Withholding tax of 19 is payable on interest and dividend payments whether domestic or to non-treaty countries. This means that the person making a payment must withhold a percentage of that payment to pay it directly to the tax authorities by submitting a prescribed form.

Hansaworld Integrated Erp And Crm

Brief information is shown below.

What is spanish withholding tax. What do we mean by Spanish Withholding Tax. Tax withholding noun retencin de impuestos f Tax withholding is a form of tax collection. Need to translate withholding tax to Spanish.

If you want more information please ask us. When Spanish companies or entrepreneurs who are tax resident in Spain receive an invoice which includes an amount to withhold they need to understand that they are not being taxed but that the person who has issued the invoice is the one who should make an advance payment of hisher future Personal Income Tax and that. Taxes in Spain are split between state and regional governments.

La retencin fiscal evita que los hombres de negocios ricos saquen mucho dinero del pas. However Spanish withholding tax can generally be credited against a shareholders UK tax liability on that dividend at a maximum rate of 10 of the gross dividend for dividends paid on or after 12 June 2014 but excluding any withholding tax which is eligible to be refunded. Spanish entities can borrow funds from related or third parties.

Spain imposes withholding tax WHT on certain classes of income earned by non-residents-Dividends. Owning a property as a non-resident in Spain. Interest payments made by a Spanish resident company to a non-resident at arms length are generally subject to a 19 withholding tax.

The withholding tax prevents wealthy businessmen from taking too much money outside of the country. 20 to be 19 in 2016 A reduced rate may be available under an applicable Double Tax Treaty. Heres how you say it.

VAT IVA in Spanish. Domestic Corporate Taxation Spain Scope of Income Tax. Withholding tax for foreign companies on Finnish dividends under the respective tax treaty is typically but not always 5 percent when the recipient holds at least 25 percent of the shares of the company making the payment.

You can learn more about the non-resident tax here. This means that Spanish tax rates can vary across the country for income tax property tax wealth tax capital gains tax and inheritance tax in Spain. If you are from any other country a 24 fixed rate will be applied to your incomes in Spain.

Ordinarily WHT is the mechanism by which the Spanish tax authorities collect the final tax levied on non-residents. The Protocol retains the provision authorizing the branch profits tax but it specifically subjects such tax. In Spain withholding taxes apply in a number of cases.

Impuesto sobre el valor aadido or impuesto sobre el valor agregado is due on any supply of goods or services sold in Spain. Also no withholding tax will generally apply to interest and royalty payments made by Spanish or US companies to residents in the other State provided that the recipient of the income is the beneficial owner. Nevertheless non-residents from any European Union country Iceland or Norway will pay a flat rate of 19.

La retencin en origen. As previously mentioned the withholding tax rate can be reduced or eliminated under EU legislation or a double-taxation treaty. The taxpayer may of course set off this withholding tax on his final declaration.

Spain has a patent box regime under which 60 of the net qualifying income derived from the licensing or the transfer of qualifying intangible assets eg. The treaty currently in force imposes a 10 additional branch tax on the remittance of profits by branches to their head offices. The current normal rate is 21 which applies to all goods which do not qualify for a reduced rate or are exempt.

Spanish personal income tax PIT for individuals who are resident in Spain for tax purposes and Spanish non-residents income tax NRIT for individuals who are not resident in Spain for tax purposes who obtain income in Spain. Spanish tax also applies to property ownership investment interest and goods and services VAT in Spain. However where dividends are paid to a company that has share capital which has been held during the previous year equal to or above 5 withholding tax does not apply.

Patents technological IP secret formulae. Real estate taxes transfer taxes tax on the erection and installation projects and construction work tax on. 20 to be reduced to 19 in 2016 Royalties.

Spanish withholding tax can be credited provided the dividends have been taxed. The tax treaties typically lower the applicable statutory rates depending upon the type of income. The Spanish system for direct taxation of individuals is mainly comprised of two personal income taxes.

There are two lower rates of 10 and 4. In the case of resident beneficiaries however it is simply an advance payment of a tax that is then normally self-assessed by the. La retencin de impuestos es una forma de recaudacin fiscal.

It is a general rule that interest payments to an EU resident.

China Business Cross Border Withholding Tax 101 My Company In England Provides Services To A China Based Company Why Is 10 Deducted From The Service Fee The Square

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Solved How To Record And Pay Withholding Tax On Supplier

How To Manage Withholding Taxes Odoo 9 0 Documentatie

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Solved How To Record And Pay Withholding Tax On Supplier

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

Hansaworld Integrated Erp And Crm

Hansaworld Integrated Erp And Crm

Https Www Shareview Co Uk 4 Info Portfolio Santanderhelp En Home Help Documents Spanish Withholding Tax Information Dividends 27 08 20 Pdf

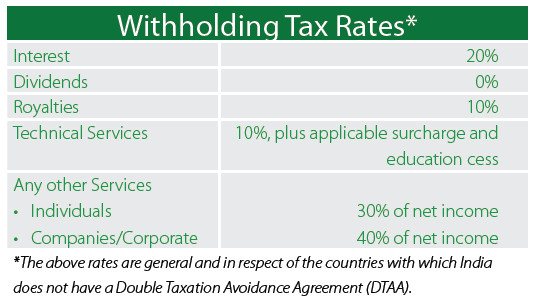

Asiapedia Withholding Tax Rates In India Dezan Shira Associates

Hansaworld Integrated Erp And Crm

Withholding Tax Claims In Spain How To Maximize Investment Performance Of Foreign Funds Insights Dla Piper Global Law Firm

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Denmark Coronavirus Withholding Tax Extensions Activpayroll

Hansaworld Integrated Erp And Crm