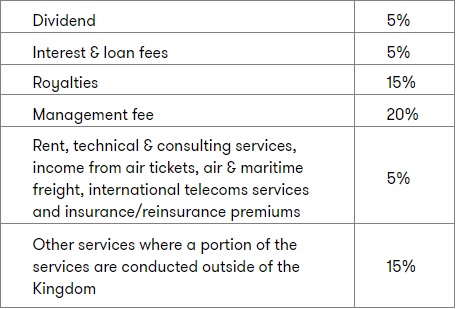

The Saudi Zakat Tax and Customs Authority ZATCA has published an English-language Withholding Tax Guideline dated 6 July 2021 which provides guidance on the application of the withholding tax WHT provisions of the Income Tax Law and its. WHT Rates differ between 5-20 based upon the type of service and whether the beneficiary is a related party as follows.

Saudi Arabia Tax Current Developments And Their Impacts On Permanent Establishments Pes Wts Global

Depending on the type of business tax rates may differ across sectors.

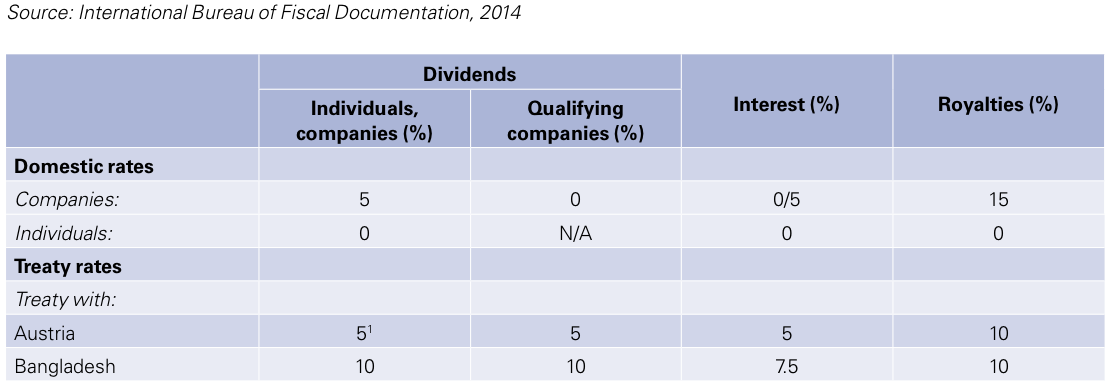

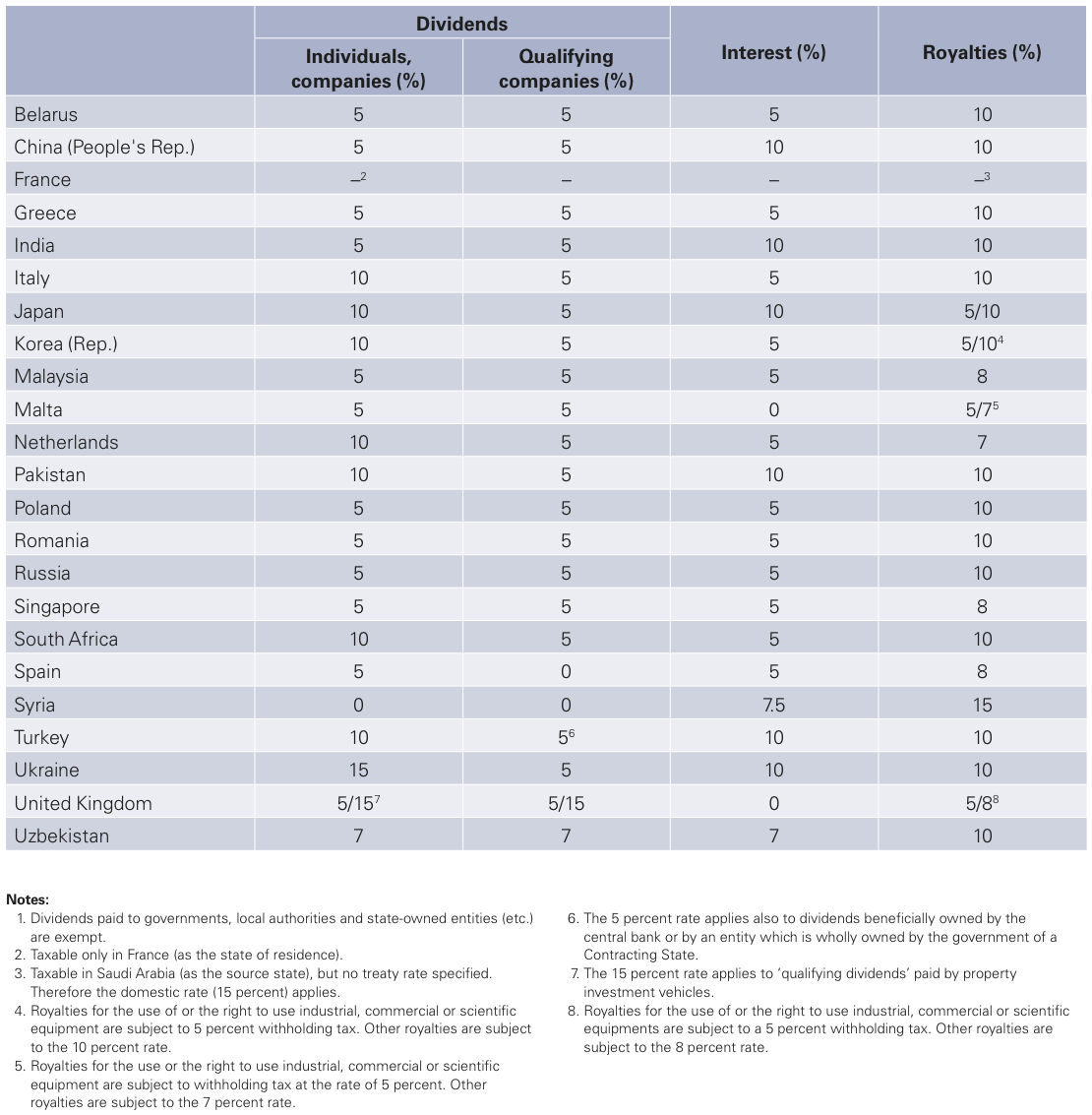

Withholding tax rates saudi arabia. A 5 withholding tax applies on dividends paid to a nonresident unless the rate is reduced under a tax treaty. Saudi Arabia Corporate - Withholding taxes Last reviewed - 31 December 2020 Payments made from a resident party or a PE to a non-resident party for services performed are subject to WHT. According to the provisions of article 68 of the Income Tax Law ITL the withholding tax should be imposed on the total amount paid to the non-resident based on the nature of services and the rates defined are as follows.

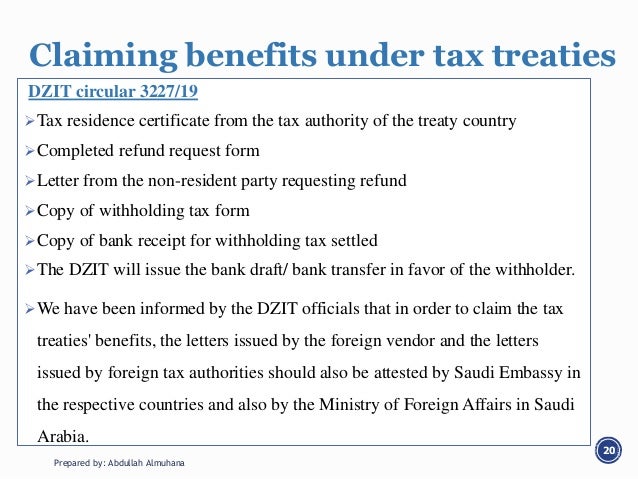

See the international tax treaties on the website of the General Authority of Zakat and Tax Saudi Arabia has 51 tax treaties in force Withholding Taxes When paid to a non-resident withholding tax rates are 5 for dividends 5 for interest and 15 for royalties unless otherwise provided in a. The rates vary between 5 15 and 20 based on the type of. No withholding tax is imposed on dividends paid to a resident.

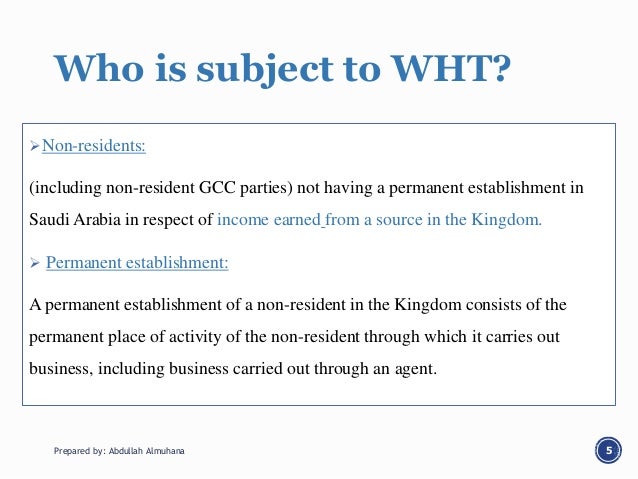

1-Withholding tax shall be imposed according to the percentages specified in III above on the full amount paid to the non-resident as of 13061425H corresponding to 30072004. Non-residents who do not have a legal registration or a permanent establishment in Saudi Arabia are subject to withholding tax on their Saudi Arabia sourced income. Tax treaty network UAE national or resident individuals and UAE resident companies have access to an extensive and growing double tax treaty DTT network.

Non resients receiving income from Saudi source may be subject to withholding tax at rates ranging from. Tax Rates Online An online rates tool produced by KPMG that compares corporate indirect individual income and social security tax rates within a country or across multiple countries. 15 - Royalties.

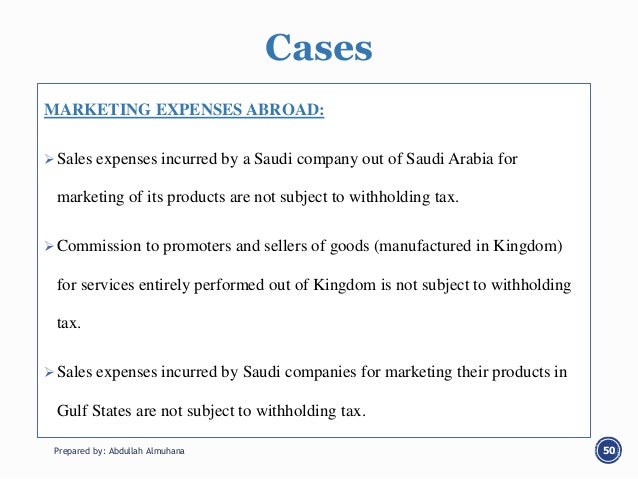

Non-residents that provide services in Saudi Arabia without having a PE or branch are subject to withholding tax ranging from 5 to 20 depending on the nature of services. The WHT base is determined according to the total payments made and not the profit from the transaction. However income from oil and hydrocarbons production is subject to tax at rates ranging from 50 to 85 depending on the amount of investment.

There is a 20 corporate income tax rate in Saudi Arabia. You are required to settle these tax fees within 10 days following receipt of the company tax. Deloitte International Tax Source Online database providing tax rates including information on withholding tax tax treaties and transfer pricing.

Corporate tax in Saudi Arabia. What is the withholding tax rate prevailing in Saudi Arabia. Withholding Tax in Saudi Arabia Withholding tax is applicable when payments is made from a permeant establishment PE or a resident party or to a non-resident party for services performed.

Non-Saudi and non-resident GCC nationals and entities with a permanent establishment in Saudi Arabia are subject to flat income tax rate of 20 on their business income in Saudi Arabia. According to the provisions of article 68 of the Income Tax Law ITL the withholding tax in Saudi Arabia should be imposed on the total amount paid to the non-resident based on the nature of services and the rates defined are as follows. 20 - Management fees.

What is the withholding tax rate prevailing in Saudi Arabia. Withholding Tax WHT is an income tax assessed on Non-residents who generates income from a source in the Kingdom. Other provisions should be taken into account when the tax withholding.

Withholding tax WHT in Saudi Arabia Author. There are currently no withholding taxes WHTs applicable in the United Arab Emirates. 15 - Amount paid to the head office or.

Contractor WHT During the contract award whether traditional or lump sum it is in the suppliers interest to provide a breakdown of the tender price to determine the labour plant and materials costs as construction materials are exempt from WHT minimizing the tax. Royalties consultancy and technical services and international telecommunication services paid to head office or an affiliated company. Non resients receiving income from Saudi source may be subject to withholding tax at rates ranging from 5 to 20 depending on the nature of the service.

A 20 tax rate applies to foreign companies which are paid by the non-Saudi owner or liable shareholders. This rates for WHT are. The rates may vary between 5 15 and 20 based on the type of service and.

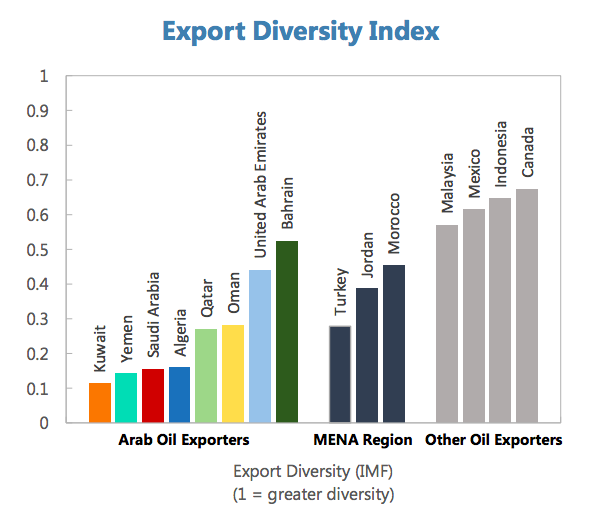

Taxation In The Mena Region Exploring Economics

Figure 1 Saudi Arabia Withholding Tax Rates 2013 Institute For Mergers Acquisitions And Alliances Imaa

Taxation Of Cross Border Mergers And Acquisitions Saudi Arabia 2014 Institute For Mergers Acquisitions And Alliances Imaa

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Overview Of Wht In Saudi Arabia Youtube

Saudi Tax Zakat Update List Of Topics Ppt Download

Saudi Arabia Tax Amnesty Wts Global

Withholding Tax In Saudi Arabia Services For Incorporate The Company In Saudi Arabia Neom Sagia Qiddiya

Saudi Arabia Sa Total Tax Rate Of Profit Economic Indicators Ceic

Tax Summaries Saudi Arabia Services For Incorporate The Company In Saudi Arabia Neom Sagia Qiddiya

New Year New Tax Saudi S Evolving Taxation System Proven

Amendments To The Executive Regulation To Oman Income Tax Law Income Tax Tax Exemption Tax