75000-in aggregate during a financial year S1531a 1531b services Every Prescribed Person. Lowest Individual Tax Rate in Pakistan is 2 and Highest Rate is 30.

Withholding Taxes in Pakistan.

Withholding tax rates in pakistan 2017-18 pdf. 1513591 1591 151 Order to grant refuse reduced rate of withholding on Profit on Debt In exercise of the powers conferred by section 1591c of Income Tax Ordinance 2001 it is hereby. The tax so paid in excess of normal tax liability can be carried forward for upto five tax years for adjustment against tax liability of a subsequent tax year. Increase from Rs5b in 1991 to above Rs 422b in 2012 speaks of exponential.

What are the income tax rates in Pakistan in 2017-2018. Theres a lower limit of earnings under which no tax is charged - and then a progressively higher tax rate is applied based on how much you earn above that level. Rs 20005 of amount exceeding Rs 500000.

Taxes are the main source of revenues for the government of modern ages. 2018 Online 15-Sep-2017 30-Jun-2018 Due Date. Document Date Period.

The most up to date rates available for resident employed taxpayers in Pakistan are as follows. ACCOUNTANTS OF PAKISTAN Date. In case of a stock fund if dividend receipts of the fund are less than capital gains the rate of tax deduction shall be 125 instead of 10 httptagmcopdfWithHoldingRatesTaxYear2019pdf Tariq Abdul Ghani Maqbool Co.

Budget 2017-18 age of TRev. Net Taxable Income Rs. The original Statue Income Tax Ordinance 2001 as.

Prior to the Finance Act 2017 the general rate of minimum tax was 1 which has been enhanced to 125 through the Finance Act 2017. Up to Rs 400000. Income Tax Card in Pakistan 2017-18.

Interest payments to non-residents that have no permanent establishment in Pakistan are subject to withholding tax of 10 percent. ICMA Pakistan Budget Commentary 2017-18 BUDGET AT A GLANCE Page 8 BREAKUP OF FEDERAL TAX REVENUE RECEIPTS Rsin million Budget 2016-17 Revised 2016-17 age of TRev. 01-Jul-2017 - 30-Jun-2018 15-Sep-2017 Valid Upto.

Withholding is an act of deduction or collection of tax at source which has generally been in the nature of an advance tax payment. Taxpayers whose names appear on the active taxpayers list issued by the Federal Board of Revenue from time to time or that hold a taxpayers card and a 20 withholding tax in the case of nonfilers is levied on dividends unless the rate is. Payment for advertisement services to a non- resident person relaying from outside Pakistan Any Other payment except payment to foreign news agencies syndicate services non-resident contribution having no permanent establishment in Pakistan PAYMENT TO NON-RESIDENTS 151 Nature of payment Rate TY 2018-19 700 1300 WITHHOLDING TAX DEDUCTION CHART.

Payments to non-residents that have no permanent establishment in Pakistan are subject to withholding tax in the case of specified. 125 16 3 Where holding period of a security is twenty-. Change your personal details.

Withholding Tax Rates - Federal Board Of Revenue Government Of Pakistan. Registration No 15-Sep-2017 Medium. Though the tax collection has seen an increase to about 60 in the past 3 years but at the same.

Rs 500000 - Rs 750000. Pakistan has a progressive tax system. Holding Period Tax Rates Filer Non-filer 1 Where holding period of a security is less than twelve months.

A 125 withholding tax for filers of an income tax return in Pakistan ie. The government imposes taxes to collect revenue to run the government to impose its policies for fair distribution of wealth and to administer the government. Tax Rates for Companies and Banks.

Withholding Income Tax Regime WHT Rates Card Guideline for the Taxpayers Tax Collectors Withholding Tax Agents - as per Finance Act 2020 updated up to June 30 2020 Disclaimer-This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding Tax Regime. Their contribution is about 41 percent of total direct tax revenues. Register for Income Tax.

