Indirect tax imposed at each stage of production and supply. Withholding tax is applicable when payments is made from a permeant establishment PE or a resident party or to a non-resident party for services performed.

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

The tax base for a nonresident ca rrying out activities in Saudi Arabia through a PE is the income arising from the activities of the PE less allowable expenses.

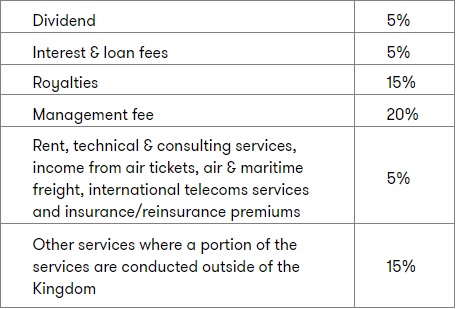

What is withholding tax in ksa. Non resients receiving income from Saudi source may be subject to withholding tax at rates ranging from 5 to 20 depending on the nature of the service. Withholding Tax WHT is an income tax assessed on Nonresidents who generates income from a source in the Kingdom. The tax base of a corporation is determined independently from its shareholders partners or subsidiaries.

The person responsible for withholding tax Every resident whether or not a taxpayer according to Income Tax Law ITL and a permanent establishment of a non-resident in the Kingdom which pays an amount to a non-resident from a source in the Kingdom. Non-resident may claim relief for WHT paid in KSA while paying the income tax in his country under a Double Taxation treaty concluded with KSA. In general the final consumer is the one who bears the full cost of this tax while the business collects and calculates the tax and pays it in favor of the state.

Different withholding tax rates apply depending on the nature of the payments made by the resident to the non-resident. Global business set up experts Every country in the world. What Is a Withholding Tax.

The amount withheld is a credit against the income. Summary of the key provisions of the DTT is listed below. The final settlement paid to the consultant would be 855000 900000 - 45000.

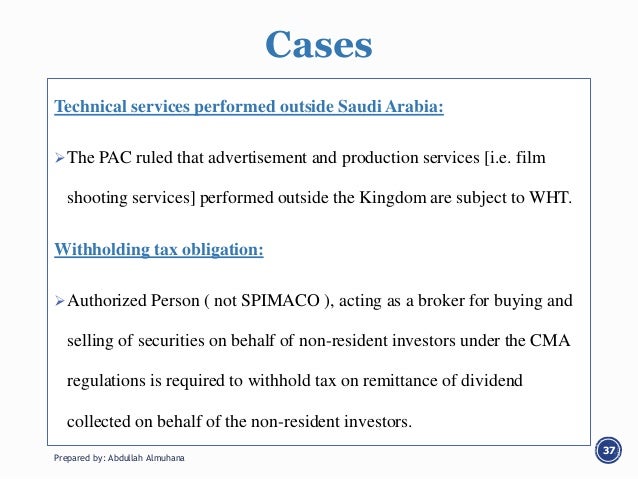

Corporate - Withholding taxes Last reviewed - 31 December 2020 Payments made from a resident party or a PE to a non-resident party for services performed are subject to WHT. Withholding tax comparison for offshore and onshore entities in Saudi ArabiaKey Countries apart of KSA double tax treaty network. Withholding Taxes When paid to a non-resident withholding tax rates are 5 for dividends 5 for interest and 15 for royalties unless otherwise provided in a tax treaty.

Withholding Tax Withholding tax is the tax deducted at source on payments made by a resident in the GCC country to a person outside that GCC country. What are the current income tax rates for residents and non-residents in Saudi Arabia. However it differs from ordinary taxation that the Resident person or the permanent establishment in KSA making a payment to Nonresidents is required to withhold a part of that payment corresponding to tax and remit it to ZATCA.

Currently KSA income tax only provides WHT exemption on dividend declared and distributed by companies engaged in natural gas investment Oil and Hydrocarbons. A withholding tax is the amount an employer withholds from an employees wages and pays directly to the government. Tax rates Coreporate income tax of 20.

Withholding Tax in Saudi Arabia. Imposed at 5 of the stages of the multiple economic cycle with the right to deduct taxes. The rates may vary between 5 15 and 20 based on the type of.

