It is possible that the UK will be able to renegotiate some existing double taxation treaties so that they replicate the current position. Certain countries such as Singapore UK excluding REITs etc.

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

For instance UK charges no withholding taxes to US residents.

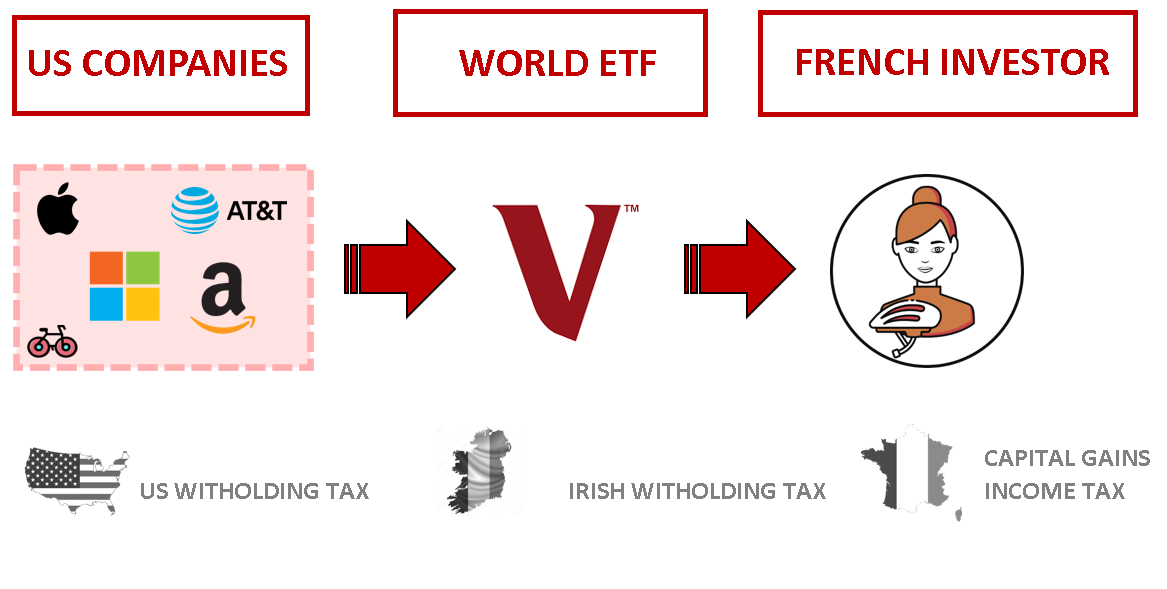

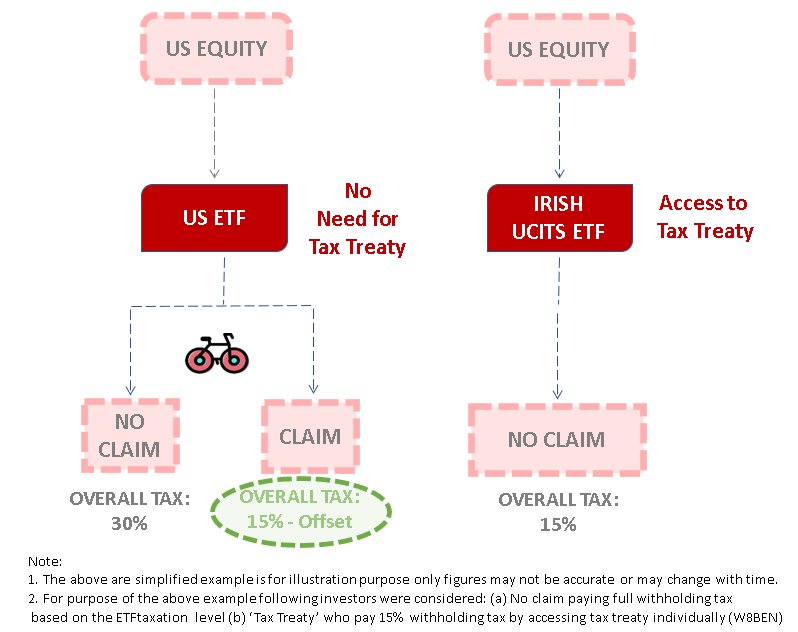

Us dividend withholding tax rate uk. We are hit with a withholding tax in the UK on the dividends from US stocks. Are great for American investors since they do not charge withholding taxes for dividends. Firstly where the treaty benefits apply the US withholding tax will in no case be greater than 15.

As a general rule UK domestic law requires companies making payments of interest to withhold tax at 20. The rate is 15 unless the dividend is paid to a company holding at least 25 of the paid-up capital in the Dutch company. Income tax is payable on any dividend income received above 2000 at the rates specified below.

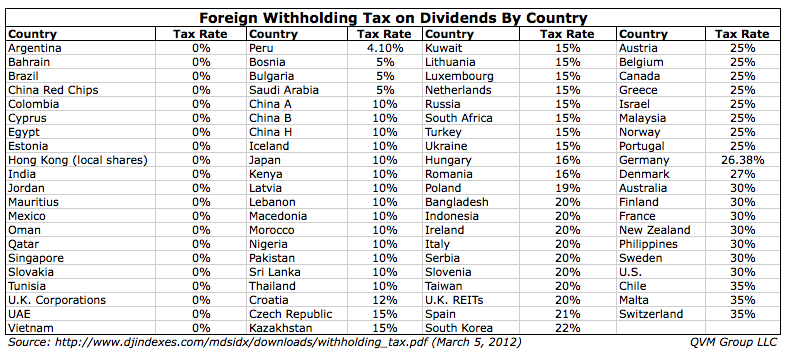

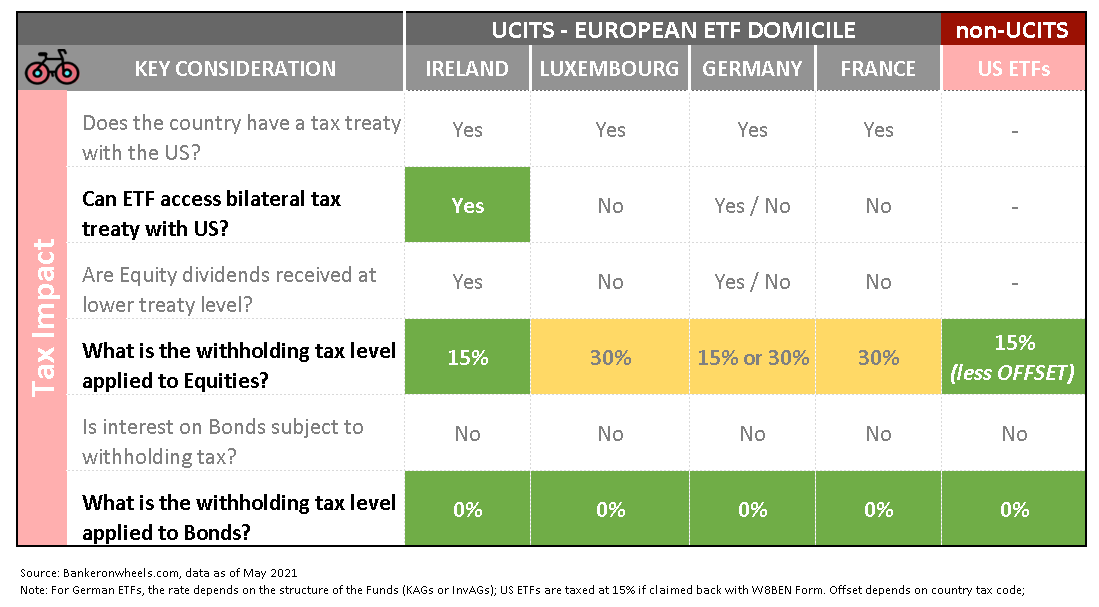

25 15 effective rate for Americans due to tax treaty China mainland. Here is the withholding tax rate for some of the largest countries. However this rate does not apply to UK REITs Dividends paid out REITs would be charged at 20.

This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. To make sure you are only getting taxed at a lower rate of 15 you must fill in a W-8BEN form. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

From 1 April 2020 dividend distributions to residents are subject to a withholding rate of 10 and dividend distributions to non-residents are subject to a withholding rate of 20. I 5 if the dividends received are subject to a profits tax in the other state of at least 55 on the dividend or ii 75 if the profits tax is less than 55. 25 0 0 The Parliament has adopted a 15 withholding tax.

US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to. Otherwise the maximum WHT rate on dividends is 15. 12 rows You must withhold tax at the statutory rates shown below unless a reduced rate or.

Have a nominal tax rate of 10. The foreign withholding rate can vary wildly. My broker Trading 212 made me fill.

Currently this tax is 15 although it can be as high as 30. This reduction follows the pattern adopted in other United States treaties. In addition any amount of dividend income falling within the personal allowance is also tax-free.

In the UK all individuals benefit from a tax-free dividend allowance of 2000 per year. A 5 dividend WHT rate applies to dividends paid to a company that directly holds at least 10 of the voting power in the company paying the dividends. Withholding Tax on US Dividends - Articles 10 and 23 The treaty allows both the US and the UK to tax dividends paid to a resident of the other country but subject to certain conditions limits the.

Among the high withholding tax rate countries are New Zealand Denmark Germany and Switzerland. Foreign Dividend Withholding Tax Rates by Country. For example the US Government charges non-US residents withholding tax of 30 on any income received from US investments.

The personal allowance is currently 12570 and first. Secondly if the dividends are paid to a UK company owning directly or indirectly 10 or more of the US company the withholding tax will be no greater than 5 of the gross amount of the payment. The amount withheld in taxes varies wildly by nation.

The UK government has double taxation agreements DTAs in. However there are a number of exceptions to this. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income.

No withholding tax where the company receiving the dividend holds directly at least 25 of the issued share capital of the company paying the dividends. Others such as Colombia Mexico Thailand etc. The United States will reduce its withholding rates to 15 percent on dividends to United Kingdom portfolio investors and to five percent on dividends to United Kingdom parent corporations.

The royalty or fee for technical services is subject to a withholding rate. A second new provision is found in paragraph 4 of Article 9 Associated. In this latter case the WHT rate will be reduced to.

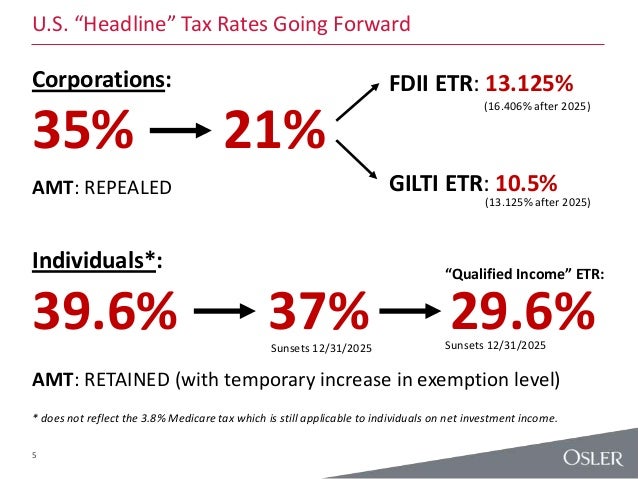

Doing Business In The United States Federal Tax Issues Pwc

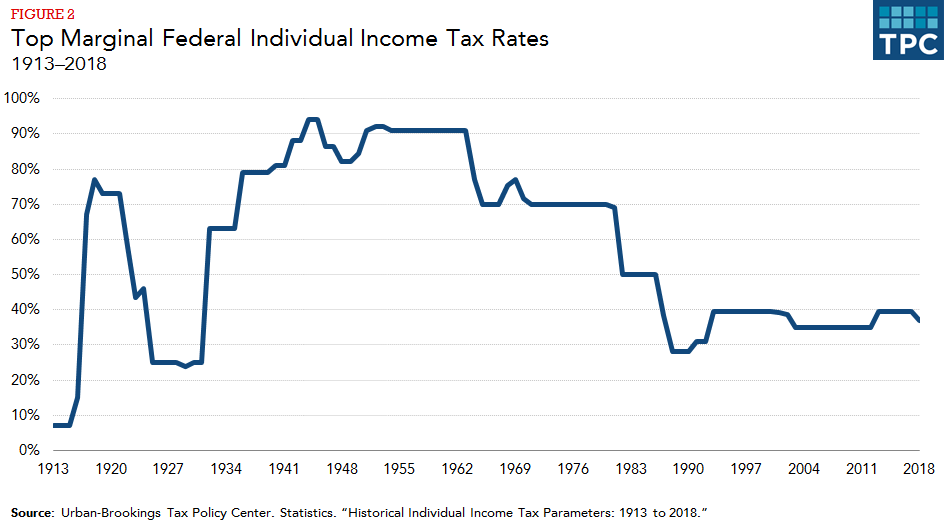

How Do Marginal Income Tax Rates Work And What If We Increased Them

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Expat Tax Advice For Us Non Residents Living In The Us

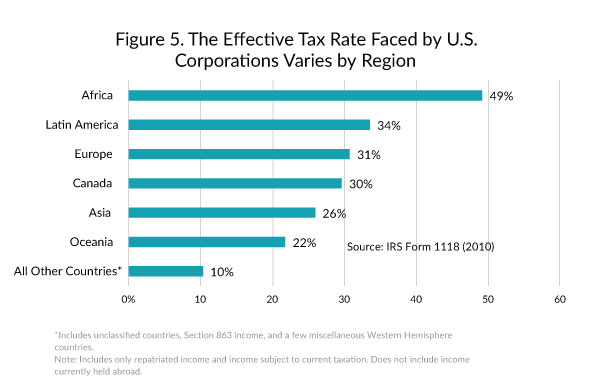

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

Average Tax Rate What Is The Average Tax Rate Tax Foundation

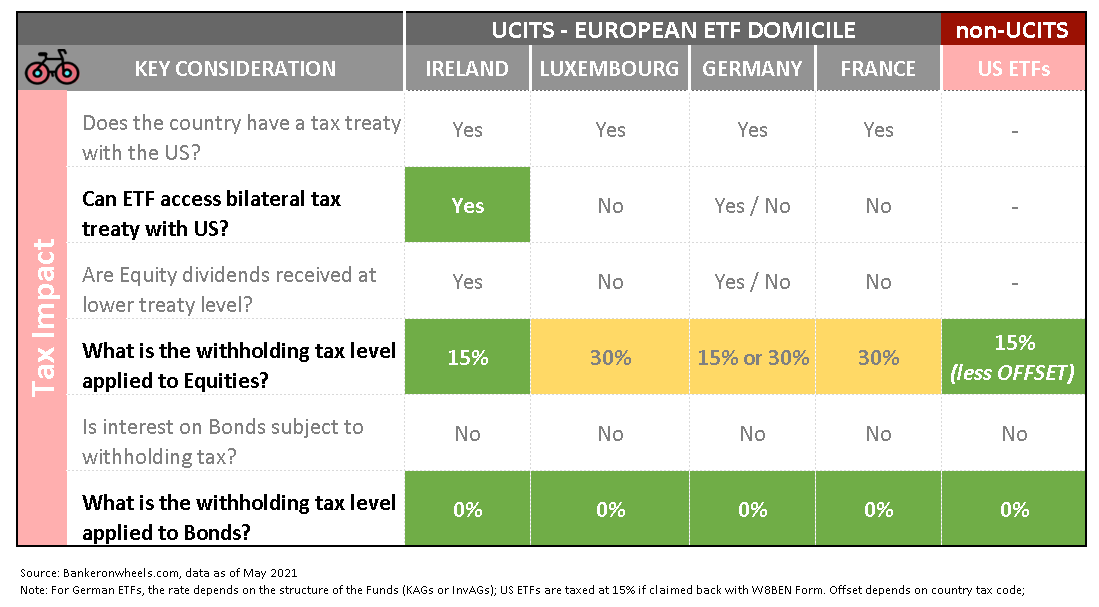

Easy And Boring Money How To Reduce Withholding Tax Bankeronwheels Com

Stocks That Avoid Unrecoverable Foreign Dividend Withholding In Tax Deferred Accounts Seeking Alpha

Easy And Boring Money How To Reduce Withholding Tax Bankeronwheels Com

United States Income Tax History Tax Code And Definitions

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

Comparison Of Us Uk And German Corporate Income Tax Systems Grin

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

United States Income Tax History Tax Code And Definitions

Easy And Boring Money How To Reduce Withholding Tax Bankeronwheels Com

Easy And Boring Money How To Reduce Withholding Tax Bankeronwheels Com

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology