If you expect to owe 500 or more on April 15th you must pay your income tax to Illinois quarterly using Form IL-1040-ES. The state UI tax rate for new employers also known as the standard beginning tax rate also can change from one year to the next.

No Progressive Tax Home Facebook

The wage base is 12960 for 2021 and rates range from 0525 to 6925.

What is the unemployment tax rate in illinois. It saw its rate fall from 43 in December 2018 to 37 a year later amounting to a 06 reduction. 065 68 including employment security assessment of 006 Alaska. If youre a new employer your rate is 3175.

The May monthly change in payrolls was revised from the preliminary report from -7900 to 4300 jobs. Illinois state officials have shown that the states unemployment rate has improved for seven consecutive months with the rate currently at 66 percent NBC Chicago 2014. Year State Tax Type Tax Rate Taxable Wage Base.

If you are paying late you must add 2 percent interest to your payment for each month youre late. In Illinois the base rate is 12960 and that means only the first 12960 paid to an employee is subject to unemployment taxIn Illinois unemployment tax rate ranges from 055 to 775. An employers contribution rate is determined by multiplying the employers benefit ratio for that calendar year by the adjusted state experience factor for the same year.

Illinois is still continuing to increase its workforce. Accordingly an employer may pay between 7128 and 100440 per employee into the Illinois Unemployment fund. Within the past year alone Illinois has added a total of.

Bureau of Labor Statistics BLS and released by IDES. But its worth noting those states saw very similar changes in their unemployment rates. Illinois Medicare Tax Rate is 29 NET Illinois FICA Tax Rate is 153 124 29 Illinois FICA Tax Limit Social Security Tax.

Unemployment tax rates are to range from 0625 to 725 The Illinois unemployment-taxable wage base is to be 12740 for 2020 down from 12960 for 2019 the state department of Employment Security said Dec. The May preliminary unemployment rate. In Illinois unemployment tax rate ranges from 055 to 775.

The 2021 Illinois state unemployment insurance SUI experience-rated tax rates will range from 0675 to 6875 an increase of 05 from the range of 0625 to 6825 for 2020. No Income Limit. Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed.

The Illinois Department of Employment Security announced that unemployment tax rates are set to increase for 2021. Your unemployment tax contributions are due a month after the end of each quarter. 118500 Illinois FICA Tax Limit Medicare Tax.

52 Zeilen SUI New Employer Tax Rate Employer Tax Rate Range 2021 Alabama. Previously the tax rate was raised from 3 to 5 in early 2011 as part of a statewide plan to reduce deficits. If the employer is eligible for the maximum credit it means that the tax rate will be only 06 ie.

BLS data show Pritzker is correct that Illinois saw a greater drop in its over-the-year unemployment rate than any of the other states he referenced. Illinois state unemployment insurance tax rates and wage base Aug 01 2021 The 2021 Illinois state unemployment insurance SUI experience-rated tax rates will range from 0675 to 6875 an increase of 05 from. Violations of this law lead to substantial penalties.

050 employee share 15 59. Paid state unemployment taxes on time in full. Standard rate 257 207 employer share.

In recent years it generally has been somewhere between 35 and 40. 030 142 including solvency surtax California. The Illinois Department of Employment Security IDES announced today that the unemployment rate rose 01 percentage point to 72 percent while nonfarm payrolls increased 12500 in June based on preliminary data provided by the US.

In Illinois the base rate is 12960 and that means only the first 12960 paid to an employee is subject to unemployment tax. Established employers are subject to a lower or higher rate than new employers depending on an experience rating This means among other things whether your business has ever had any. The SUI taxable wage base also increases to 12960 for 2021 up from 12740 for 2020.

The Illinois income tax was lowered from 5 to 375 in 2015. Newly registered businesses must register with IDES within 30 days of starting up. Illinois SUTA dumping law prohibits employers from illegally lowering their unemployment insurance tax rates.

The employers can claim this maximum credit of 54 if they satisfy both the conditions below. The unemployment rate in Illinois is expected to keep decreasing. 15 62 emergency 15.

Effective January 1 2021 unemployment tax rates for experience-rated employers are to range from 0675 to 6875. Unemployment tax rates are to range from 0675 to 6875 The Illinois unemployment-taxable wage base is to be 12960 for 2021 up from 12740 for 2020 the state department of Employment Security said Nov. If you are paying late you must add 2 percent interest to your payment for each month youre late.