If the contract sum is for 900000. Withholding tax WHT in Saudi Arabia Author. Withholding Tax exemption and reductions.

An exemption from withholding tax WHT on interest and service fees A reduced WHT rate of 10 on royalty payments A maximum 5 WHT on dividends same as the domestic dividend WHT rate in KSA. The withholding tax in Saudi Arabia will be calculated at 5 in case of consultancy contract as per the below. The withholding tax will be at 5 on 900000 which amounts to 45000.

It is also known as retention tax as the tax is paid to the government by the payer of the income and not the recipient. The rates vary between 5 15 and 20 based on the type of service and whether the beneficiary is a related party. Withholding Tax Non-residents without a PE in Saudi Arabia are subject to withholding tax on the payments from Saudi Arabian residents and non-residents with a PE in Saudi Arabia that are sourced from the Kingdom see table.

Under the law and tax regulations of the Kingdom of Saudi Arabia KSA there is an obligation for all clients to pay withholding tax WHT on all out of kingdom international payments to non-Saudi residentregistered partiescompanies direct to the General Authority of Zakat and Tax. A withholding tax is an amount that an employer withholds from employees wages and pays directly to the government. Withholding TAX in Saudi Arabia Comprehending Withholding Tax in the Kingdom of Saudi Arabia.

Withholding Tax In Saudi Arabia Services For Incorporate The Company In Saudi Arabia Neom Sagia Qiddiya

Amendments To The Executive Regulation To Oman Income Tax Law Income Tax Tax Exemption Tax

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Accounting And Tax Zakat In Saudi Arabia By Ernst Young

Overview Of Wht In Saudi Arabia Youtube

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Https Www Keypoint Com Media Files Ksa Wht Pdf

Https Zatca Gov Sa En Helpcenter Guidelines Documents Wht 20guideline Pdf

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

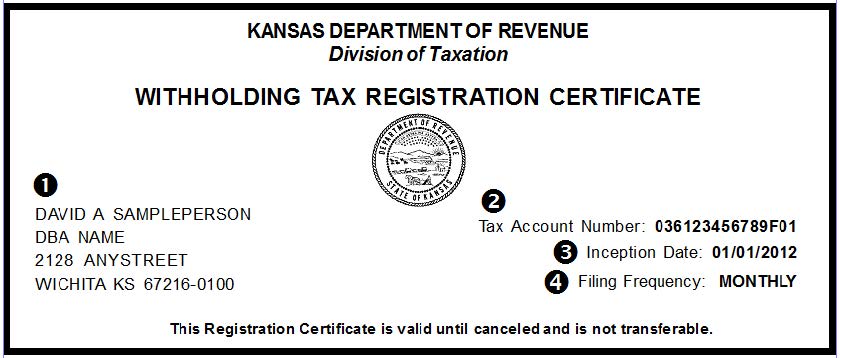

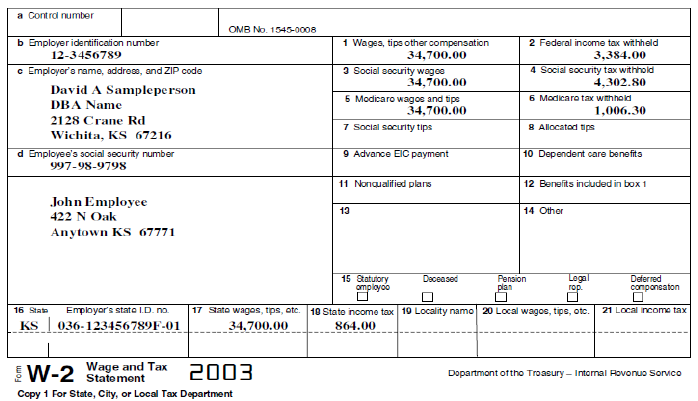

Kansas Department Of Revenue Kw 100 Kansas Withholding Tax Guide

Saudi Tax Zakat Update List Of Topics Ppt Download

Kansas Department Of Revenue Kw 100 Kansas Withholding Tax Guide

Format Of Bank Confirmation Letter New Balance Confirmation Letter Confirmation Letter Lettering Words