Note that the flat 37 rate applies even if an employee has submitted a federal Form W-4 claiming exemption from federal income tax withholding. August 22 2021 by Kevin E.

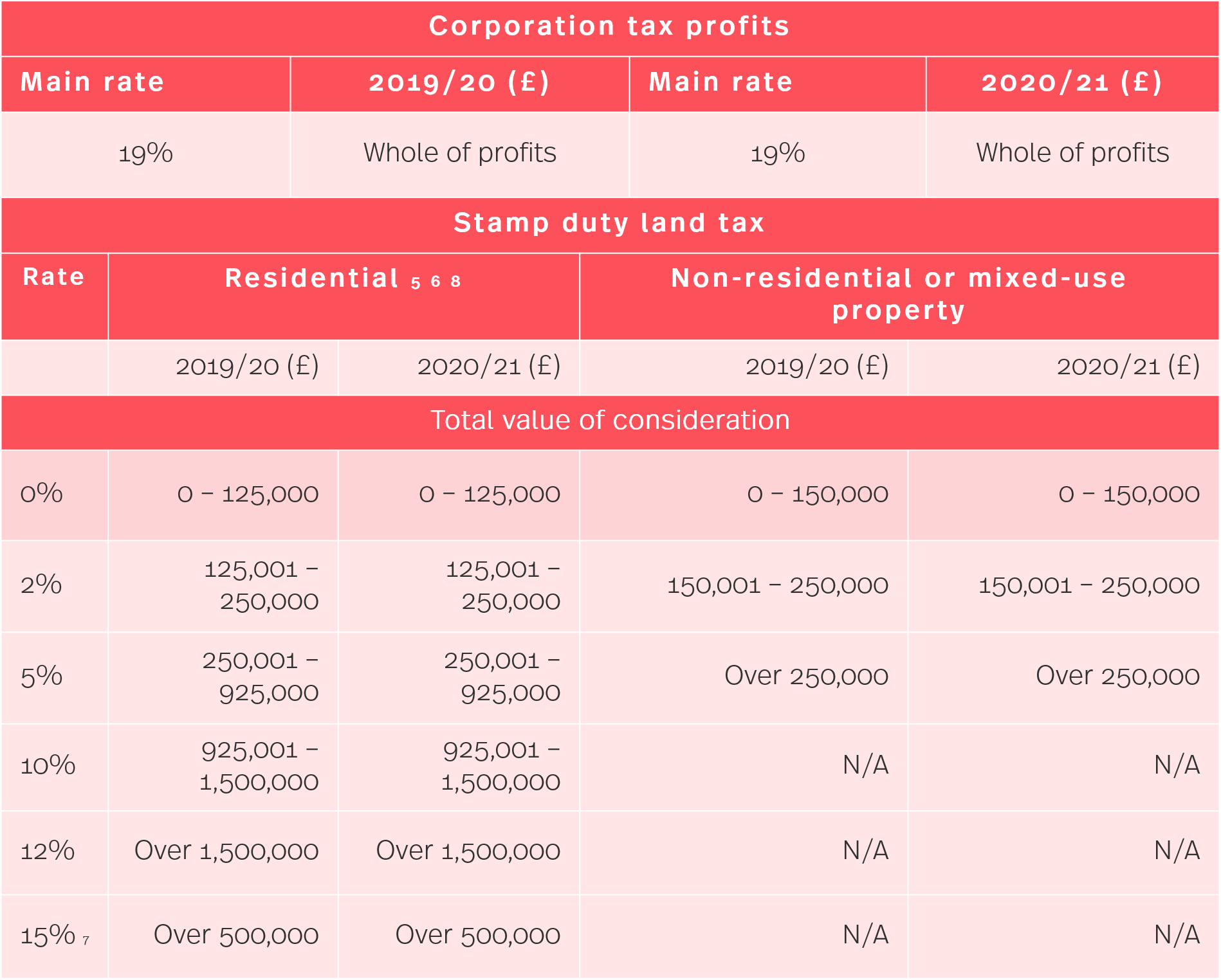

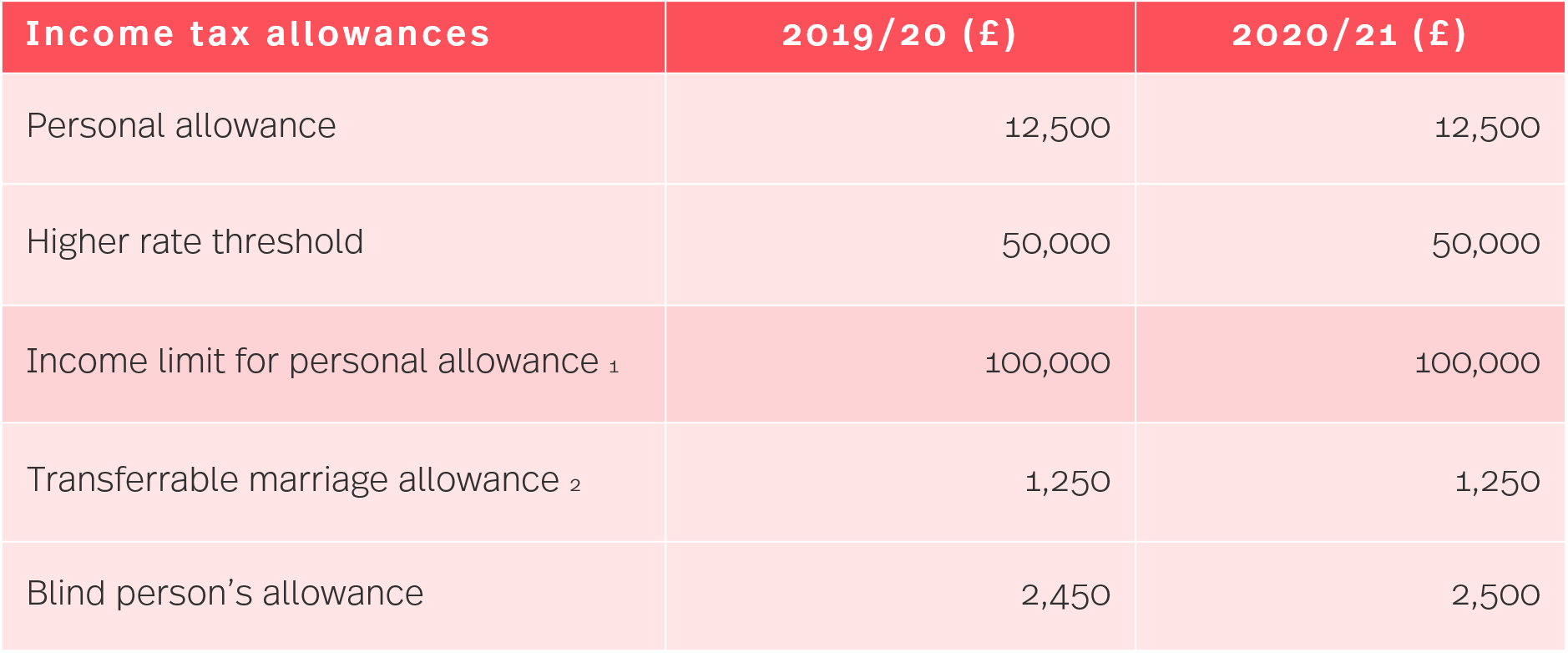

Simmons Simmons Hmrc Tax Rates And Allowances For 2020 21

Prime Ministers package for construction sector.

Withholding tax rates for 2021-22. Categories Federal Tax Withholding Tables Tags federal payroll tax chart for 2021 federal payroll tax rate for 2021 income tax withholding rates for 2021 michigan withholding tax rate for 2021 new payroll tax rates for 2021 payroll tax rates for 2021 tax withholding chart for 2021 withholding tax rates 2021 deloitte withholding tax rates 2021-22 withholding tax rates for 2021. Income Payment made by top withholding agents to their localresident suppliers of goods other than those covered by other rates of withholding tax. There are no changes to most withholding schedules and tax tables for the 202122 income year.

