Withholding tax rates in the Income Tax Act 2004. The 2 rate is not specified in the Finance Act 2021 but this appears to be an oversight as the rate was mentioned in the 20212022 budget speech.

Corporate Income Tax Cit Rates

Corporate income tax CIT rates.

Withholding tax rates tanzania. 11 Income Tax 2004 9 SCHEDULES FIRST SCHEDULE TAX RATES 1. Income of individual persons. Interest income is taxed by way of WHT at 10.

Company Y would pay a net amount of USD 850 after withholding USD 150 tax at 15. However the total income of a non-resident individual is charged at the rate of 20. If the recipient is non-resident the tax is final.

Non final withholding taxes. The applicable rates are 10 and 20 percent of the gain for residents and non-residents respectively. Everything you need to know about taxes.

Rates of Income Tax for Individuals. Corporate income tax CIT due dates. 5 or 10 10 15.

If the recipient is resident the tax is non-final. For non-resident employees of a resident employer the income is subject to withholding tax at the rate of 15. If we assume Company Xs profit before tax is 20 of revenue this would mean a profit of USD 200.

Capital gains realised on the disposal of business and investment assets in Tanzania are subject to tax at the rate of 30 for corporations and the graduated rates for individuals. Rates of Withholding Tax. 60 Types of withholding tax Final Withholding Taxes are taxes in which the withholdee cannot claim any tax credit when calculating the income tax payable for a year of income.

Basis Tanzanian residents are taxed on their worldwide income. However the exemption is upon approval by the Commissioner. Non final withholding taxes.

International conventions and avoidance of double taxation withholding taxes. - Final withholding taxes. Rates of Income Tax for Entities.

The expectation is that it will be introduced through a Government Notice. If you make royalty payments or payments for the use of natural resources you must withhold tax at a rate of 15. Section Type of payment From To Rate Final non-final 81 Employment Resident employer Resident employee Regulations Non-final 81 Employment Resident employer Non resident employee 15 Final 82 Dividend Resident corporation listed on Dar es Salaam Stock Exchange All 5 Final 82 Dividend Resident corporation not listed on Dar es Salaam.

Presumptive Income Tax for Individuals. The law has divided withholding taxes in to two major categories namely. Presumptive Income Tax for Individuals.

Withholding tax WHT rates WHT rates DivIntRoy Resident. For example Company X is a non-resident that performs services from a place abroad to a beneficiary in Tanzania Company Y with a value of say USD 1000. Rates of Withholding Tax.

The disposal by a resident of an investment with an overseas source is subject to tax at a rate of 30. Rates of Income Tax for Individuals. 5 or 10 10 15.

The total income of non-resident individual is chargeable at the rate of 30 3. SECOND SCHEDULE EXEMPT AMOUNTS THIRD SCHEDULE DEPRECIABLE ASSETS ALLOWANCES AND INCLUSIONS 1. The disposal of an investment with a Tanzanian source is subject to tax at a rate of 10 if disposed by a resident and 30 if disposed by a non-resident.

Income tax is charged at a rate of 30 on income of a resident corporation and of a permanent establishment PE of a non-resident corporation or 5 of turnover for technical and management service providers to mining oil and gas entities deducted by way of WHT. Income of a non-resident employee of a resident employer is subject to withholding tax of 15. Detailed description of corporate withholding taxes in Tanzania Quick Charts Back.

There is however what is called single installment tax on realization of interest in land shares and securities held in resident entity or building situated in Tanzania. Non-residents are taxable on income with a source in Tanzania. _____ SECOND SCHEDULE _____ EXEMPT AMOUNTS _____ THIRD SCHEDULE _____ DEPRECIABLE ASSETS ALLOWANCES AND INCLUSIONS 1.

Classification and Pooling of Depreciable Assets. Where the income from investment represents a final withholding payment the tax rate applicable is the relevant withholding tax WHT rate. The monthly income include basic salary overtime.

Are taxes which the withholdee is entitled for a tax credit an amount equal to the tax. Final withholding taxes are taxes in which the withholdee cannot claim any tax credit when calculating the income tax payable for a year of income. Categories of withholding taxes.

Are taxes which the withholdee is entitled for a tax credit being an amount equal to the tax. Rates of Income Tax for Entities.

Asiapedia Key Tax Rates In Cambodia Dezan Shira Associates

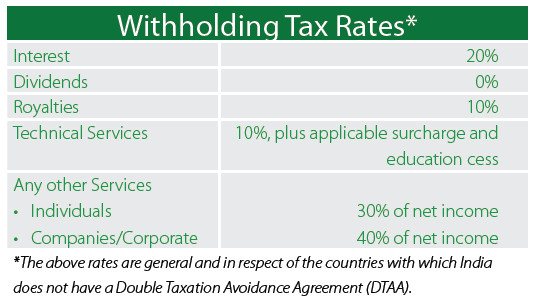

Asiapedia Withholding Tax Rates In India Dezan Shira Associates

Indonesia Selected Issues In Imf Staff Country Reports Volume 2011 Issue 310 2011

Quick Overview Of Dutch Real Estate Rsm Audit Tax Consulting

Quick Overview Of Dutch Real Estate Rsm Audit Tax Consulting

Double Tax Treaties In Eac Member Countries Download Table

Pdf A Sourcebook Of Income Tax Law In Tanzania Calvin Juvenaly Academia Edu

Introductory Guide Taxation System In Cambodia Pdf Free Download

Quick Overview Of Dutch Real Estate Rsm Audit Tax Consulting

Rsm Newsletter Thin Capitalization Rule In Tanzania

Double Tax Treaties In Eac Member Countries Download Table

Pdf Tax Systems And Tax Harmonisation In The East African Community Eac

Quick Overview Of Dutch Real Estate Rsm Audit Tax Consulting

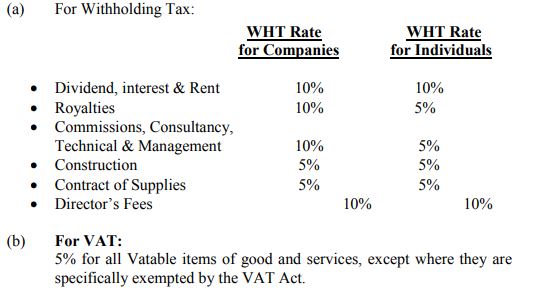

Withhoding Tax Wht And Value Added Tax Vat Collection Aziza Goodnews

Pdf Tax Systems And Tax Harmonisation In The East African Community Eac