Either 5 of the tax payable or twenty thousand shillings whichever is higher. Deducted and remitted on or before the 20th of the following month.

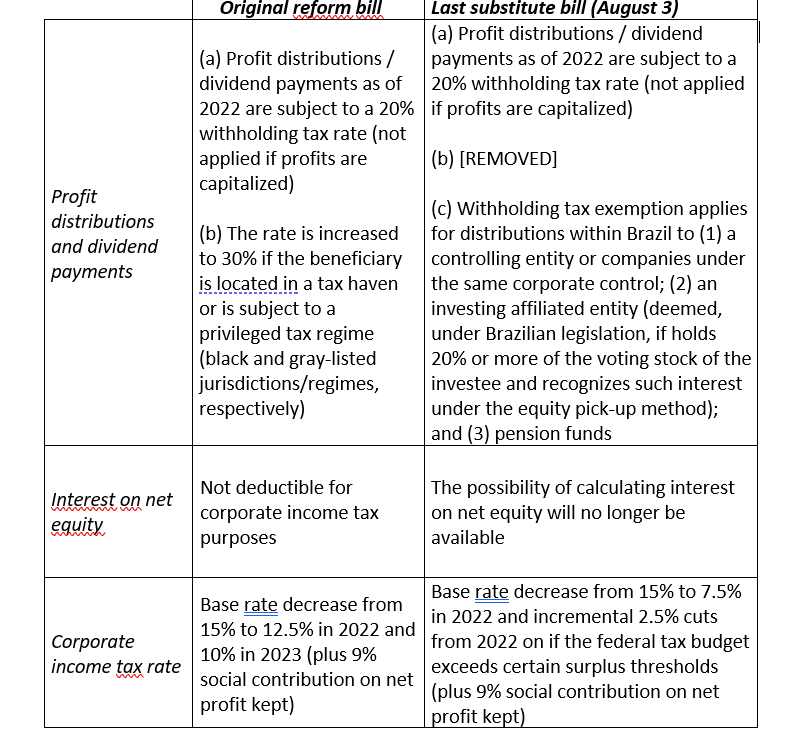

Guide To Starting A Business In The Netherlands Legalee

480 K250 per annum An officer may prior to the date of retirement elect to receive three-quarters of his annual pension and to receive in lieu of the other one-quarter a lump sum gratuity equal to twenty times its amount.

Pension withholding tax rates kenya. Dividends received by a company resident in Kenya from a local subsidiary or associated company in which it controls directly or indirectly 125. Tax Free Pension Benefits in Kenya At withdrawal or retirement you are entitled to receive tax free lump sum payment from the fund of Kshs. On first KShs 400000.

Pension withdrawal tax rates The Act has reduced the highest tax band on pension withdrawals from registered retirement funds after 15 years to 25 for amounts exceeding KES1200000 per annum. The following tax band will apply to such income. 25 On any amount in excess of KShs 1600000.

Pension withdrawal tax rates. Monthly personal Relief Ksh 2400 28800 annually On pensions the new tax rates are. For example if you are a member of a registered retirement benefits scheme earn Kshs 200000 and contribute 75 percent of your salary every month and your employer contributes a similar amount the figures will be.

The rate is. What is exempt from Withholding Tax. 60000- for every year of membership in the scheme up to a maximum of Kshs.

On next KShs 400000. Withholding tax at the rate of 20 on payments made to a non-resident entity in respect of sales promotion marketing advertising services and transportation of goods excluding air transport services has been introduced. 11181 but under Kshs.

Interest when paid to both resident and non-resident persons is liable to withholding tax at 15 on the gross interest paid with the exception of interest from housing bonds to resident persons which is subject to withholding tax at the rate of 10 on the gross interest paid. On retirement before 65yrs the annual tax free pension is Kshs300000. On next KShs 400000.

The person making the payment is responsible for deducting and remitting the tax to Kenya Revenue Authority KRA. Shall be final tax wef 01012014 20 20 Pensions Pension withdrawals graduated rates 10-30 5 Excludes commission paid to non-residents for international travel air tickets. KRA Withholding Tax rates This is a method whereby the payer of certain incomes is responsible for deducting tax at source from payments made and remitting the deducted tax to KRA.

Under the 9th Schedule to the Income Tax Act a. On next KShs 400000. 1118 on Taxable Income of Kshs.

Interest from banks at 15 dividends at 5 and royalties at 5 insurance commission at 5 and consultancy fee 5 for residents. Withholding Tax is deducted at source from several income like. 20000 minus NSSF contributions per month or 30 percent of pensionable emoluments whichever one is less.

However any presumptive tax will be claimed. On the next Shs 16666 200000 pa 20. Where the treaty rate is higher than the non-treaty rate the lower rate applies.

The Finance Act 2018 introduced presumptive tax at the rate of 15 of the Single Business Permit fee issued by the County Government. Withholding Tax Transactions in Kenya. Any amount in excess of tax free amounts.

11180 10 For Taxable Income from Kshs. Businesses liable to turnover tax will still be liable to presumptive tax. YEAR 2017 MONTHLY TAXABLE INCOME INCOME BRACKETS TAX ON TAXABLE INCOME TAX RATE IN EACH SHILLING For Taxable Income under Kshs.

10 years x 12 months x K1000-0-00cts pa. However the KRA has in the past taken the position that the management or professional fees would fall on the Article on other income and should therefore be subject to withholding tax at 20. One is required to declare the income and the withholding tax certificates upon filing individual tax returns and pay any tax due What is the penalty for late filing.