Reduction in tax rates for individuals Paraqraph Division I Part I of the First Schedulel Prior to the Finance Act 2018 the minimum threshold for taxable income was Rs400000- for individuals and tax rates for non-salaried and salaried individuals were separately provided in paragraphs 1 and IA respectively in Division l Part-I of the. Withholding Tax Rates In Pakistan 2017-18 Time To Revisit The Withholding Tax Policy In Direct taxes the contribution of WHT tax is about 60 to 70. Direct Taxes Income Tax.

15 18 2 Where holding period of a security is twelve months or more but less than twenty-four months. It is an effective mechanism and importanttimely source of revenue. WITHHOLDING TAX RATES SECTION WITHHOLDING AGENT Rate 1531a sales of goods Every Prescribed Person section 1537 Company 4 of the gross amount Other than company 45 of the gross amount No deduction of tax where payment is less than Rs.

Rs 400000 - Rs 500000. The rate of tax to be paid under section 37A shall be as follows Sr.

Portugal 2019 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Portugal In Imf Staff Country Reports Volume 2019 Issue 221 2019

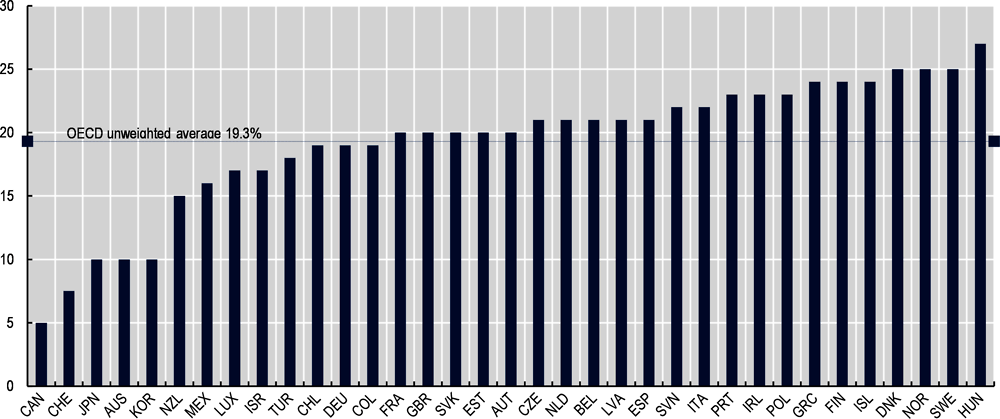

