Income Tax is imposed on individuals only at the national level and is not separately imposed at the local level. PAYE Income Tax Threshold.

Jamaica Tax Calculator 2021 Tax Year Icalculator

Income Tax and Non Residents.

What is the tax rate in jamaica. PAYE Income Tax Additional Rate. Revenues from the Sales Tax Rate are an important source of income for the government of Jamaica. The government has approved a tax increase islandwide of 175 to bring it up to 20 in April 10 10 in lieu of 825 as per information I received through onestopva.

Its amount is based on the net income companies obtain while exercising their business activity normally during one business year. Filing Income Tax returns. The corporate income tax rate applies to both resident and non-resident companies.

The current rate of interest is approximately 1604 per annum but. Over 65 Allowance 8000000. Provided income from all sources in any year of assessment exceeds the tax free income threshold of 796536.

Compare Sales Tax Rate by Country. Theres also a 20 government tax on rental cars and a 20 tax on all overseas phone calls. Income Tax and Pensioners.

In Jamaica the sales tax rate is a tax charged to consumers based on the purchase price of certain goods and services. A 275 rate applies to companies with aggregate annual turnover of less than AUD50million for income years commencing on or after 1 July 2018. Also overtime pay is determined by the number of hours worked in a week and not the number of days so overtime is only paid if you have worked more than 40 hours in a week.

The corporate tax rate is 30. Non-resident companies are subject to tax on Jamaican-sourced income. Tax is imposed on certain sources of income such as interest dividends royalties and fees by way of withholding at a rate of 33 for non-resident corporations.

Income Tax and School Leavers. Jamaica Tax Tables 2015 EmployeeEmployer Taxes. The new GCT rate of 15 has been published in the Jamaica Gazette dated March 30 2020 volume number CLXIII No.

PAYE Income Tax Rate. One of a suite of free online calculators provided by the team at iCalculator. For annual income amount in excess of the threshold ie JMD 15 million till JMD 6 million the income tax is charged at a flat rate of 25.

Tax Administration Jamaicas TAJ RAiS is automatically imposing interest on overdue income tax. Individuals are required to file Income Tax Return - IT01 which include. Jamaica Income Tax Rates 2014 and Deductions Jamaica Income Tax Rate for Individual Tax Payers Individual Tax Rate is 25 Jamaica Income Tax.

NIS Employee Rate 150000000. Taxes -- The government imposes a 10 to 15 room tax depending on your category of hotel. The income tax is charged at a rate of 30 when the annual income exceeds JMD 6 million.

Review the 2020 Jamaica income tax rates and thresholds to allow calculation of salary after tax in 2020 when factoring in health insurance contributions pension contributions and other salary taxes in Jamaica. Jamaica has flexi-work so it depends on your arrangement with your employer. See how we can help improve your knowledge of Math Physics Tax Engineering and more.

Jamaica Tax Tables 2019 EmployeeEmployer Taxes Contributions. Chargeable income derived in excess of JMD 6 million per annum is subject to income tax at a rate of 30. Payroll Taxes and Contribution Rates - EmployeeEmployer.

61 titled The Provisional Collection of Tax General Consumption Tax Order 2020. I ncome Tax for Individuals Businesses Income Tax Rates Thresholds and Exemption 2003-2020 Notes and Instructions for completion of Returns of Income Tax Payable IT01 - IT05. The lower rate is subject to a passive income test.

The benchmark we use refers to the highest rate for Corporate Income. Employed persons with other income including pensioners Partners showing share of partnership profits - IT01 IT03. PAYE Income Tax Additional Threshold 8000000.

Persons wishing to obtain a copy of the Gazette pertaining to this new GCT rate may do so from the Government Printing Office. Review the 2021 Jamaica income tax rates and thresholds to allow calculation of salary after tax in 2021 when factoring in health insurance contributions pension contributions and other salary taxes in Jamaica. PAYE Income Tax Rate 55723200.

Youll be charged a US37 departure tax at the airport payable in either Jamaican or US. See how we can help improve your knowledge of Math Physics Tax Engineering and more. The Tax Year runs from 1 July 2018 - 30 June 2019.

The benchmark we use for the sales tax rate refers to the highest rate. One of a suite of free online calculators provided by the team at iCalculator. An annual tax-free threshold of JMD 15.

PAYE Income Tax Threshold PAYE Income Tax Additional Rate 000. Jamaica Corporate Tax Rate In Jamaica the Corporate Income tax rate is a tax collected from companies.

Total Tax Revenue Us Taxes Are Low Relative To Those In Other Developed Countries In 2014 Us Taxes At All Developing Country Gross Domestic Product Slovenia

Money Saving Expert Credit Cards Shopping Bank Charges Cheap Flights And More Money Saving Expert Income Tax Tax Rate

Jewel Runaway Bay Resort Jamaica Jamaica Vacation Jamaica Travel Cheapest All Inclusive Resorts

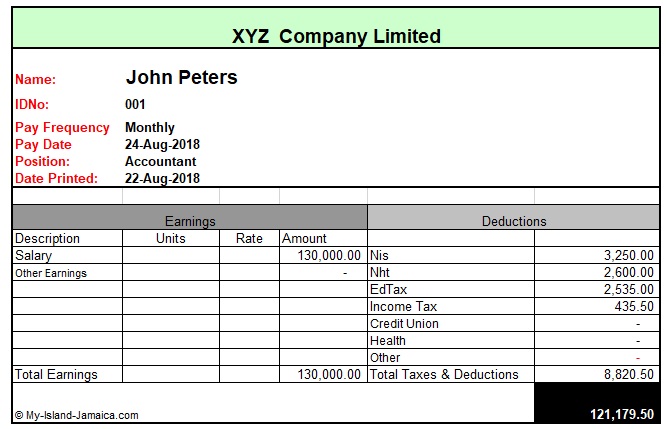

What Are Statutory Deductions In Jamaica

Doing Business In The United States Federal Tax Issues Pwc

Jamaican Taxi System Taxi Jamaica Jamaicans

The President Of The Jamaica Agricultural Society Jas Norman Grant Says The Property Tax Measures Taken By The Governmen Agricultural Sector Property Tax Tax

What Is The Tax Percentage Paid By Businesses In Different Countries Answers Map Urban People World Map Showing Countries

The Taxes That Raise Your International Airfare Valuepenguin

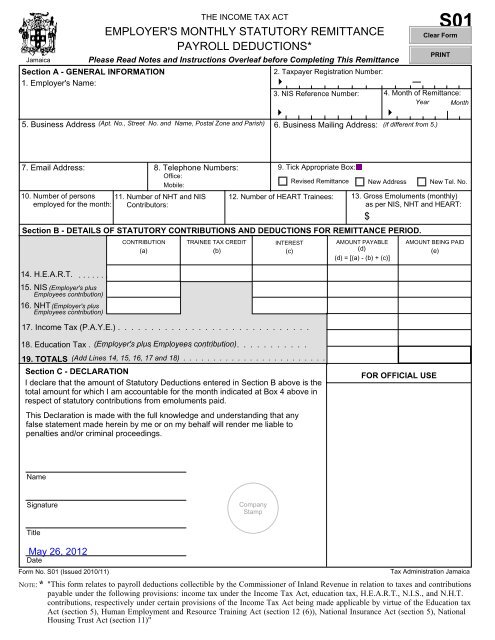

S01 Tax Administration Jamaica Taj

Funny Tax Deductions Funny Infographics Tax Deductions Deduction Business Tax

Https Www Mona Uwi Edu Registry Sites Default Files Registry Uploads Didyouknow5 Pdf

Tax Warning Barbados Today Economy Global Economy Barbados

Understanding The Difference Between P45 P60 Payslips Online Tax Forms Income Tax National Insurance Number

The Taxes That Raise Your International Airfare Valuepenguin

How To Calculate Foreigner S Income Tax In China China Admissions