Phrue/w680/kiara+advani+images+%25281%2529.jpg)