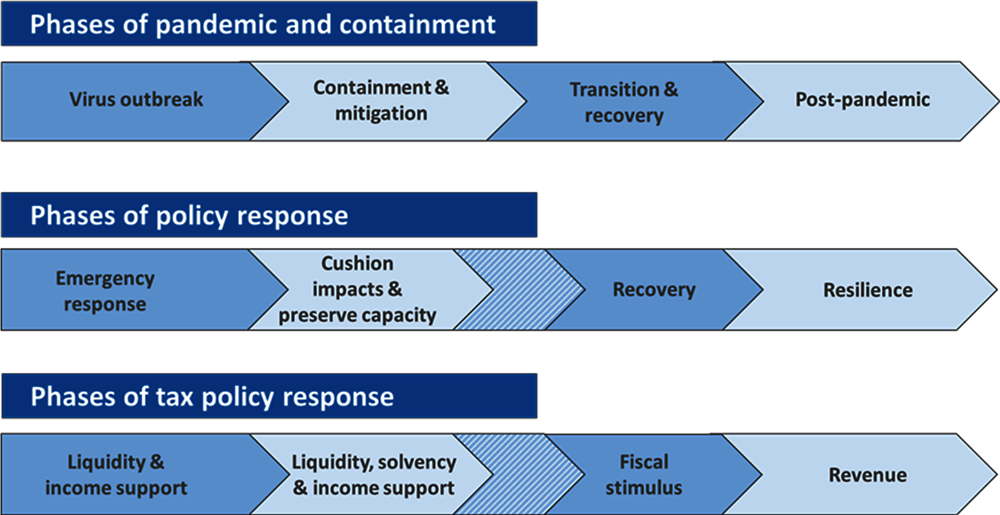

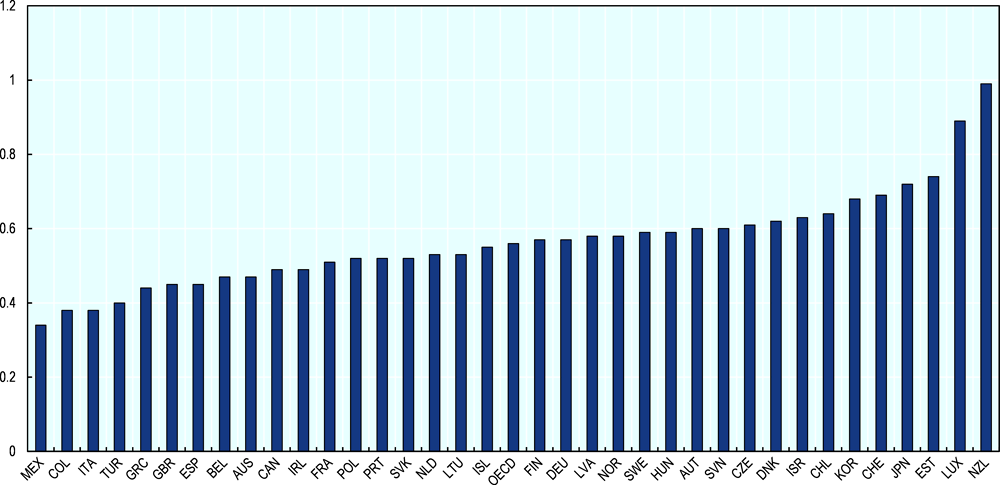

2 Value Added Taxes Main Features And Implementation Issues Consumption Tax Trends 2020 Vat Gst And Excise Rates Trends And Policy Issues Oecd Ilibrary

Https Www Eadvisors In Authorised Capital Vs Paid Up Capital Share Capital Meaning Of Authorised Share Capital Meaning Of Paid In 2020 Capitals Paying Shared

Nepal 2020 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Nepal In Imf Staff Country Reports Volume 2020 Issue 096 2020

Nigeria Gdp Distribution Across Economic Sectors 2020 Statista

Aaaiwiwi Pdf Withholding Tax Capital Gains Tax

Https Www Pwc Com Gx En Tax Corporate Tax Worldwide Tax Summaries Pwc Worldwide Tax Summaries Corporate Taxes 2017 18 Asia Pacific Pdf

Adidas Annual Report 2019 Home

Sales Tax Software Market Is Registering A Healthy Cagr In The Forecast Period Of 2019 2026 In 2020 Tax Software Marketing Data Sales Tax

Measuring Intellectual Capital With Financial Data

Measuring Intellectual Capital With Financial Data

2 Value Added Taxes Main Features And Implementation Issues Consumption Tax Trends 2020 Vat Gst And Excise Rates Trends And Policy Issues Oecd Ilibrary