Pensions and Lumpsum payments after age 65 are tax free. This is to ensure that non-residents who provide such services to a Kenyan resident are subject to tax in respect to income earned in or derived from Kenya. On all income amounts in excess of Shs 57334 688000 25.

The highest pension withdrawal tax rate has been reinstated to 30 for amounts above KES1600000 when withdrawn after 15 years or when the other prescribed conditions are met by an individual. Rate may be less for countries with double tax treaty with Kenya. KRA Withholding Tax rates.

The percentage deducted varies between incomes and is dependent on whether you are a resident or non- resident. 21 Zeilen Pensionsprovident schemes withdrawal 10. In Kenya contributors enjoy a maximum tax benefit of Kshs.

2017 EMPLOYERS GUIDE TO PAYE KENYA REVENUE AUTHORITY P38 TAX TABLES TAX TABLE FOR MONTHLY INCOME. On the next Shs 16667 200000 pa 15. In addition the Act has widened the tax bands on income withdrawals from retirement funds before the expiration of 15 years in line with the individual tax rates highlighted above.

Dehmal Financial Consultancy Posts Facebook

Tax Accounting Impact 2020 Tax Plan

.jpg)

Tax Accounting Impact Tax Plan 2019 Pwc Insights And Publications

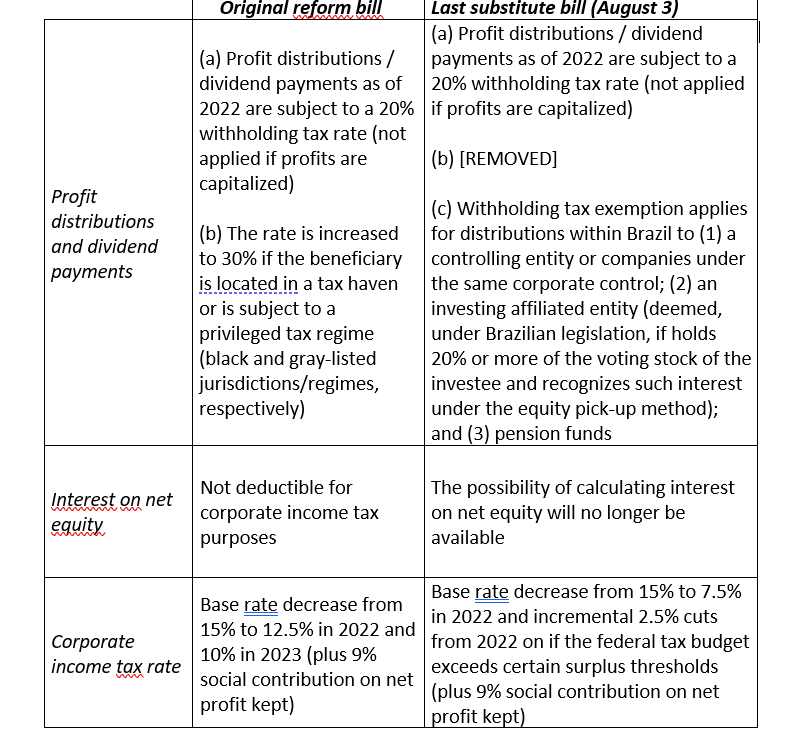

Brazil S Upcoming Tax Reform Will Impact Inbound Investors Mne Tax

Global Corporate And Withholding Tax Rates Tax Deloitte

.webp)

Tax Regulations For Dutch Companies

Tax Formula Tax Tax Deductions Adjusted Gross Income

Global Corporate And Withholding Tax Rates Tax Deloitte

Corporate Income Dividend Withholding Tax Outline

Agreements On Beps 2 0 Provides Needed Breakthrough On The Future Of International Tax International Tax Review

Germany Taxing Wages 2021 Oecd Ilibrary

Corporate Income Dividend Withholding Tax Outline

Taxation In The Netherlands Doing Business In The Netherlands 2021 Pwc Netherlands

Https Www Ibfd Org Sites Ibfd Org Files Content Pdf 18 043 Global Individual Tax Handbook Final Web Pdf

Update Withholding Tax On Interest And Royalty Payments To Low Tax Countries

Irs Webinar For Small Business Tax Changes 2018 Tax Reform Basics For Small Businesses And Pass Through Entities Thursday N Irs Taxes Income Tax Filing Taxes

Conditional Withholding Tax On Dividend Payments Proposed Deloitte Netherlands

![[Download] Whatsapp DP Images ✅ Whatsapp Profile Pictures](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiA91BRwYG5DedFYpMdoyylxsS7zbFCp-nDvQYbuzuYq2c7v8fMoiLnw3VXyV-YRCvIGY1X8nIX3nAxfSIrwHCYDZ0C83ldFP3GkIz5MvoeNzH3OXRlfIaDUPEihdaox8BsF71CNfcOp6fn/w680/whatsapp+dp+%25281%2529.jpg)

![[Download] Kiara Advani Images ( ͡◉ ͜ʖ ͡◉)](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjtddeFOE7-u6iQJSDuyR1y3cVV0Q42mVStdcv9uhHNoImH20LndvwKvNr_ohUxLyLkY-dzlglSxmoH-8HmogVd4oOzmhPleHANfajwSHgqhforffJ6yPQy5bN56dd_aTfnskpoDW3Phrue/w680/kiara+advani+images+%25281%2529.jpg)