33 28 0. Non-resident withholding tax is imposed on interest at 15 percent and dividends at 30 percent or 0 percent if fully imputed.

Your Bullsh T Free Guide To Taxes In Germany

If we approve your application well let you know what your tailored tax rate is.

Withholding tax rates new zealand. Tailored tax rates for salary wages and pensions. Withholding tax WHT rates WHT rates DivIntRoy Resident. If youre a foreign investor who gets non-resident passive income then your tax will be paid to us by your New Zealand.

The New Zealand government has legislated a new income tax rate of 39 on income over NZD 180000 that will come into force on 1 April 2021. Non-resident withholding tax NRWT is a tax withheld from New Zealand payments of interest dividends and royalties to non-residents foreign investors. The percentage is the final liability.

Non-resident entertainers and sportspeople. The tax rate can be found out at Sch 1. Online database providing tax rates including information on withholding tax tax treaties and transfer pricing.

When someone earns income from interest contract work or other sources that are not salary or wages there are some situations when the payer must withhold tax from that income and pay it to us on the persons behalf. Tax on Schedular PaymentsWithholding Tax rates. If you are a non-resident contractor receiving a contract payment for a contract activity or service and none of the above activities are applicable thenNon-resident contractor and not a company Non-resident contractor and a company.

New Zealand Tax Profile. Non-resident crews of visiting pleasure craft. RWT on interest varies from 105 - 33 depends on the the recipients tax conditions.

Paying tax on investments and savings in NZ All NZ citizens and residents pay either Resident Withholding Tax RWT or tax at the Prescribed Investor Rate PIR on income from savings and investments in New Zealand. You need to apply for a tailored tax code first. Schedular payment tax rates.

If you dont let us know your IRD number or RWT rate you will be taxed at the default rate of 33. See New Zealands Corporate summary for a description of reduced rates based on shareholder holdings and treaty relief. The minimum withholding rate that can be elected is 10 or 15 for non-residents or contractors with a temporary work visa.

Your tax rate is based on your income. If the recipient is a company the default rate is 28. New Zealand residents only 20c.

Income tax return for non-resident individual taxpayers - IR3NR. You can get a tailored tax rate for income you get from. 30 15 15.

From 1 April 2020 the IRD is increasing their non-declaration rate to 45 for those customers who have not supplied their IRD number. However some resident contractors may be able to obtain a lower withholding rate as low as 0 by applying for a special tax rate certificate from the Commissioner of Inland Revenue. 153 rijen Withholding tax WHT rates Dividend interest and royalty WHT rates for WWTS.

The rate of RWT on dividends paid is 33 but the tax is reduced by the aggregate imputation and withholding payment credits attached to the dividend or taxable bonus share. It helps people to pay tax on all their income not just salary or wages. The rate of RWT on interest is 33 where the recipient does not provide a tax file number.

Moving between Inland Revenue sites. Tax Rates Online An online rates tool produced by KPMG that compares corporate indirect individual income and social security tax rates within a country or across multiple countries. Overseas fishing crew working in New Zealand.

41 rijen 10 max. Use this simple guide to confirm your Resident Withholding Tax RWT rate - itll only take a few seconds. Withholding tax is a type of income tax deduction.

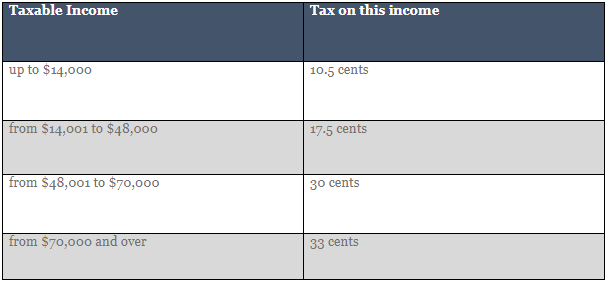

5 or 15 f. These rates might be reduced further through the application of a double tax agreement if the recipient is resident in a countryjurisdiction with which New Zealand has entered into such an agreement. Individual tax rates are currently as follows.

If the recipient is an individual person the tax rate is same as the recipients marginal tax rate. Jump back to the top of the page. These kinds of payments are called non-resident passive income NRPI.

New Zealand Tax Schedule For Personal Income Tax Download Table

Russia S Double Tax Treaty Agreements Russia Briefing News

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax Calculation 2020 21 Youtube

New Zealand Income Tax Treaty With China Kpmg United States

Your Bullsh T Free Guide To Taxes In Germany

New Income Tax Table 2020 Philippines Income Tax Tax Table Income

Your Bullsh T Free Guide To Taxes In Germany

New Zealand Tax Schedule For Personal Income Tax Download Table

Global Corporate And Withholding Tax Rates Tax Deloitte

2 Withholding Tax Rates On Royalties Paid To The United States Download Table

Frankly My Dear Tax Prep Budget Goals Estimate Template

Global Corporate And Withholding Tax Rates Tax Deloitte

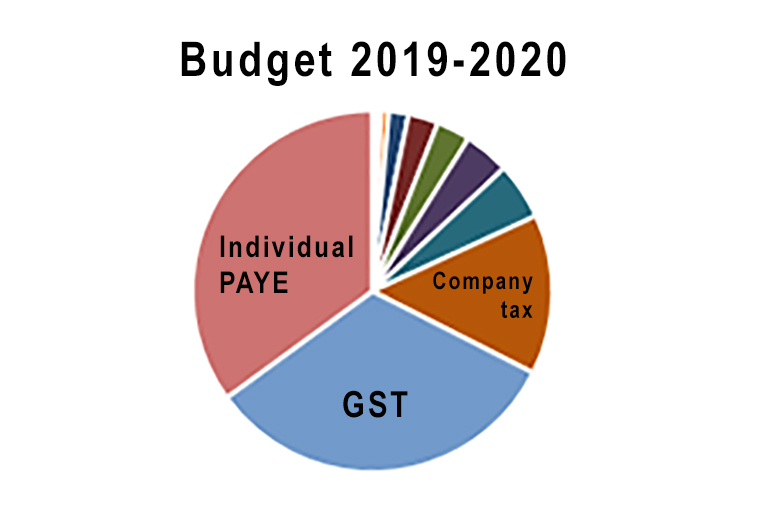

Budget 2019 Summary Of All Tax Collections Interest Co Nz

The Withholding Tax System In Thailand Lorenz Partners

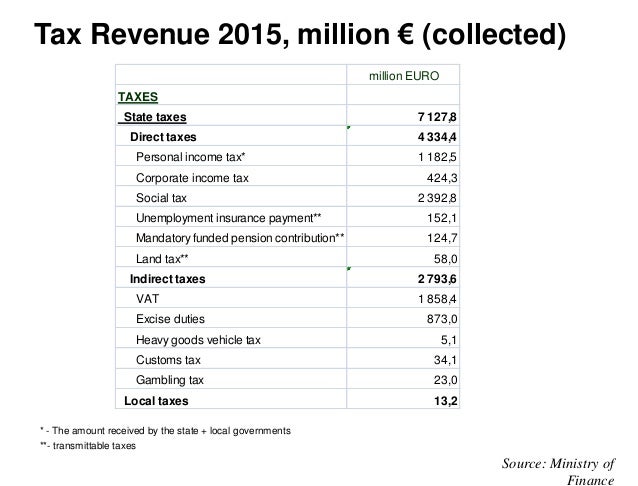

Estonian Taxes And Tax Structure As Of 1 January 2016

New Zealand Withholding Tax Artist Escrow Services Pty Ltd

Estonian Taxes And Tax Structure As Of 1 January 2016

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

2 The New Zealand Tax System And How It Compares Internationally