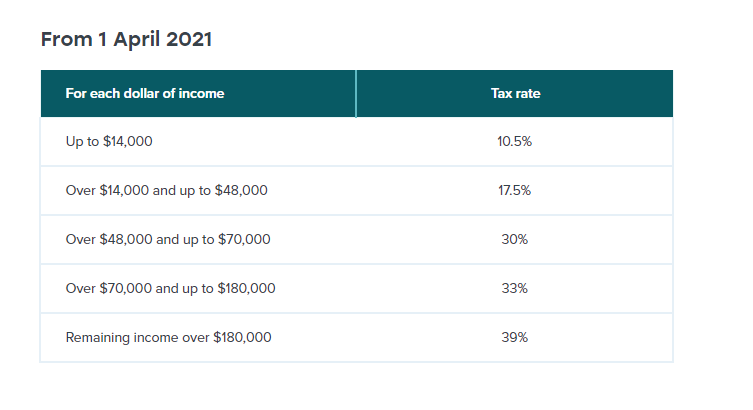

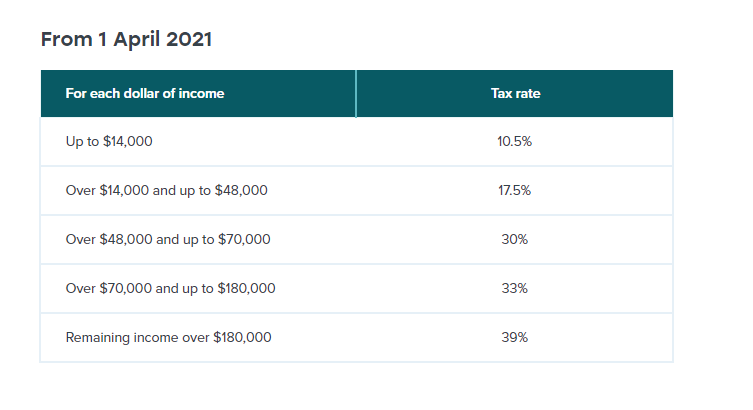

Income Tax is a gradual tax that has four brackets. Employees earning a wage or salary are taxed directly from their pay.

Andrea Black Let S Talk About Tax Nz

Income tax for individuals Tax codes and rates income and expenses paying tax and getting refunds.

What is paye tax nz. In most cases it is deducted from the pay that you will receive before you receive it and is taxed via a series of tiered tax rates depending on the amount you earn and your tax code. The incremental tax rates increase as the salary increases. KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE.

Pay As You Earn PAYE is a withholding income tax for employees in New Zealand. There are other types of tax too - but here were only going to focus on income tax. Over 14000 and up to 48000.

You need to register for GST if. Business expenses external link Inland Revenue. All taxes are paid to Inland Revenue.

To use the PAYE calculator enter your annual salary or the one you would like in the Insert Income box below. New Zealands Best PAYE Calculator. Each pay period you need to calculate and deduct PAYE.

New Zealand has a simple progressive and fair tax system - people with higher taxable incomes pay higher PAYE tax rates. Income tax for businesses and organisations. Create budgets savings goals and plan for retirement.

