96 Zeilen The WHT rates shown in the table relate to the new DTT. However lower rates of 0 to 15 may apply provided that specific requirements are met as set out in Directive 2003123EC amending Directive 90435EEC on the taxation of parent companies and subsidiaries or in any applicable double tax treaty.

Global Corporate And Withholding Tax Rates Tax Deloitte

Dividends paid by a local entity to a local individual are subject to income tax withholding.

Withholding tax rates uk. Withholding tax Withholding tax may be deducted from dividends and interest you earn on overseas investments. In brief the rules will apply a 20 per cent UK income tax liability on payments. But you may well pay withholding tax on ETFs or other investments held in other territories even if you hold that investment in an ISA or a SIPP.

UK investors are exempt from withholding tax on the income they receive from ETFs domiciled in Ireland and Luxembourg. WHT rate is increased to 35 when the income is paid or due to entities resident in black-listed jurisdictions. Not subject to WHT if the EU Interest Royalty Directive 200349 applies.

WHT rate is increased to 35 when the income is paid in bank accounts open in the name of one or more account holders but on behalf of non-identified third parties. The general withholding tax rate is 20. Relating to the exploitation of IP and other property rights in the UK.

The UK government has double taxation agreements DTAs in. Another 5 percent is charged if the delay exceeds 6 months and again another 5 percent penalty is charged if the delay exceeds 12 months. Additionally if the tax is paid more than 30 days late a penalty of 5 percent of the tax unpaid is charged.

The DTT however provides for a lower rate of 0 where payments are made from a Malaysian entity to a UAE entity. UK withholding tax is a method of collecting tax at source from the person who makes a payment instead of raising an assessment on the recipient. 25 0 0 The Parliament has adopted a 15 withholding tax.

Confirmation that you will be responsible for withholding any tax due. It passes the administrative burden onto the person making the. For example the US Government charges non-US residents withholding tax of 30 on any income received from US investments.

Under the UK regime the UK- REIT pays no tax on its qualifying property income but the company principal company for a Group REIT will withhold UK income tax at the basic rate. Where the recipient company is in a country which does not have a double tax treaty with the UK containing a. UK withholding taxoverview Tax collected from the payer.

As a general rule UK domestic law requires companies making payments of interest to withhold tax at 20. How much relief you get depends on the UKs double-taxation agreement with the country your incomes from. The tax rate applicable is 7 percent for the fiscal year 2020 and 13 percent as of FY 2021.

The UAE-Malaysia DTT provides for a reduced rate of 10 where dividend payments are made from a UAE entity to a Malaysian entity. A 20 percent withholding tax applies to royalties yearly interest certain qualifying annual. The rate is 49 for interest derived from i loans granted by banks and insurance companies and ii bonds or securities that are regularly and substantially traded on a recognised securities market.

Withholding tax is an effective way for tax authorities such as Her Majestys Revenue Customs HMRC to collect tax. However there are a number of exceptions to this. Withholding tax is usually worked out at the UK basic rate.

Find out information on the UKs tax treaties related taxation documents and multilateral agreements. Entertainers or sportspersons with a reduced tax rate. You usually still get relief even if there is not an agreement unless the.

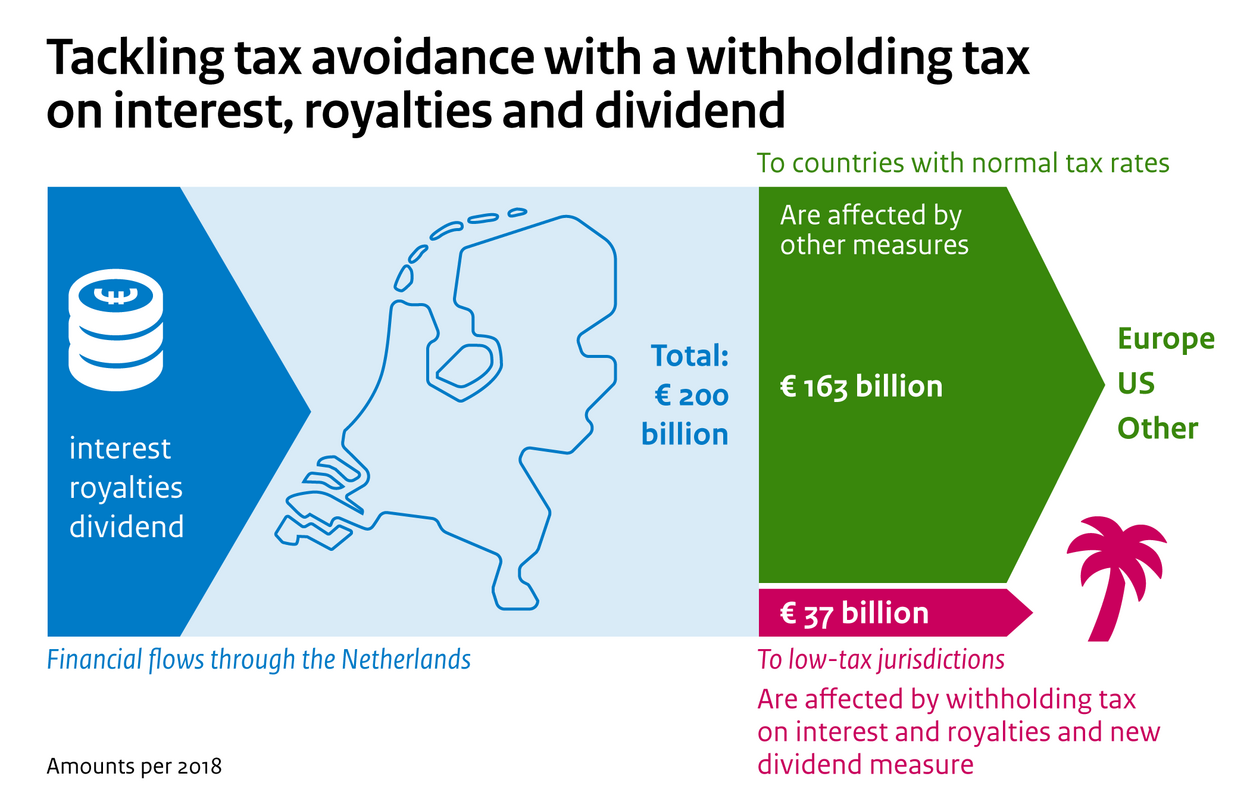

Dividend Withholding Tax Bill Submitted News Item Government Nl

Step By Step Document For Withholding Tax Configuration Sap Blogs

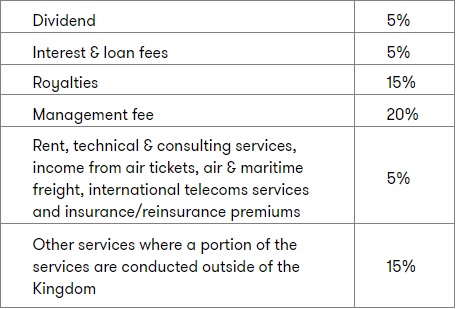

Saudi Tax Zakat Update List Of Topics Ppt Download

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Step By Step Document For Withholding Tax Configuration Sap Blogs

Global Corporate And Withholding Tax Rates Tax Deloitte

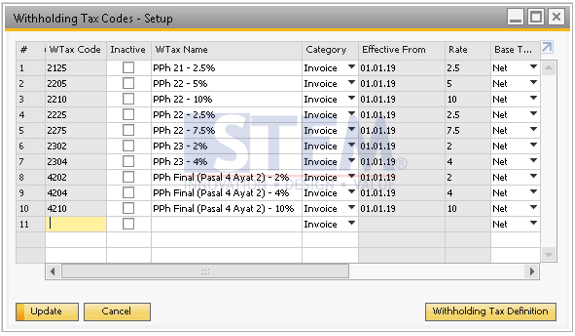

Withholding Tax Codes In Sap Business One Sap Business One Indonesia Tips Stem Sap Gold Partner

Step By Step Document For Withholding Tax Configuration Sap Blogs

Withholding Tax Sap Help Portal

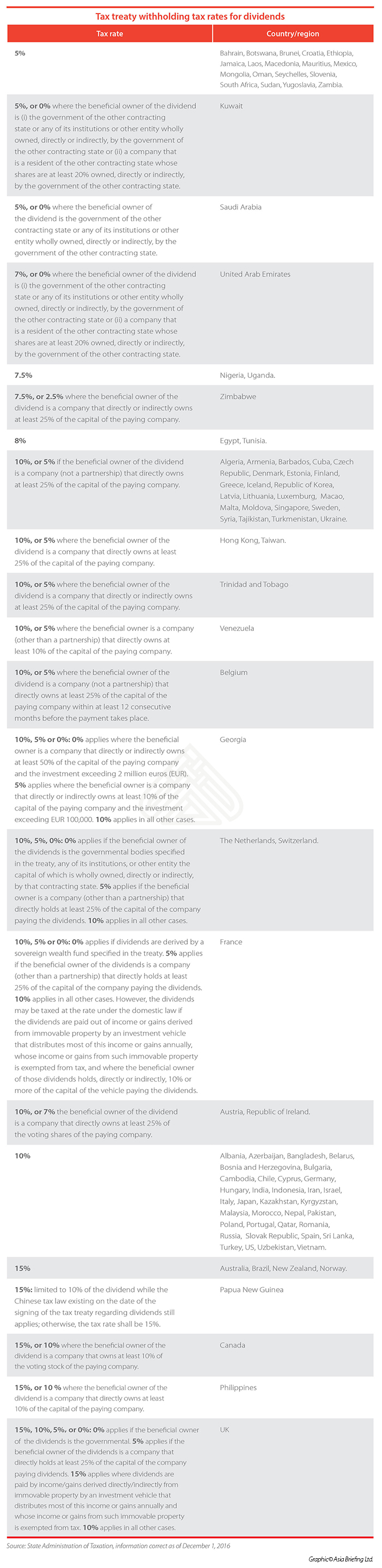

Withholding Tax In China China Briefing News

Step By Step Document For Withholding Tax Configuration Sap Blogs

Bulgaria Business Attraction In The Eu No More Tax

Withholding Tax Codes In Sap Business One Sap Business One Indonesia Tips Stem Sap Gold Partner

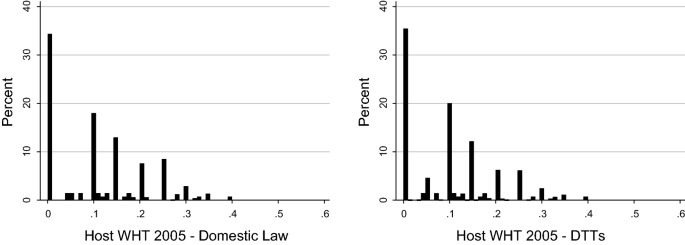

On The Relevance Of Double Tax Treaties Springerlink