2021 Withholding Tax Table Texas. 400 crore Any other domestic company 30 30. With the annual indexing of the repayment incomes for study and training support loans the following tables were updated for the 202122 year.

Standard Withholding Table 2021. Rounding To figure the income tax to withhold you may reduce the last digit of the. Section 313402g-1 See Publication 15-T for the 2021 federal income tax withholding tables.

45 pence for the first 10000 business miles in a tax year then 25 pence for each subsequent mile. The extension of the low and middle income tax offset is only claimable when individuals lodge their income tax return. No personal exemption Recap alert.

Income Payment made by NGAs LGU etc to its localresident suppliers of services other than those covered by other rates of withholding tax. Categories Federal Withholding Tables Tags irs backup withholding rate 2021 irs bonus withholding rate 2021 irs payroll tax rates 2021 irs social security and medicare withholding rates 2021 irs supplemental withholding rate 2021 irs withholding rates 2021 what are the federal withholding rates for 2020 what are the tax withholding rates. A 15 if at least 10 of the voting powers in the company paying the dividends is controlled by the recipient companyb 25 in other cases.

Domestic Company Assessment Year 2021-22 Assessment Year 2022-23 Where its total turnover or gross receipt during the 25 NA previous year 2018-19 does not exceed Rs. Rate per business mile 2021 to 2022. Updated up to June 30 2020.

Federal Withholding 32 2021. Applicable Withholding Tax Rates. Circular E 2021 Table.

25 0 0 The Parliament has adopted a 15 withholding tax rate on the gross payment on interest royalties and certain lease payments to related parties resident in low-tax jurisdictions with an effective date of 1 July 2021 1 October 2021 for lease payments. August 11 2021 July 31 2021 Federal Withholding Tables by Federal Withholding Tables Withholding Tax Charts For 2021 The total instructions of Federal Income Tax Withholding are released by the IRS Internal Revenue Service annually. Ca State Withholding Form 2021.

2021 Federal Tax Withholding Rates. Categories Federal Withholding Tables Tags federal payroll tax chart for 2021 federal payroll tax rate for 2021 income tax withholding rates for 2021 michigan withholding tax rate for 2021 new payroll tax rates for 2021 payroll tax rates for 2021 tax withholding chart for 2021 withholding tax rates 2021 deloitte withholding tax rates 2021-22 withholding tax rates for 2021. Categories Federal Withholding Tables Tags federal income tax rates 2021 federal income tax rates 2021 canada federal income tax rates 2021 single federal income tax refund schedule 2021.

The following are aspects of federal income tax withholding that are unchanged in 2021. 400 crore Where its total turnover or gross receipt during the NA 25 previous year 2019-20 does not exceed Rs. Between 2020 and 2021 many of these changes remain the same.

The Federal Budget did not result in any changes to tax rates or income thresholds for 2021-22 income year. 15 if the 37 mandatory flat rate withholding applies or if the 22 optional flat rate withholding is being used to figure income tax withholding on the supplemental wage payment. No withholding allowances on 2020 and later Forms W-4.

Federal Withholding Form 2021. A 15 of royalty relating to literary artistic scientific works other than films or tapes used for radio or television broadcastingb 20 in other cases. August 22 2021 by Trafalgar D.

2021 Federal Tax Withholding Rates. The extension of the low and middle income tax offset announced at the Federal Budget is only claimable when individuals lodge their income tax return.

Download Excel Based Income Tax Calculator For Fy 2020 21 Ay 2021 22 Financial Control Income Tax Income Tax

How To File Your Income Tax Return In Austria Expatica

Illustration Of Diesel Petrol Prices Build Up Under Gst Regime If Included Petrol Price Petrol Marketing Cost

How To Become Active Taxpayer In Fbr Income Tax Income Tax How To Become Income

China S Individual Income Tax Everything You Need To Know

Missouri Income Tax Rate And Brackets H R Block

A J On Twitter Income Tax Slabs According To Finance Bill 2021 22

Simmons Simmons Hmrc Tax Rates And Allowances For 2020 21

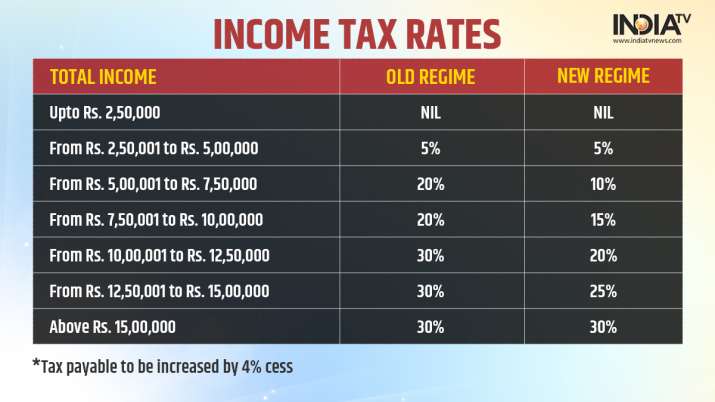

Income Tax Rates Slab For Fy 2021 22 Or Ay 2022 23 Ebizfiling

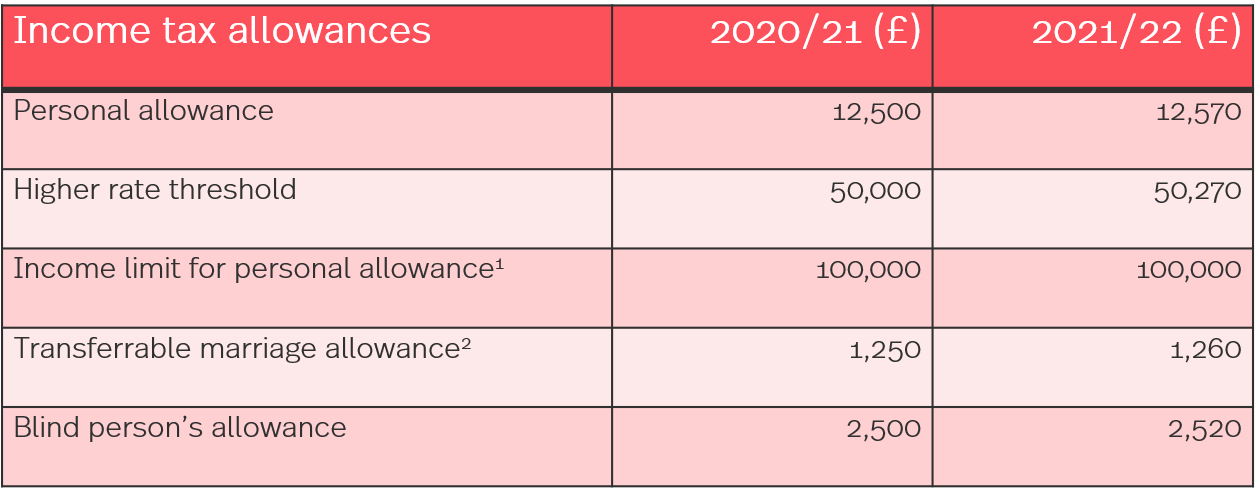

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

A J On Twitter Income Tax Slabs According To Finance Bill 2021 22

Austria Salary Calculator 2021 22

How To File Your Income Tax Return In Austria Expatica

Download Excel Based Income Tax Calculator For Fy 2020 21 Ay 2021 22 Financial Control Income Tax Income Tax

Income Tax Rates For Fy 2021 22 How To Choose Between Old Regime And New Regime My Droll

Amar Associates Income Tax Rates For Tax Year 2021 Facebook

Mbv Taxation Accounting 2020 2021 Tax Rates Great News For Next Tax Season Providing Tax Withheld Amounts By Your Software Provider Don T Change You Should Get A Greater Refund