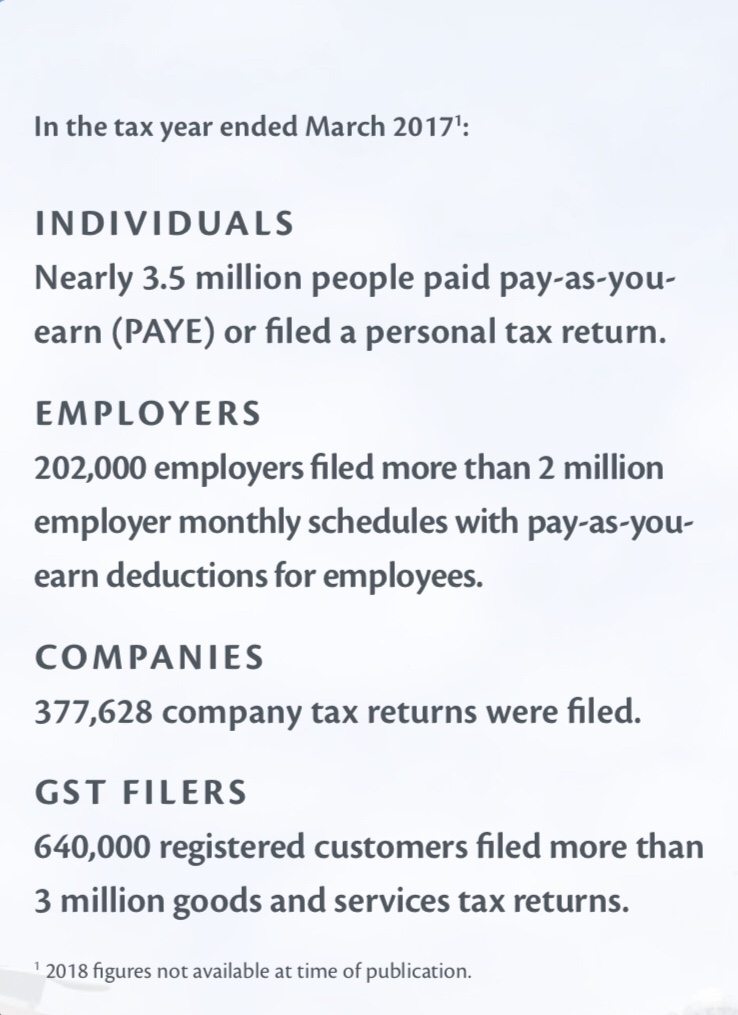

If youre earning any sort of income you have to pay tax. The taxes are collected at a national level by the Inland Revenue Department IRD on. The amount of tax you pay depends on your total income for the tax year.

COVID-19 Inland Revenue. You can claim back expenses for business activity that you carry out. Its also important to understand your obligations for.

For contractors tax can also be deducted from your pay. Income tax and provisional tax If you own a business or are self-employed youll pay tax in one lump sum or several instalments. For each dollar of income Tax rate.

All employees are taxed under the Pay as you Earn PAYE system which means that the correct amount of tax is deducted from your wage before you get it. In New Zealand the main two types of tax are income tax a tax on what you earn and Goods and Services tax a tax on what you buy - widely known as GST. Everyone in New Zealand needs to pay tax on income they earn whether theyre an individual business or organisation.

Make sure youre paying the right amount so you do not end up with a large bill. Tax relief and income assistance is available to people affected by the downturn in business due to the COVID-19. If you live overseas and have a bank account in New Zealand the tax rate on the interest is 10 or 15 depending on where you live.

This way of paying income tax is called provisional tax. The income tax in New Zealand starts at 105 for incomes up to 14000 NZD and ends at 39 for wages greater than 180000 NZD. Payments for non-resident withholding tax NRWT like dividends interest and royalties a New Zealand resident pays to a non-resident.

Calculate your take-home pay KiwiSaver Secondary Income Tax Tax Code net worth. Personal income tax scale 105c per 1 on annual taxable income up to 14000 175c per 1 on annual taxable income between 14001 and 48000 30c per 1. However being in a tax bracket doesnt mean you pay that PAYE income tax rate on everything you earn.

Generally the payments you get from renting out property are income. At tax time your total profit the amount you need to pay tax on is your taxable income minus the expenses you can claim so the more you can claim the less tax you have to pay. From 1 April 2021.

Our PAYE calculator shows you in seconds. Calculate your take home pay from hourly wage or salary. As an employer youre responsible for deducting and paying PAYE income tax on your employees behalf.

Residential rental income and paying tax on it. The table below will automatically display your gross pay taxable amount PAYE tax ACC KiwiSaver and student loan repayments on annual monthly weekly and daily basis. Expenses are the costs you incur in the day-to-day running of your business.

PAYE is deducted before you pay your employees and you pay it to Inland Revenue on. PAYE pay as you earn is tax deducted from your employees wages or salary. You need to pay tax on rental income in the year its earned.

You pay tax on net profit by filing an individual income return. How to pay tax. GST if youre renting out short-term rental property excess deductions.

New Zealand has progressive or gradual tax rates. This is known as PAYE pay as you earn. The rates increase as your income increases.

Autumn Statement From Inland Revenue Means More Austerity And Higher Taxes On Middle Class And Wealthy Pensions Uk Pension Financial Advice

April 2021 Updates What Do You Need To Know Ontrack Bookkeeping Ltd

Without Hiring A Trustworthy Company That Offers Accountancy Services In Auckland It Is Very Difficult To Run A Com Tax Accountant Tax Refund Tax Preparation

Pin On Murray Sharma Associates Limited Tax Agent Nz

Pin On Tips For British Expats

Tax And Taxation In New Zealand Henderson International

The Government Wants To Tax You For Items You Sell On Ebay Ebay Government How To Plan

Nz Tax Return Preparation Bookkeeping Outsourcing Tax Return

Allowing Contractors To Elect Their Own Withholding Rate

Andrea Black Let S Talk About Tax Nz

Andrea Black Let S Talk About Tax Nz

50 600 After Tax Nz Breakdown August 2021 Incomeaftertax Com

Https Www Ird Govt Nz Media Project Ir Home Documents Forms And Guides Ir300 Ir399 Ir336 Ir336 2019 Pdf Modified 20200511220619

Get Ready For Health And Safety Law Changes Business Plan Template Free Business Plan Template Health And Safety

K Rankin S The Standard Tax Credit And The Social Wage Existing Means To A Universal Basic Income