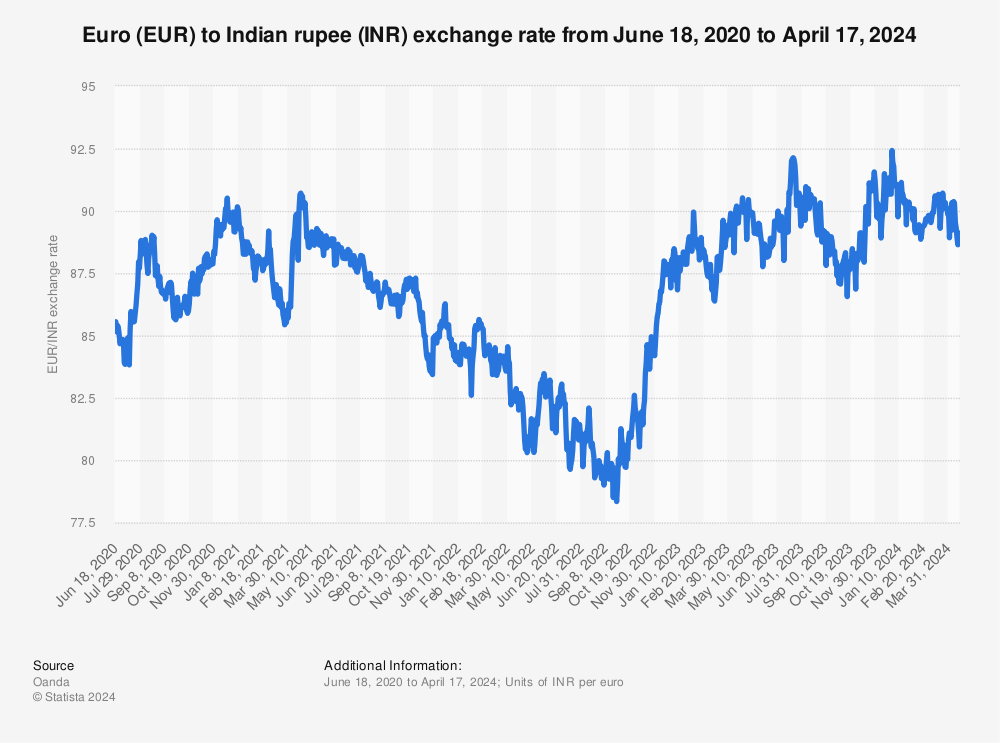

Euro To Inr 2000 2021 Statista

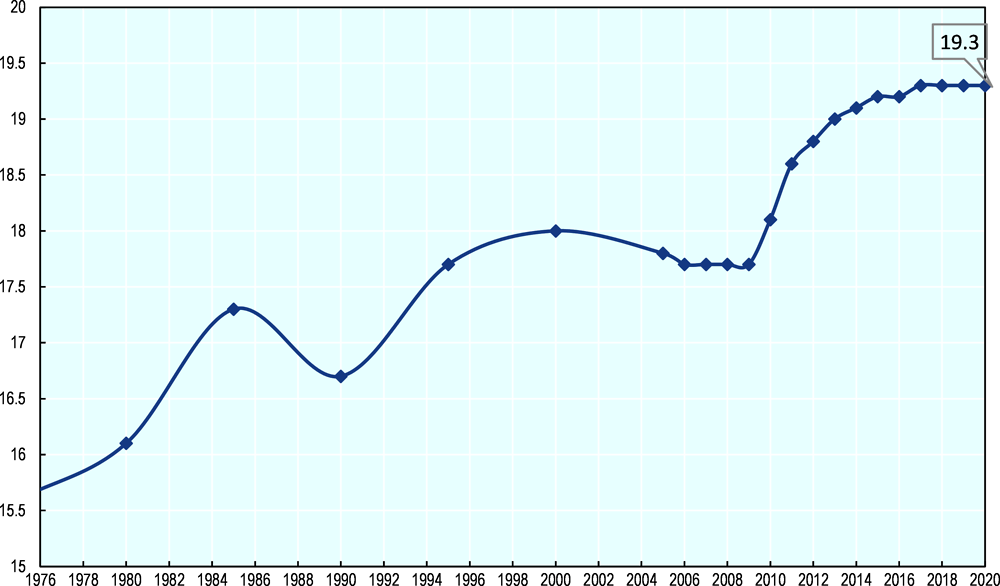

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary

Forever Living Products Price List Forever Living Products Forever Aloe Lips Aloe Lips

2 Value Added Taxes Main Features And Implementation Issues Consumption Tax Trends 2020 Vat Gst And Excise Rates Trends And Policy Issues Oecd Ilibrary

Euro To Inr 2000 2021 Statista

2 Value Added Taxes Main Features And Implementation Issues Consumption Tax Trends 2020 Vat Gst And Excise Rates Trends And Policy Issues Oecd Ilibrary

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary