Because Ohio collects a state income tax your employer will withhold money from your paycheck for that tax as well. Ohio 2020 SUI tax rates increase taxable wage base decreases.

What Are Employee And Employer Payroll Taxes Ask Gusto

3560 1424 of excess of 5000.

Employment tax rates ohio. The Ohio self employment tax totals 153 with 124 covering Social Security and 29 going to Medicare. Ohio Employer Withholding Tax Tables 2021 are the established of info that can help employers to determine the amount of tax that ought to be withheld off their employees income. As mentioned above Ohio state income tax rates range from 0 to 4797 across six brackets.

But youll also see a withholding for state taxes. 0712 of Ohio taxable income. UI tax is paid on each employees wages up to a maximum annual amount.

New Employer Rate If an employers account is not eligible for an experience rate the account will be assigned a standard new employer rate of 27 unless the employer is engaged in the construction industry in which case the 2017 rate is 62 the 2018 rate is 60 the 2019 rate is 59 the 2020 rate is 58 and the 2021 rate is 58. The 2020 SUI taxable wage base reverts to 9000 down from 9500 for 2018 and 2019. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in the downloadable XLS file.

24915 3559 of excess over 15000. Exempts employment labor services and employment placement services from sales tax. If an employers account is not eligible for an experience rating it will be assigned a standard new employer rate of 27 percent.

The same brackets apply to all taxpayers regardless of filing status. Act by December 31 to potentially lower tax rates The Ohio 2020 state unemployment insurance SUI tax rates will range from 03 to 94 up from the 2019 range of 03 to 92. W-2s need to reflect the 4-digit school district number.

For example San Francisco Denver and Newark require employees to pay local income taxes. Ohios Department of Job and Family Services notes that the exact tax rate will be determined for each enterprise. 58 2009 State Business Tax Climate Index.

Standard rate 257 207 employer share. 030 142 including solvency surtax California. Changes to Ohio Unemployment Tax Rates.

Made no significant changes to the business income deduction which offers many business owners a lower 3 tax rate on qualifying income. In OH the average rate for counties and large municipalities weighted by total personal income within each jurisdiction is 182 weighted local rates are from Tax Foundation Background Paper No. For a full list of changes to Ohio unemployment tax rates see the Department of Jobs and Family.

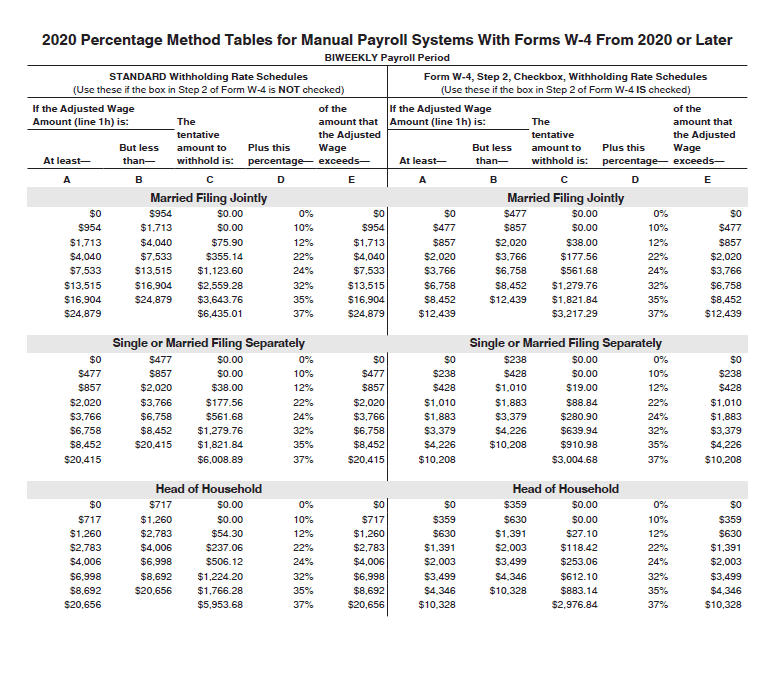

However its always possible the amount could change. 10680 2847 of excess over 10000. To make use of the desk and determine the federal income tax withholding the employers need to utilize the info through the W4 form employees filing statuses and the pay out consistency.

SUI tax rates range from 03 to 90. Ohio These occupational employment and wage estimates are calculated with data collected from employers in all industry sectors in metropolitan and nonmetropolitan areas in Ohio. 050 employee share 15 59.

For more information about contribution rates visit httpsjfsohiogovouiouctaxratesstm. How much do I owe in self employment tax to the government. SUI New Employer Tax Rate Employer Tax Rate Range 2021 Alabama.

The state UI tax rate for new employers also known as the standard beginning tax rate can change from one year to the next. Issues that arise regarding these taxes are generally complex. That amount known as the taxable wage base has been stable at 9000 in Ohio since the year 2000.

The first bracket covers income up to 22150 while the highest bracket covers income. Each state sets its own withholding tax rates such as Arizona which withholds between 008 and 51 depending on the number of deductions an employee is eligible for. Ohio employer and school district withholding tax filing guidelines 2021 School district tax rates.

Each year brings changes to Ohio unemployment tax rates. While the Lowest Experience Rate and New Employer Rate have held constant since 2017 the Highest Experience Rate has gone up by 02 each year. Ohio employers also have the responsibility to withhold school district income tax from the pay of employees who reside in a school district that has enacted such a tax.

In states with large urban areas youll often find local taxes added to your employment tax requirements. Reduces personal income tax rates Ohio top rate is now 399 versus 4797. New employers in the construction industry are to be assessed a rate of 580 in 2021 also unchanged from 2020.

42710 427 of excess over 20000. The new-employer tax rate is to be 270 for 2021 unchanged from 2020. Making it imperative a tax lawyer is contacted to help protect your interests.

15 62 emergency 15 surcharge. Ohio State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state SUI in full and on time you get a 90 tax credit on FUTA. 065 68 including employment security assessment of 006 Alaska.

However employers are expected to contribute at a tentative rate of 27 percent. Ohio local income taxes which are referred to unofficially as the RITA Tax range from 05 to 275. Wage Base and Tax Rates.

There are -447 days left until Tax Day on April 16th 2020. Ohios unemployment taxable wage base will remain at 9000 for 2021. More details on employer withholding are available below.

Federal Withholding Table 2021 Payroll Calendar

Sui Sit Employment Taxes Explained Emptech Com

Grow Your Freelance Business Reducing Self Employment Taxes 42 West The Adorama Learning Center Small Business Tax Business Tax Capital Gains Tax

2021 Federal State Payroll Tax Rates For Employers

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

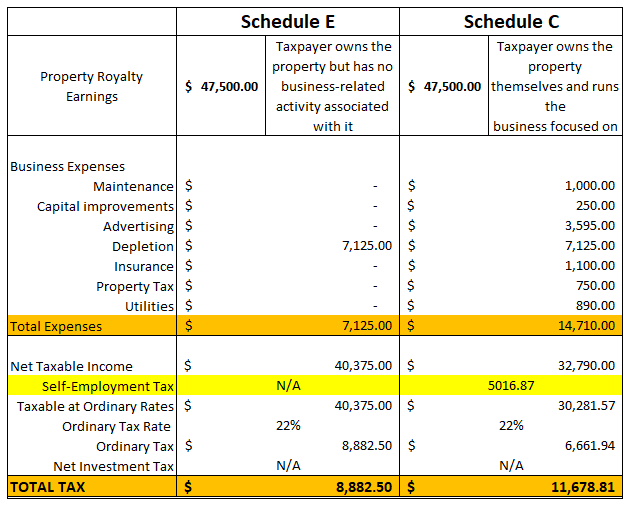

Royalty Income Taxes For 2020 With Filling Procedures Taxhub

Sui Sit Employment Taxes Explained Emptech Com

Employer Withholding Department Of Taxation

Are You Properly Classifying Sales Employees Connectedpayroll Payroll Connectpay In 2020 Business Continuity Planning Payroll Business Continuity

Key Issues Tax Expenditures Types Of Taxes Tax Infographic

2021 Federal State Payroll Tax Rates For Employers

High Taxes Mean Less Revenue For Some States Personal Liberty Map Illinois States

Payroll Tax What It Is How To Calculate It Bench Accounting

Pin By Sara Elizabeth Siegler On Whistleblower The Ohio State University Medical University Ohio State

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita