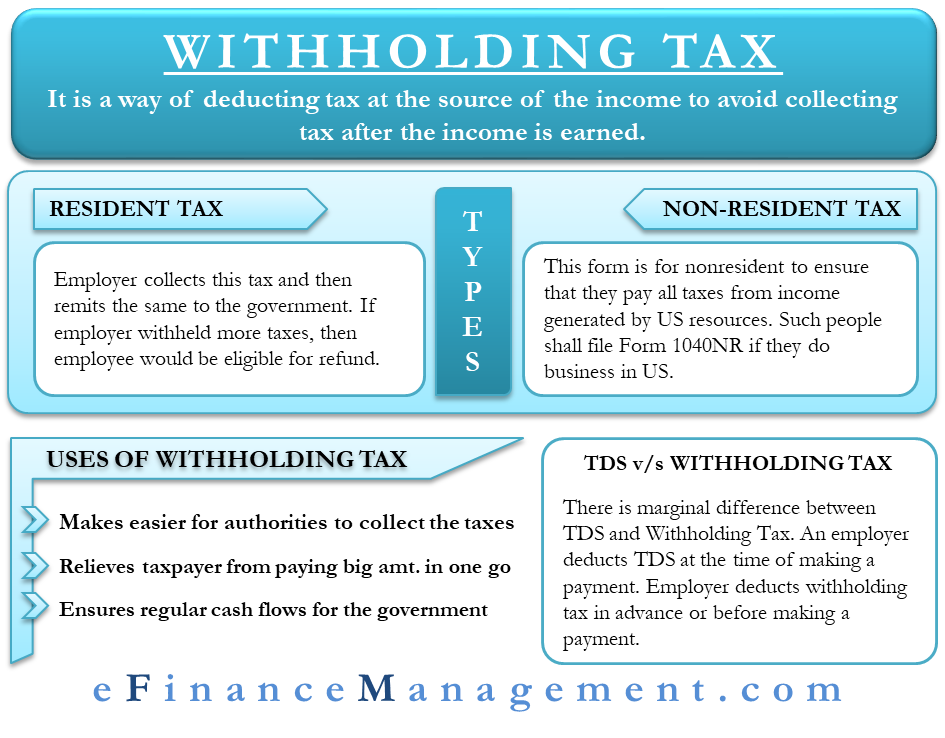

US tax law requires the withholding of tax for non-US persons non-resident aliens at a rate of 30 on payments of US source stock dividends short-term. To determine whether you are a US domiciliary the following factors are considered.

Tax Information Form W 8 Requirements For Non Us Authors Envato Author Help Center

This income is taxed at a flat 30 rate unless a tax treaty specifies a lower rate.

Us withholding tax rates for non residents. FDAP income is taxed at a flat 30 percent or lower treaty rate if qualify and no deductions are allowed against such income. The default withholding tax rate is 30 and income tax treaties provide for lower rates usually around 15 or less. 12 Zeilen Withholding Tax Rates.

Gross investment income from interest dividends rents and royalties paid to a foreign private foundation. 25 0 0 The Parliament has adopted a 15 withholding tax. Income Tax Return for Certain Nonresident Aliens with No Dependents.

Generally the non-resident withholding tax is considered your final tax obligation to Canada on that income. All persons making US-source payments to foreign persons withholding agents generally must report and withhold 30 of the gross US-source. Brokers handle this tax withholding and pay those taxes to the Internal.

7 Investments that have been owned for less than one year are subject to short-term capital gains taxes which. US taxpayers use Form W-9 to file theirs. Facts and circumstances test.

Feb 2019 This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. The treaty rules vary depending on which country the treaty was entered into. Therefore the US taxes on benefits have the much higher flat rate.

However if it is paid by a listed corporation or publicly offered investment trust the tax rate reduces to 15315. These are the same rates that apply to US. Nonexempt recipient account holders for whom the QI is required to report on Form 1099 and has provided you with Forms W-9 prior to you making the reportable payment or if applicable designated broker proceeds to which backup withholding does not.

Nonresident Alien Income Tax Return. Nonresident aliens must file and pay any tax due using Form 1040NR US. Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source non-business income.

General withholding tax rate is 2042. The current tax rates are 0 15 or 20 depending on your individual tax bracket. Out of IRS Tax Compliance.

6Interest on loan Interest on a loan provided to a person operating a business in Japan is subject to. Scholarship or fellowship grant paid to other nonresident aliens. Corporate - Withholding taxes.

Effectively Connected Income should be reported on page one of Form 1040-NR US. Taxable part of US. Nonexempt recipients by establishing a single withholding rate pool not subject to backup withholding for all US.

Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. Married taxpayers need to file their US tax return separately from their spouse though. If you are a non-resident actor a non-resident withholding tax of 23 applies to amounts paid credited or provided as a benefit to you for film and video acting services rendered in Canada.

Instead foreign individuals must complete a form in the Form W-8BEN series such as Form W-8BEN. Non-resident aliens for tax purposes have only two different filing statuses to choose from. The types of payments and withholding tax rates prescribed in Section 70 are.

For international payments of dividendshare of profits income. Generally married filing jointly is not an option. If you and the QI agree the QI may apply the alternative procedures for US.

Scholarship or fellowship grant paid to holder of F J M or Q visa. Thus you may be a resident for income tax purposes but not US domiciled for estate and gift tax purposes. Nonresident Alien Income Tax Return or Form 1040NR-EZ US.

For international payments of services income royalty or rights income interest income capital gains income property rental income and professional services income. You must meet all of the treaty requirements before the item of income can be exempt from US. For US estate and gift tax purposes is different than determining US income tax residence see page 2.

Statement of intent in visa applications tax returns will etc. Last reviewed - 06 February 2021. While all treaties do vary if even slightly most treaties reduce the tax on dividends significantly from a general 30 FDAP withholding rate all the way down to 15 10 5 or even zero.

Permanent residents and citizens are not subject to the 30 or lower treaty rate withholding tax that foreign individuals are required to pay. Taxable part of US. 3 Non-Resident Withholding Tax Rates for Treaty Countries 134 Non-Resident Withholding Tax Rates for Treaty Countries1Continued Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 Lithuania7 10 515 10 101525 Luxembourg 10 515 010 25 Malaysia 15 15 15 1525 Malta 15 15 010 1525 Mexico 10 515 010 1525 Moldova 10 515 10 1525.

Form 8833 Tax Treaties Understanding Your Us Tax Return

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Global Corporate And Withholding Tax Rates Tax Deloitte

Fillable Form 1042 2016 Irs Forms Fillable Forms Tax Return

How To Save U S Taxes For Nonresident Aliens

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

How To Avoid The 30 Tax Withholding For Non Us Self Publishers Thinkmaverick My Personal Journey Through Entrepreneurship Psychology Books Self Personal Journey

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

W 8 Ben Form Fotolia Com W 8 Ben W 8ben Instructional Design Teachers College Irs Forms

Tax Information Form W 8 Requirements For Non Us Authors Envato Author Help Center

Withholding Tax All You Need To Know

Tax Information Form W 8 Requirements For Non Us Authors Envato Author Help Center