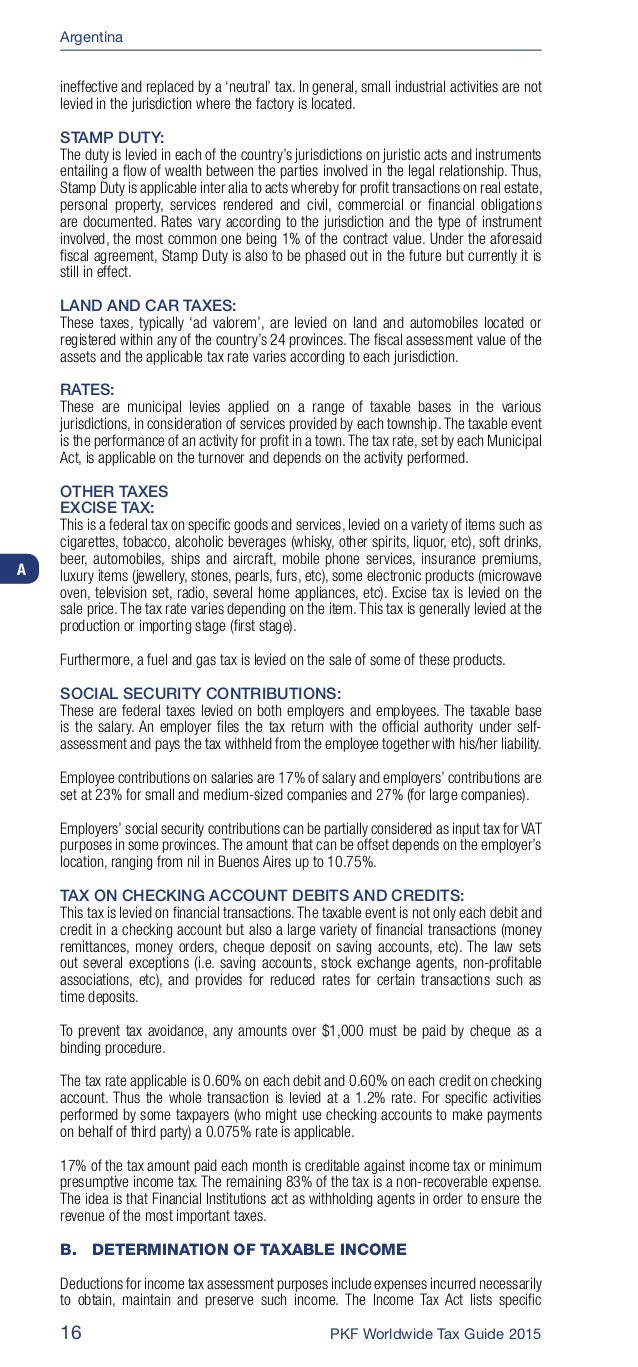

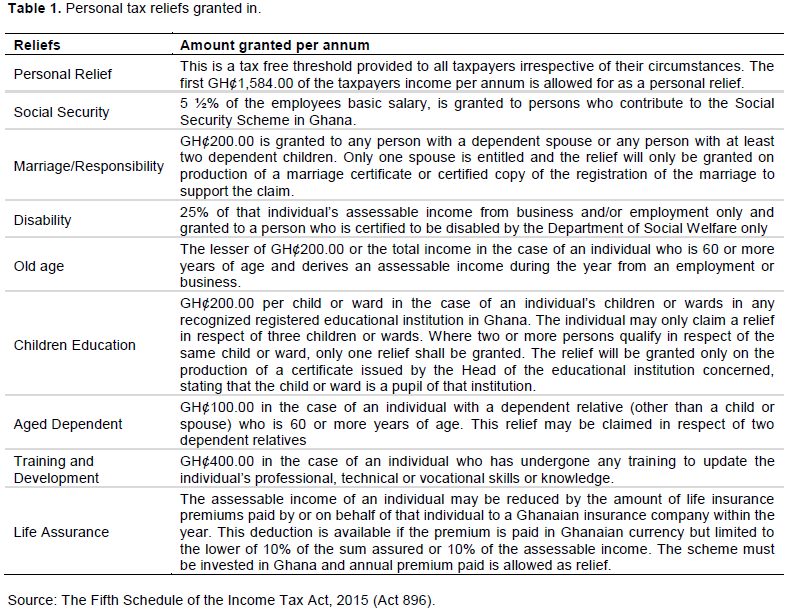

Progressive tax rates and brackets for individuals are established on annual income as follows. INCOME TAX ACT 2015 ACT 896 As Amended by INCOME TAX AMENDMENT ACT 2015 ACT 9021.

Journal Of Accounting And Taxation Utilization Of Personal Tax Relief Schemes An Empirical Analysis In The Context Of Tax Evasion

A withholding agent shall file and pay to the Commissioner-General within fifteen 15 days after the end of the month a statement in the prescribed form and tax withheld.

Withholding tax rate in ghana 2015. 5 for non-resident banks. The information contained in this publication is based on the Ghana Income Tax Act 2015 Act 896 and subsequent amendments. A withholding agent is entitled to recover the tax.

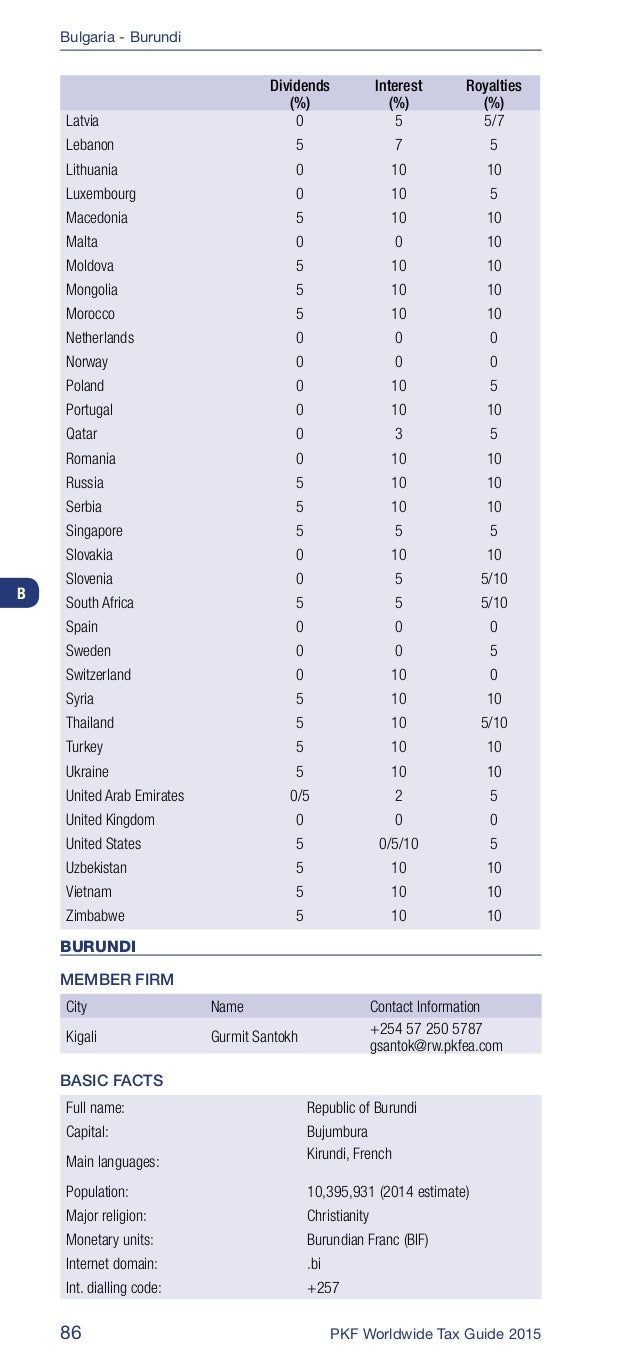

10 in any other case. On the other hand the applicable rates for this classification of tax range between a minimum of 5 to a maximum of 15. The lower rate applies where the recipient holds at least 10 of the shares.

David Lartey-Quarcoopome from the Training and Development Department of GRA breaks down the new levy and gives clarity on how it interacts with both the Standard Rate and the Flat Rate of the Value Added Tax. Income Tax Regulation 2016 LI. The 2014 Budget had targeted a reduction in Ghanas fiscal deficit from 101 percent of gross domestic.

Withholding tax rate in ghana 2015 2021 Alabama state use tax The AL use tax only applies to certain purchases The Alabama use tax is a special excise tax assessed on property purchased for use in Alabama in a jurisdiction where a lower or no sales tax was collected on the purchase. Chargeable income GH Rate of tax First 2 592 0 Next 1 296 5 Next 1 812 10 Next 33 180 175 Exceeding 38 880 25 Regional Capitals other than Accra and Tema 25 rebate. Domestic tax revenue across the board is projected at GHS239bn USD75bn 36 percent lower than the budget estimate of GHS248bn.

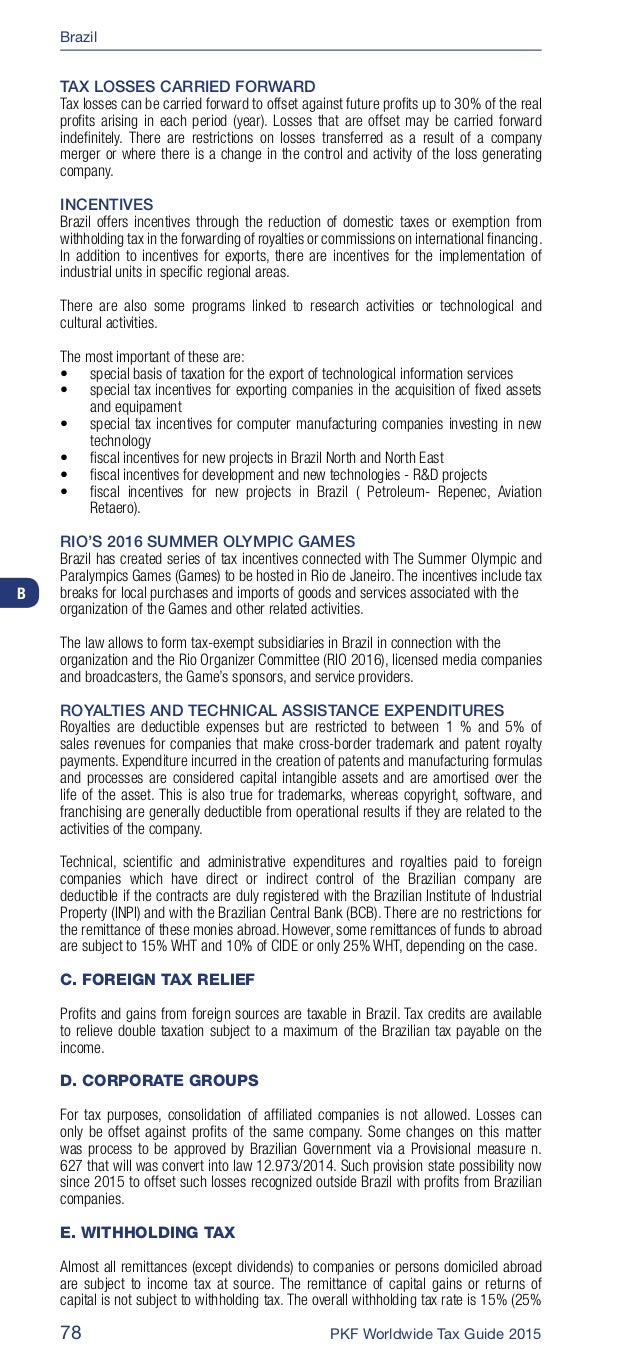

If you are a retailer of tangible goods it is 3. A withholding agent who fails to withhold the tax shall be liable to pay the tax. Taxes on income and property Maximum income tax rate for free zones.

2015 Chargeable income Rate Tax payable Cumulative income Cumulative tax GH GH GH GH First 132 0 0 132 0 Next 66 5 330 198 330 Next 92 10 920 290 1250 Next 2350 175 41125 2640 42375 Exceeding 2640 25 Chargeable income of non-resident individuals is taxed at a flat rate of 20. The higher rate applies in any other case. Tax revenue for 2015 is estimated at GH25406 million and will account for 784 of total revenue and grants.

In this interview Mr. We would like to show you a description here but the site wont allow us. The agents are required to apply a tax rate of 20.

Sub section 10 of section 116 of Act 896 provides for the taxation of supply of goods works or services by non-residents. Tax policy and revenue administration reforms continue to be key fiscal policy drivers for 2015. From USD 50000 and over the tax rate is 25 on.

The rates are however tentative and hence keep on changing from time to time. The general withholding tax rates for payments for contracts for the supply or use of goods supply of works and for the supply of any services involving one resident person to another resident person ranges from 3 to 75 and is on account of tax liability. The Income Tax Act ITA requires withholding agents making payments for services provided by non-resident persons who can be described as earning income from Ghana to withhold tax on the payments.

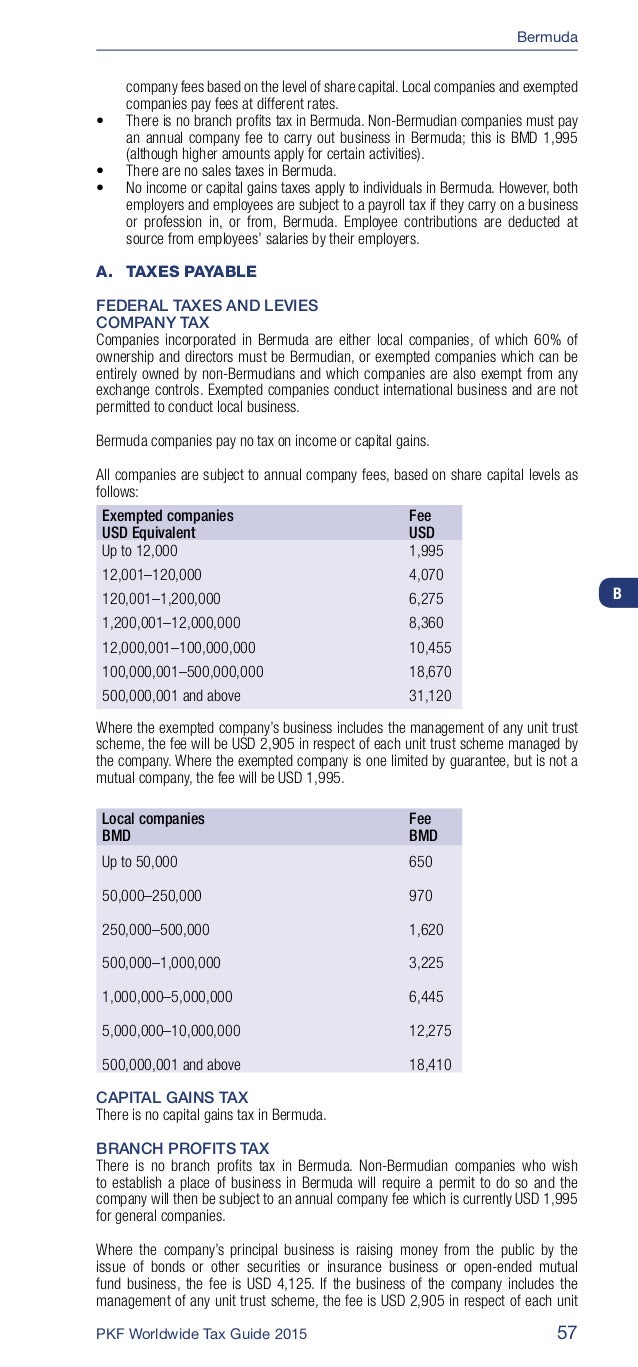

OF THE PARLIAMENT OF THE REPUBLIC OF GHANA ENTITLED INCOME TAX ACT 2015 AN ACT to provide for the imposition of income tax and for related purposes. Not yet in force. From USD 0 to USD 11000 the tax rate is 0 exempt.

And if you are not a retailer it is 125 but you must charge two other levies totalling 5 and apply the VAT. 40 rows Withholding Tax Rates in Ghana. Tax is withheld at source and it is a final tax.

From USD 11001 to USD 50000 the tax rate is 15. What are the obligations associated with paying VAT in Ghana. The threshold for withholding tax in Ghana is set at GHC 2000.

The Web site of the Ghana Revenue Authority. Ghana Fiscal Guide 20152016 5 Below are the individual income tax rates effective from 1 January 2016. Policy initiatives introduced to achieve this include.

This is the minimum amount that attracts WHT as stipulated in the law. The National Pensions Act 2008 Act 766 National Pensions Amendment Act 2014 Act 883 Guidelines for the Registration of. The tax rates for the supply of goods works or services by non-residents is twenty percent 20 in accordance with paragraph 8 1 c ix of the first schedule of Act 896.

The Ghana Revenue Authority implemented the New Covid 19 1 Health Recovery Levy CHRL from the 1st of May 2021.

Mali Selected Issues In Imf Staff Country Reports Volume 2018 Issue 142 2018

Eur Lex 52020sc0263 En Eur Lex

Pakistan Staff Report For The 2015 Article Iv Consultation Ninth Review Under The Extended Arrangement Request For Waivers Of Nonobservance Of Performance Criteria And Request For Modification Of A Performance Criterion In

Journal Of Accounting And Taxation Utilization Of Personal Tax Relief Schemes An Empirical Analysis In The Context Of Tax Evasion

Mali Staff Report For The 2015 Article Iv Consultation Fourth Review Under The Extended Credit Facility Arrangement And Request For Modification Of A Performance Criterion In Imf Staff Country Reports Volume 2015 Issue 339 2015

Mali Staff Report For The 2015 Article Iv Consultation Fourth Review Under The Extended Credit Facility Arrangement And Request For Modification Of A Performance Criterion In Imf Staff Country Reports Volume 2015 Issue 339 2015

Pdf Effect Of Taxation On Dividend Policy Of Quoted Deposit Money Banks In Nigeria 2006 2015

Https Openknowledge Worldbank Org Bitstream Handle 10986 34847 Ghana Enhancing Revenue Mobilization Through Improved Tax Compliance And Administrative Systems Pdf Sequence 1 Isallowed Y

Vat Multiple Taxations Undermine Stock Market Performance The Guardian Nigeria News Nigeria And World News Business The Guardian Nigeria News Nigeria And World News

Chapter 6 Tax Incentives To Use Or Not To Use In Unleashing Growth And Strengthening Resilience In The Caribbean

Https Openknowledge Worldbank Org Bitstream Handle 10986 34847 Ghana Enhancing Revenue Mobilization Through Improved Tax Compliance And Administrative Systems Pdf Sequence 1 Isallowed Y

Pdf Ghana Economic Update First Edition Hopes And Headwinds Ghana S Economic Prospects In A Difficult External Environment