Illinois Department of Employment Security website.

Https Www2 Illinois Gov Rev Research Publications Pubs Documents Pub 131 Pdf

Https Www2 Illinois Gov Rev Forms Withholding Documents Currentyear Il 941 Instr Pdf

Illinois Tax And Labor Law Summary Care Com Homepay

Filing For Unemployment Benefits In Illinois And Encountering Issues Try These Tips During The Coronavirus Crisis Abc7 Chicago

Usa Unemployment Rate Tax Rate Unemployment

Pua Unemployment Il Ides Asks Some To Pay Back Illinois Unemployment Benefits Slashes Weekly Payments Abc7 Chicago

States With Highest And Lowest Sales Tax Rates

High Taxes Mean Less Revenue For Some States Personal Liberty Map Illinois States

Irs Tax Season 2021 Starts Friday From Stimulus Checks To Unemployment Benefits Here S What You Need To Know In 2021 Irs Taxes Federal Income Tax Tax Return

St 1 Form 2019 Fill Online Printable Fillable Blank Pdffiller

Illinois Tax Forms 2020 Printable State Il 1040 Form And Il 1040 Instructions

Where Your State Gets Its Money Fivethirtyeight Http J Mp 1hyejnz States State Tax How To Get

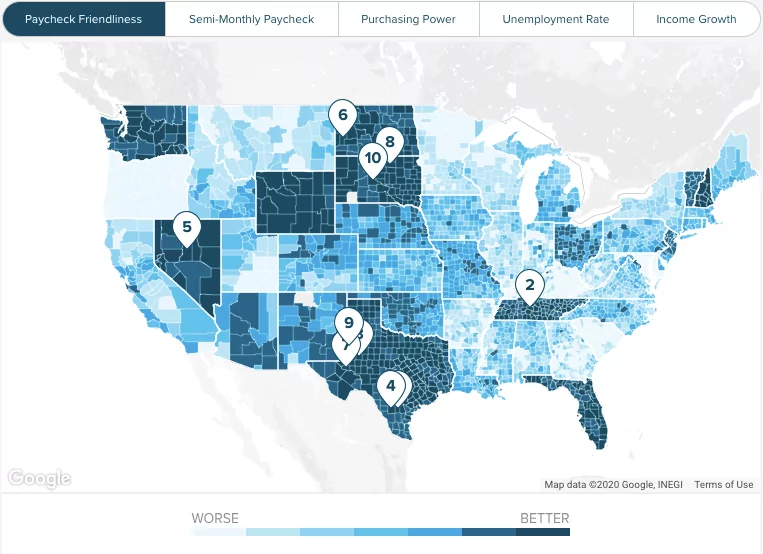

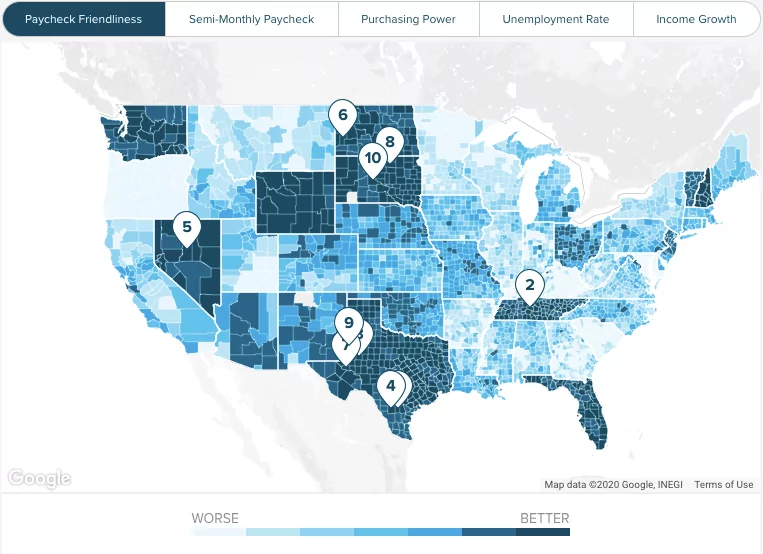

Illinois Paycheck Calculator Smartasset

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Revenue

Where S My Illinois State Tax Refund Il Tax Brackets Taxact

Https Www2 Illinois Gov Rev Research Publications Pubs Documents Pub 101 Pdf