1 using BIR Form No. WITHHOLDING TAX COMPUTATION UNDER TRAIN LAW USING VERSION 2 TABLE.

Withholding Tax Computation Under The Train Law Lvs Rich Publishing

Under the TRAIN law the compensation range that is not subject to tax has been increased to P2083300 for monthly paid employees.

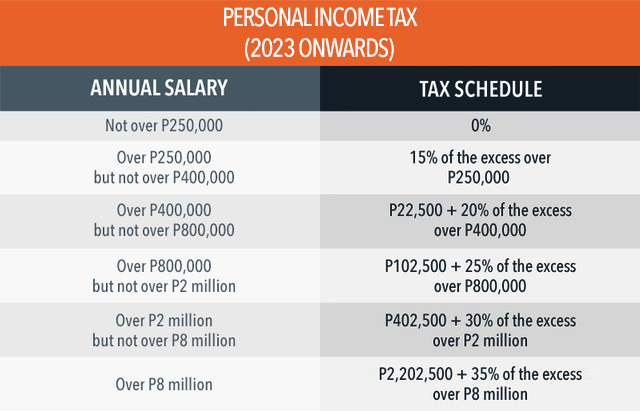

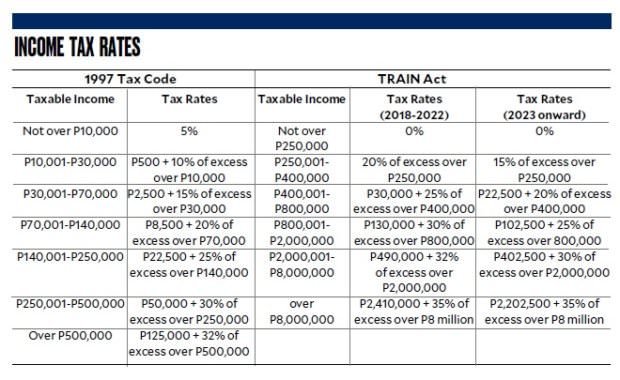

Withholding tax table train law. The BIR has released a withholding tax table for the convenience of taxpayers. Vi Finally the highest income tier receiving salaries of at least P8 million per year will have withholding taxes of P241 million plus 35 of the excess over P8 million. The Tax Reform for Acceleration and Inclusion TRAIN Act has lowered the personal income tax since the 2018 taxable year.

RA 10963 became effective last January 1 2018. 10963 TRAIN Law relative to some changes in the rate of Creditable Withholding Tax on certain income payments Published in Manila Bulletin on February 11 2019 Digest Full Text. New tax base for value-added tax vat under train law from 1919500 to 3 000000 threshold with the same tax rate of 12.

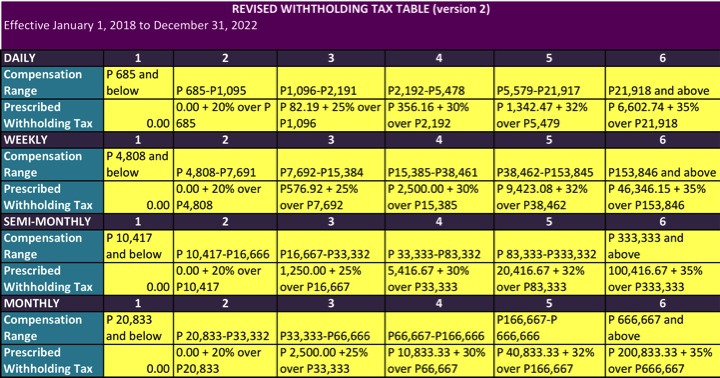

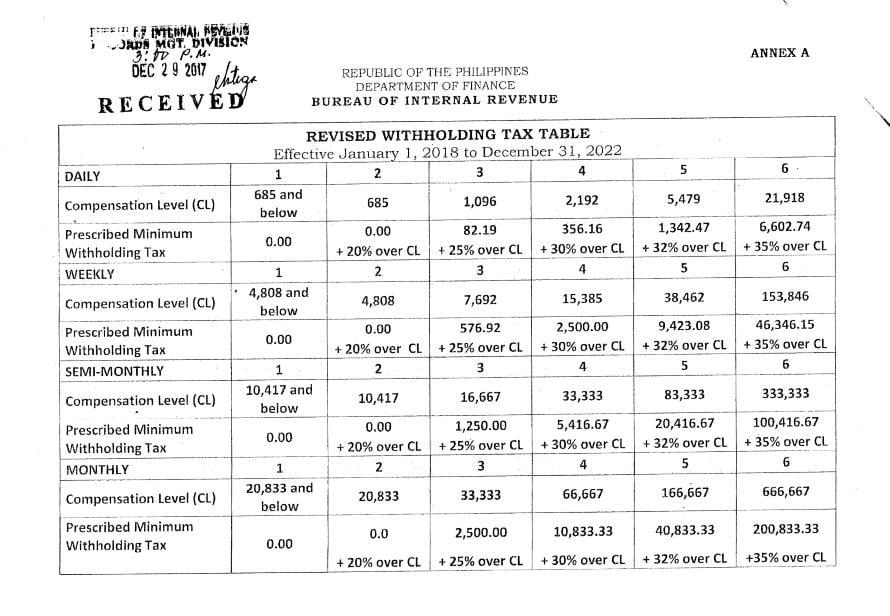

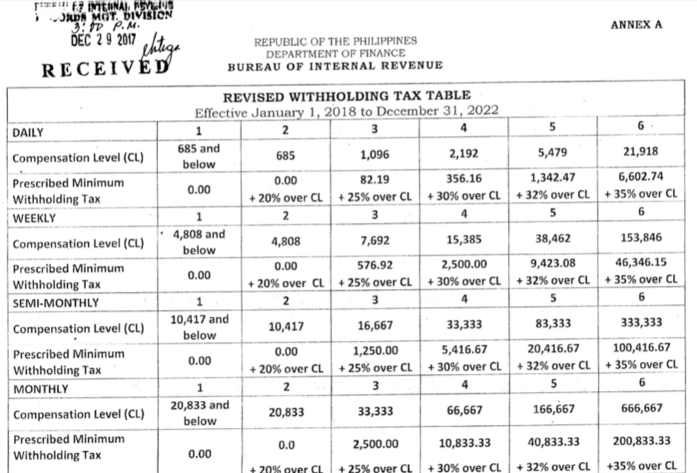

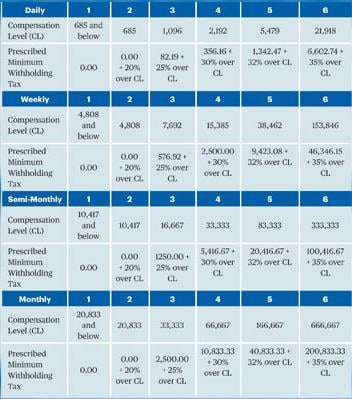

The Bureau of Internal Revenue BIR has circularized the Revised Withholding Tax Table which should be used in computing the tax to be withheld on every payment of compensation to employees. Further amends certain provisions of RR No. The Table is effective from January 1 2018 to December 31 2022.

Graduated income tax rates. However the Bureau of Internet Revenue BIR in its Revenue Memorandum Circulars published a much specific and understandable Revised Withholding Tax Table. The tax reform law introduced a new tax structure that has resulted in higher take-home pay for employees in the Philippines.

Employee A has a total taxable gross income of 250000 less the non-taxable of 2000 which will result to taxable income of 248000. It is a method of collection of tax thats supposed to be paid to the government. With the advent of this bills signing into law the government aims to address the decades long inequity in the taxation policies from past administrations that hurt the poor and the middle class.

Withholding agents not later than January 15 of each year or at least prior to the initial payment of the professional feescommissionstalent fees etc in order for them to be subject to 5 withholding tax. Income taxes are expected to go down further with the new graduated rates starting January 1 2023. The Bureau of Internal Revenue BIR has issued a memorandum on the revised withholding tax table.

1601E and BIR Form No. Based on the new annual tax table the compensation range is covered by row 1. After the implementation of TRAIN LAW here are the Forms you need to file.

The new TRAIN tax rates are as follows. Inclusion of identified top 5000 individuals and taxpayers identified as medium taxpayers and those under the Taxpayer Account Management Program to top withholding agents who shall withhold 1 and 2 withholding tax on income payments on supplies of goods and services. 10963 Otherwise Known as the Tax Reform for Acceleration and Inclusion TRAIN Law Relative to Withholding of Income Tax.

The taxable income is less. 11-2018 which implemented the provisions of RA No. It is effective January 1 2018 to December 31 2022.

The 10 withholding tax rate shall be applied in the following cases. The maximum tax rate was also increased to 35 but this is for those earning above P8 million each year. By using the monthly withholding tax table the withholding tax beginning January 2018 is computed by referring to compensation range under column 2 which shows a predetermined tax of 000 on P20833 plus 20 of the excess of Compensation Range Minimum amounting to P9167 P25000 P5000 20833 which is P183340.

The computation of the income tax under the TRAIN Law is based on annual salary and corresponding annual tax rate. Under the TRAIN law there will be revised rates of the individual income tax effective on January 1 2023. All Internal Revenue Officers and Others Concerned Pursuant to the provisions of Section 244 of the National Internal Revenue Code and the provisions.

2-98 as amended by RR No. Pursuant to this the Bureau of Internal Revenue BIR has issued Revenue Memorandum Circular RMC 105-2017 releasing the new withholding tax. Revised Withholding Tax Table on Compensation.

Under the TRAIN Law a tax exemption was applied to those earning less than P250000 a year. The Tax Reform for Acceleration and Inclusion TRAIN Law otherwise known as Republic Act No. Effective January 1 2018 to December 31 2022 DAILY.

Agents and by income payorswithholding agents to the BIR. 10963 otherwise known as the Tax Reform for Acceleration and Inclusion or the TRAIN law as it is commonly referred to in daily parlance. 1 the payee failed to.

Withholding tax is not a tax. Again these rates will be implemented from 2018 until 2022. Using the above-mentioned annual tax table based on the TRAIN law you may now be able to check whether you have a tax refund or not.

On December 19 2017 President Rodrigo Duterte enacted into law the Republic Act no. REVISED WITHHOLDING TAX TABLE. All companies must update their employees compensation records which has already started last January 1 2018 under the implementation of Tax Reform Law RA 10963 also known as Tax Reform for Acceleration and Inclusion TRAIN.

CREATE LAW 2021 on Corporate Income Tax April 29 2021 To find out updates on corporate income tax under the CREATE Law 2021. Before the Implementation of Train Law on January 2018 taxpayers file Expanded Withholding Tax EWT on or before the 10 th of the following month and on or before Mar.

Tax Calculator Compute Your New Income Tax

How To Compute Withholding Tax Based On The Newly Enacted Train Law Tax Reform For Acceleration And Inclusion Sprout Solutions

Revised Withholding Tax Table For Compensation Grant Thornton

Revised Withholding Tax Table Bureau Of Internal Revenue

2021 Bir Train Withholding Tax Calculator Tax Tables

How Train Affects Tax Computation When Processing Payroll Philippines

Withholding Tax And Tax Rates Under Train Law Taxguro

How To Compute Income Tax Withheld On Compensation Under Train Law Reliabooks

2021 Philippine Income Tax Tables Under Train Pinoy Money Talk

Income Tax Law Under Train Law And New Rates In The Philippines

Income Tax Law Under Train Law And New Rates In The Philippines

Nlrc Revised Withholding Tax Table Based On The Tax Facebook

The Accountant S Journal 2018 Train Law The New Income Tax Table

How To Compute Income Tax Withheld On Compensation Under Train Law Reliabooks

Tax Calculator Compute Your New Income Tax

Revised Withholding Tax Table Bureau Of Internal Revenue

Withholding Tax Table In The Philippines Newstogov

Philippines Tax Updates Personal Income Tax Train Law Steemit

Revised Withholding Tax Table On Compensation Grant Thornton