The New York self employment tax is calculated in two sections. You must provide all of the following.

I Heard I Need To Look For Work While Getting Unemployment Do I Homeunemployed Com

For 2020 that amount is the first 137700 of your net earnings.

Self employment unemployment ny. Documentation required to report self-employment income. 600 Unemployment Benefits Updates April 12 - YouTube. One employer ONE EMPLOYER.

There is no way I can say with. If you work part time Eligible for at least 13 more weeks of unemployment insurance UI benefits Identified by the States profiling system as likely to. UI claimants will not receive benefits on an expired claim unless deemed not qualified for a new claim after reapplying.

Job you accept must be part time. Unemployment payments are not considered earned income. To be eligible for the fourth grant you must be a self-employed individual or a member of a partnership.

Get Unemployment Assistance. 2 New York PUA self-employment New York Question. First a set amount is established each year against which the 124 of Social Security is applied.

Following the expiration of New York States COVID-19 State of Emergency the Unemployment Insurance unpaid waiting period rule is once again in effect. Archived New York PUA self-employment New York Question. You cannot claim the grant if you trade through.

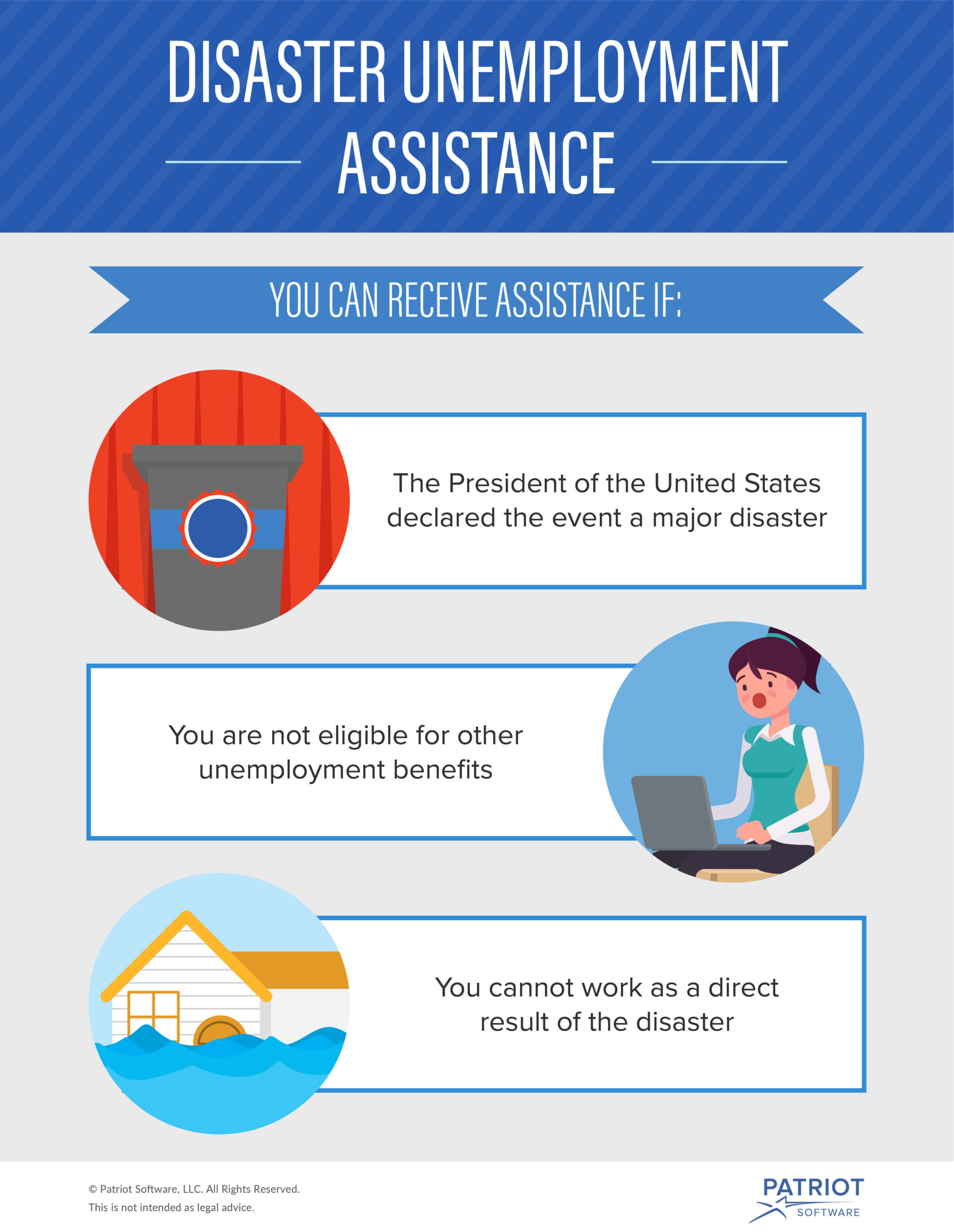

The Self-Employment Assistance Program SEAP is federally endorsed and provides a special type of unemployment aid to people who are displaced or out of work while starting a new business. In New York State employers pay contributions that fund Unemployment Insurance. To collect benefits you must be ready willing and able to work and actively looking for work during each week in which you are claiming benefits.

New Unemployment Insurance claims filed on and after June 28 2021 will include an unpaid waiting week. Log In Sign Up. Claimants receiving UI benefits including Pandemic Emergency Unemployment Compensation PEUC and Extended Benefits EB must file a new claim online or through NYS DOLs automated phone system after their BYE date.

Could someone who is self-employed and has successfully submitted an unemployment claim in NY Im upstate not NYC metro arearegion explain the questions asked and how the eligibility determination is made. How to file an Unemployment Insurance Claim on New York State Department of Labors Website PERSONAL INFORMATION PART I How many employers have you worked for in the past 18 months If you were only self-employed and had no other employment in the past 18 months select One employer from the drop-down. I am self-employed and with a reasonable expectation of no income until things return to normal.

You must file an Unemployment Insurance claim to find out if you are eligible and learn your actual benefit amount. At least 18 years of age Eligible to receive at least 13 or more additional weeks of Unemployment Insurance UI benefits The recipient of an invitation letter from the New York State Department of Labor or categorized as a dislocated worker determined via a profile score. File a claim online to receive temporary income while you search for a job.

The second amount the 29 Medicare payment is applied to all your combined net earnings. If you were just getting your small business operational when lockdown orders began you may be eligible for funding through the federal government with this program. Copy of your Schedule C Profit or Loss from Business from your federal income tax return for the tax year noted on your letter.

If you are living andor willing to look for work in the state of New York you may also file your claim by calling the Telephone Claims Center at 1-888-209-8124 duringregular business hours. Any license registration or. What You Need to Know.

APPLYING FOR THE SELF-EMPLOYMENT ASSISTANCE PROGRAM SEAP The SEAP is open to people who are out of work and meet certain requirements. You can apply to Self-Employment Assistance Program SEAP if you are. Although you pay taxes on Unemployment payments it does not show on your Schedule C line 7 or line 31 because your Schedule C is only for self-employment income while Unemployment is Unemployment So you cant count Unemployment payments as income in order to get a higher PPP.

Self Employed How To Claim 600 Week Unemployment Youtube

Unemployment Insurance Benefits For Self Employed Contractors And Farmers Department Of Labor

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Https Coronavirus Health Ny Gov Unemployment Insurance Guidance Self Employed Individuals

Https Dol Ny Gov Eligibility Self Employment Assistance Program Seap P52

Login For Resources To Self Employment Assistance Program Seap New York State Department Of Labor Self Employment Employment New York State

How To File A Claim For Unemployment Insurance In Ny Uber Or Lyft Driver Or Any Self Employed Youtube

Heres What The Relief Packages Give Self Employed Workers Paid Time Off Grocery Planning Self Employment

Pandemic Unemployment New York State Department Of Labor Facebook

Self Employed Vs Independent Contractor What S The Difference

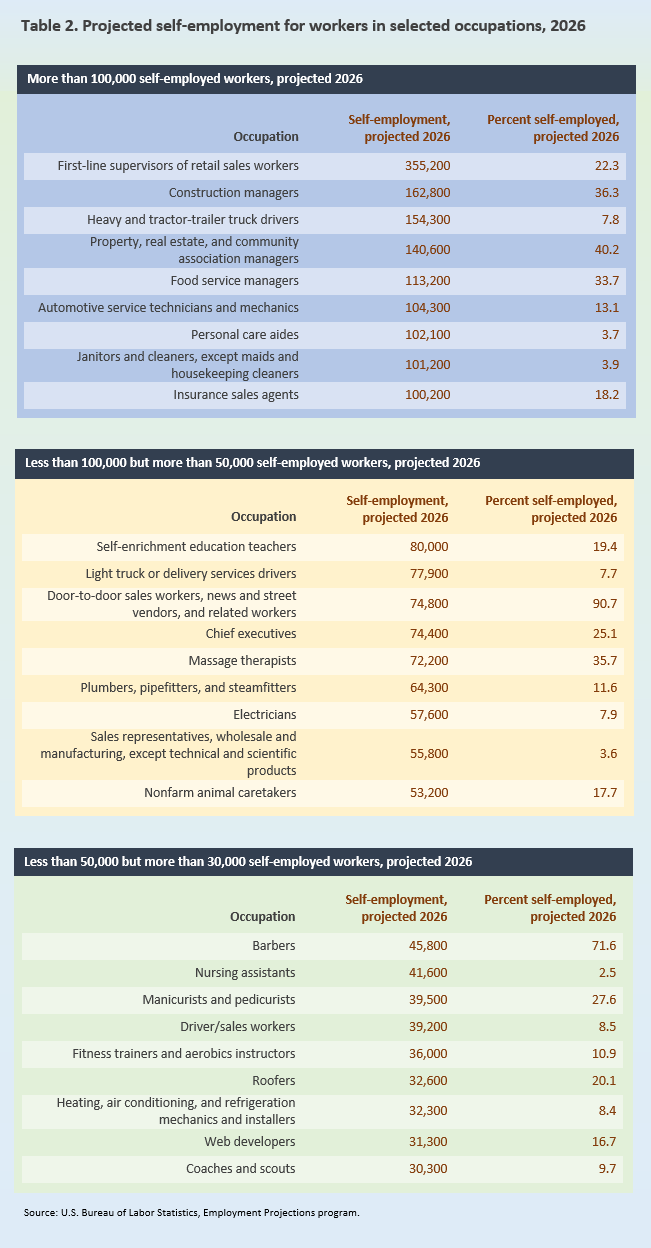

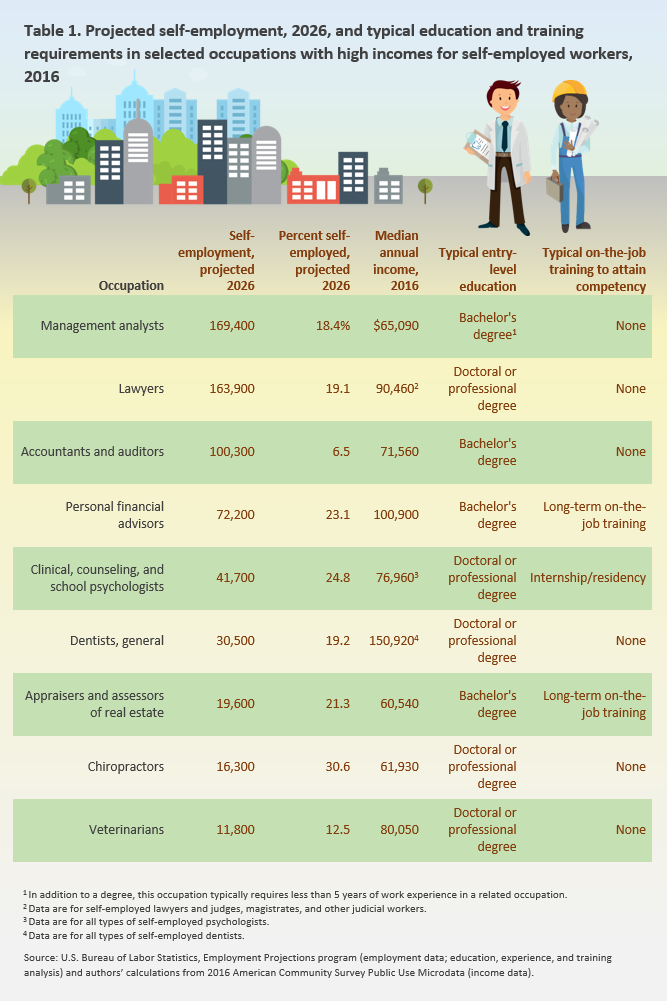

Small Business Options Occupational Outlook For Self Employed Workers Career Outlook U S Bureau Of Labor Statistics

Why You Need To Understand The Difference Between Independent Contractor Self Employed And Employee Nurse Practitioners In Business

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Unemployment Insurance Benefits For Self Employed Contractors And Farmers Department Of Labor

How To File For Unemployment Benefits If You Re Self Employed Youtube

Self Employed Unemployment Insurance Can Business Owners File

Can I Get Unemployment If I M Self Employed Credit Karma

Small Business Options Occupational Outlook For Self Employed Workers Career Outlook U S Bureau Of Labor Statistics