See EY Tax Alert 2020-1087 4-23-2030. The AMT is levied at two rates.

Your Bullsh T Free Guide To Taxes In Germany

Or Publication 51 Circular A Agricultural Employers Tax Guide for agricultural employers.

Us employment tax rates and limits for 2020. The filing deadline for the 2020 tax year is April 15 2021. Existing employers pay between 006 and 79. The AMT exemption amount for 2020 is 72900 for singles and 113400 for married couples filing jointly Table 3.

Or October 15 2021 if you apply for an automatic filing but not paying extension Which means you account for your 2020 tax bill in 2021. The employees portion of the Social Security tax which is 62 of the first 137700 of. Another tax that probably applies to your income is Social Security tax.

2020 Federal Tax Rates and Annual Limits Last updated on December 13 2019 Federal Insurance Contributions Act FICA Retirement Plan Limits Spending and Savings Accounts Health Care FSA HC FSA Dependent Day Care FSA DC FSA and Health Savings Accounts Supplemental Tax Rates Federal Unemployment Tax Act FUTA Social Security taxable earnings 137700 increased from. Social Security Tax Rates. The social security wage base limit is 137700 for 2020 and 142800 for 2021.

Add the fact that the IRS released the ground rules. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. For 2020 the FUTA tax rate is projected to be 6 per the IRS.

Qualified pension plan limits for 2019. Federal mileage rates for 2019. Federal Unemployment Tax The wage base remains at 7000.

This can get a bit confusing. Tax Rate 2019 2020 Employee. How Much Are FUTA Taxes.

Fringe-benefit inflation adjustments for 2019. The Social Security tax rate is 124 on wages you pay half and your employer pays half up to the Social Security wage base which is 137700 in 2020. FUTA Tax Rate 2020.

We are pleased to announce that we have updated our 2020 annual publication of key federal and state rates and limits to reflect updates to the 2020 state unemployment insurance wage bases and state income tax withholding rates. Health Savings Account limits for 2018 and 2019. For 2020 the self-employment tax rate is 153 on the first 137700 worth of net income plus 29 on net income over 137700.

The Social Security wage base will increase from 137700 to 142800 in 2021 higher than the 141900 high-cost and 142200 low-cost estimate published in the April 2020 Annual Report of the Board of Trustees. In our 2020 edition of US employment tax rates and limits you will find as of February 1 2020 the following. What is the 2020 self-employment tax rate.

This 7000 is known as the taxable wage base. Get the essential federal and state employment tax rates and limits for 2019 in one place with this publication. Health Savings Account limits for 2019 and 2020.

US employment tax rates and limts for 2020 Ernst Young LLP is pleased to announce the release of its 2020 annual publication of key federal and state payroll tax rates and limits. Key federal and state employment tax rates and limits for 2020 are available in our annual publication. This wage base is adjusted annually to keep up with inflation.

Social Security wage base for 2020. New employers pay 313 in SUTA for employees making more than 11100 per year. Qualified pension plan limits for 2020.

Anything above the wage base amount is not subject to Social Security tax. Other important 2020 Social Security information is as follows. They refer to it as the Unemployment Insurance Contribution Rate UI.

The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total. Our 2020 US employment tax rates and limits publication is updated through February 1 2020. Since youre paying both portions for employer and employee of Social Security and Medicare the rate breaks down as follows.

Upcoming Tax Brackets Tax Rates for 2020-2021. 26 percent and 28 percent. In 2020 the 28 percent AMT rate applies to excess AMTI of 197900 for all taxpayers 98950 for married couples filing separate returns.

Social Security Administration Press Release The Medicare tax rate for 2020 remains at 145 of all covered earnings for employers. The effective tax rate for 2020 is 06. In the report.

Refer to Publication 15 Circular E Employers Tax Guide for more information. The FUTA tax applies to the first 7000 in wages you pay an employee throughout the calendar year. The employee tax rate for social security is 62 for both years.

Social Security wage base for 2019.

Taxtips Ca Manitoba Personal Income Tax Rates

Your Bullsh T Free Guide To Taxes In Germany

Taxtips Ca Canada S Top Marginal Tax Rates By Province Territory

Alibaba Said To Warn Of Higher Taxes As Crackdown Widens Bloomberg

Income Tax Rate On Private Limited Company Fy 2020 21 Ay 2020 21

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Global Corporate And Withholding Tax Rates Tax Deloitte

/dotdash-INV-final-How-the-Ideal-Tax-Rate-Is-Determined-The-Laffer-Curve-2021-01-9873ad4f5a464341aa6731540b763d76.jpg)

How The Ideal Tax Rate Is Determined The Laffer Curve

Marginal Tax Rate Overview How It Works How To Calculate

Global Corporate And Withholding Tax Rates Tax Deloitte

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

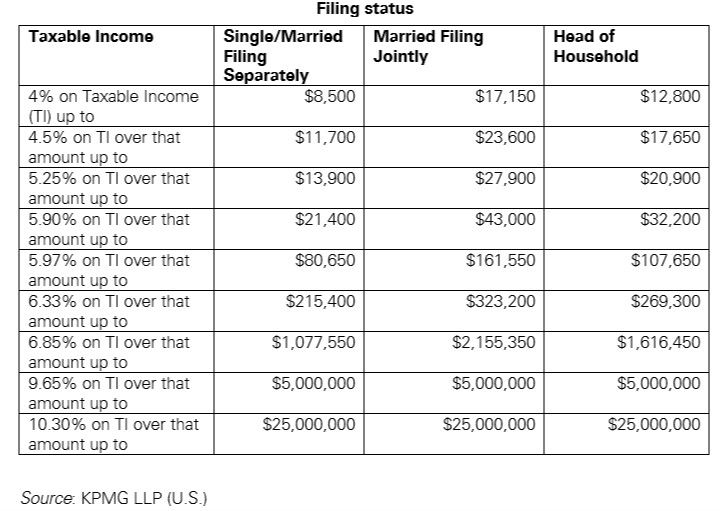

Us New York Implements New Tax Rates Kpmg Global

Income Tax In Austria For Foreigners Academics Com

25 Percent Corporate Income Tax Rate Details Analysis

Taxes In Switzerland Income Tax For Foreigners Academics Com

/taxes-word-on-wood-block-on-top-of-coins-stack-869670536-efbe1559282e4a5c87945445dd1b32a3.jpg)