A Virginia Employment Commission spokeswoman tells 13News Now that federal benefits for self-employed workers and independent contractors should. You may file a claim for unemployment insurance through this Website by clicking the link below to File a new claim for unemployment benefits or through our Customer Contact Center by calling 1-866-832-2363 Monday through Friday 830am 430pm and between 9am and 1pm on Saturday closed Sunday and state holidays.

/cdn.vox-cdn.com/uploads/chorus_asset/file/19916217/1219237615.jpg.jpg)

How To Apply For Unemployment Benefits If You Re A Freelancer Or Self Employed Vox

After weeks of delays VEC says theres one final step before workers can receive retroactive benefits through the Pandemic Unemployment Assistance program.

/cdn.vox-cdn.com/uploads/chorus_asset/file/19916217/1219237615.jpg.jpg)

Self employment unemployment virginia. So the new stimulus plan that was signed into effect yesterday helps a lot of Americans. Once you have filed your initial claim you must continue to file. The Virginia Employment Commission said it has an application available for self-employed workers to receive unemployment benefits during the COVID-19 outbreak.

An April 14 memo from the Virginia Employment Commission referencing individuals who are self-employed gig workers 1099 filers and other workers not covered under the Virginia Unemployment Compensation Act are eligible. Virginia Relay call 711 or 800-828-1120. Get peace of mind at tax time.

Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001. Virginia self employment tax forms include Form 760 760PY or 763 which compute an estimated tax liability. Box 26441 Richmond VA 23261-6441.

These individuals may include those who are self-employed independent contractors gig economy workers clergy and those working for religious organizations as well as. Freelancers self-employed workers now eligible for unemployment benefits in Virginia Under the CARES Act self-employed workers and independent contractors can apply for temporary unemployment. Wv Workforce Ready To Roll Out Extended Benefits 2 2.

With Mixed Earner Unemployment Compensation a person who made more money from self-employment or a contracting job -- that requires a 1099 form -- could receive an extra 100 a week. Important Information Concerning the CARES Act and Unemployment Insurance UI The CARES Act includes a provision of temporary benefits for individuals who are not eligible for regulartraditional unemployment insurance. Weekly unemployment benefits in Virginia range.

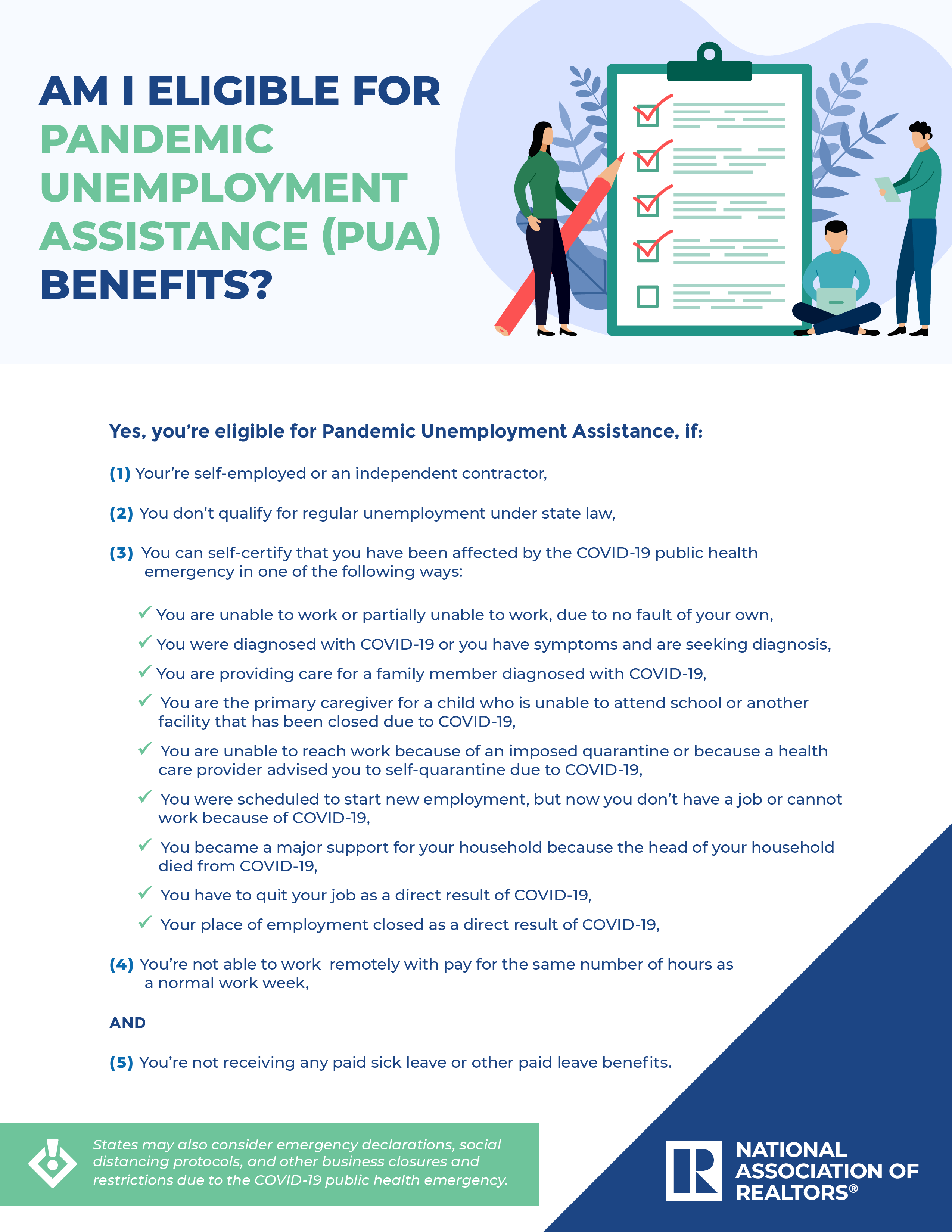

Many self-employed workers freelancers and others not covered by regular unemployment are now eligible to receive unemployment benefits under the Pandemic Unemployment Act PUA. Elizabeth Cogar didnt apply for Virginia unemployment benefits after her freelance writing job ended early last year because she didnt think she was eligible. But did you know that as a self employed person you can now claim u.

866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO. In order for an individual to be eligible either you or an employer had to make contributions in the past 5 to 18 months. Freelancers self-employed workers now eligible for unemployment benefits in Virginia Under the CARES Act self-employed workers and independent contractors can apply for temporary unemployment.

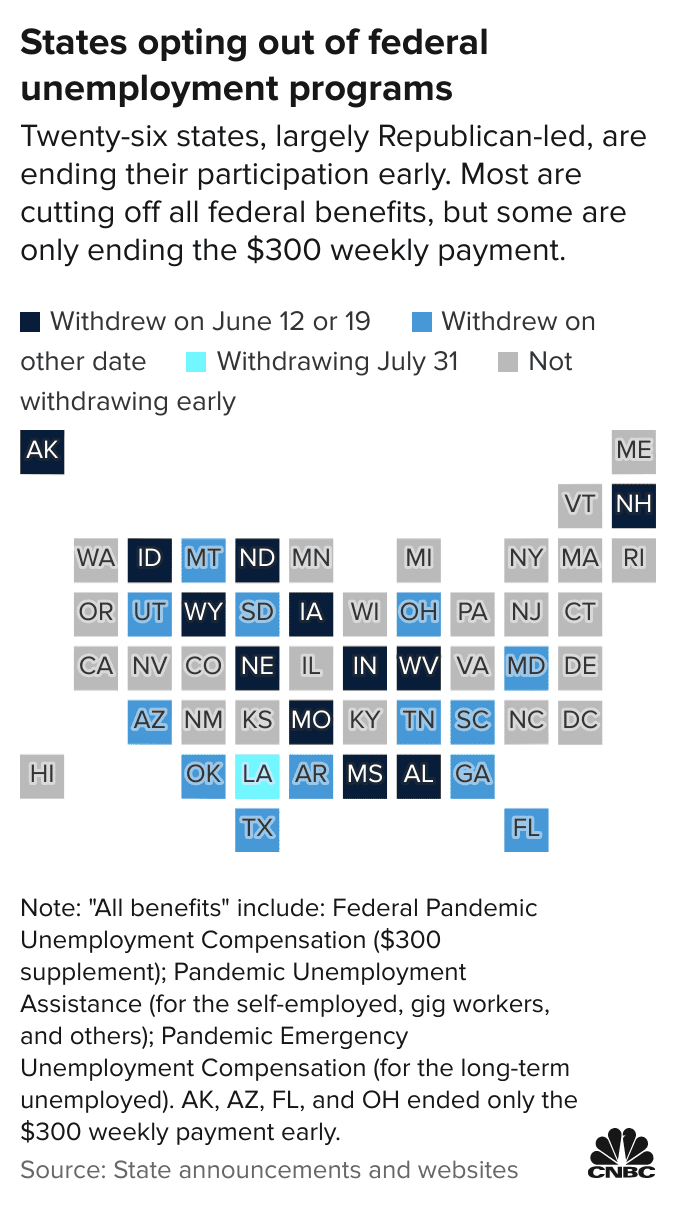

15 even though the Virginia. Who will be shut off early from all unemployment aid with more than. Texas represents the biggest share of self-employed and gig workers in the US.

Original article April 17 2020. If you are self-employed or an independent contractor gig economy worker clergy as well as those working for religious organizations and other workers including non-profit entities you are not covered by the state unemployment. Traditionally the self-employed have not been able to receive unemployment as they do not pay the government unemployment insurance.

Self-employed Virginia residents and gig-economy workers will be waiting a few more weeks for their unemployment benefits to start rolling in. Unemployment virginia self employed. Cogar 62 changed her mind last.

Maximize your self employment tax deductions and save money. Self employment unemployment virginia. The federal requirement is Form 1040-ES Estimated Tax for Individuals.

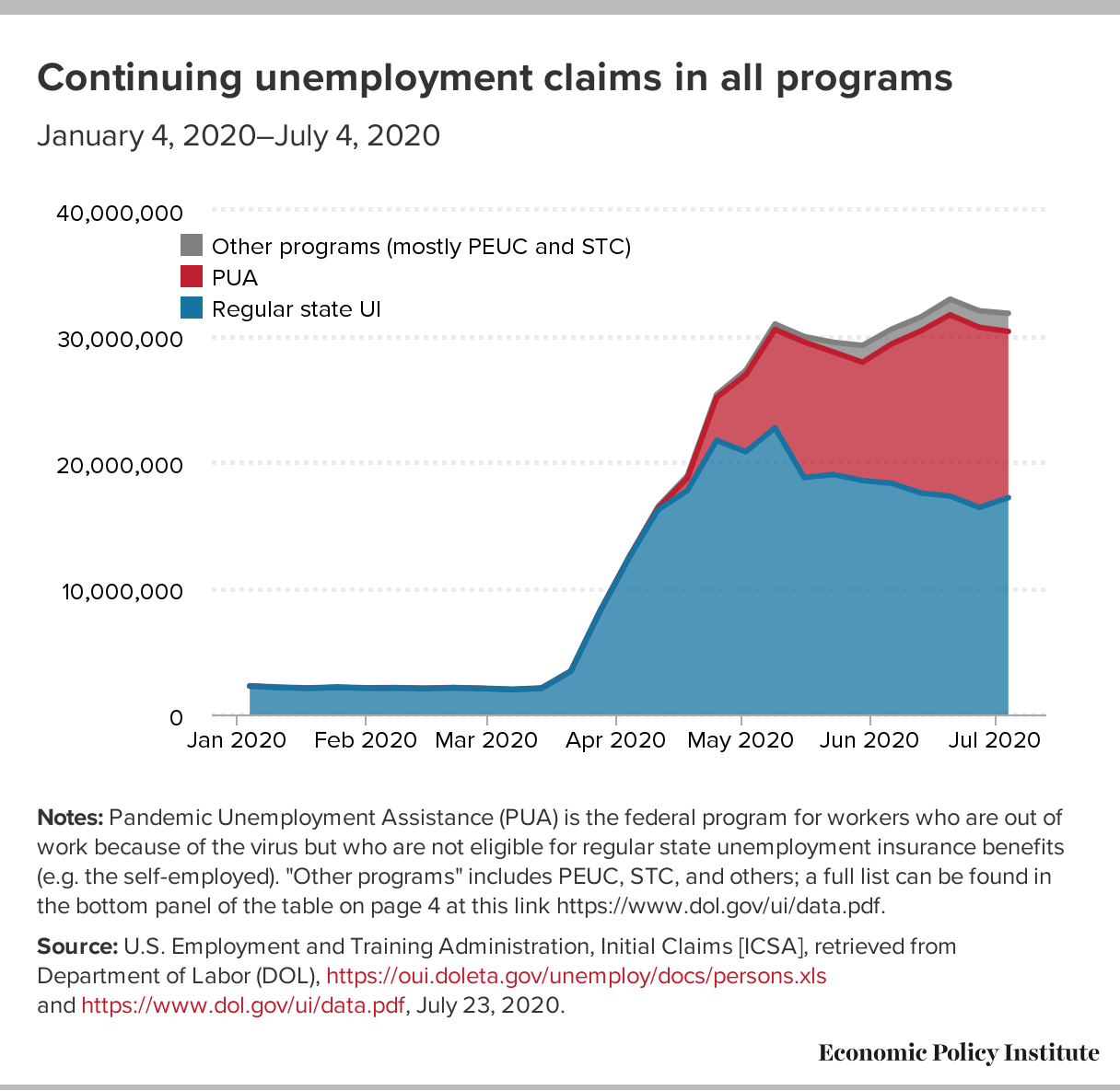

Joblessness Remains At Historic Levels And There Is No Evidence Ui Is Disincentivizing Work Congress Must Extend The Extra 600 In Ui Benefits Economic Policy Institute

Changes Coming To Virginia S Unemployment Insurance Due To Cares Act

Virginia Employment Commission Faces Backlash From Citizens Articles Fairfaxtimes Com

Pandemic Unemployment Assistance Initial Claims In West Virginia Puaicwv Fred St Louis Fed

Cuts To Unemployment Benefits Didn T Get People Back To Work Study Finds

How To File For Unemployment Benefits If You Re Self Employed Youtube

Pandemic Unemployment Assistance Pua Benefits Checklist

Unemployed Contractors Self Employed Virginians Can Now File Weekly Claims Through Gov2go App Youtube

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

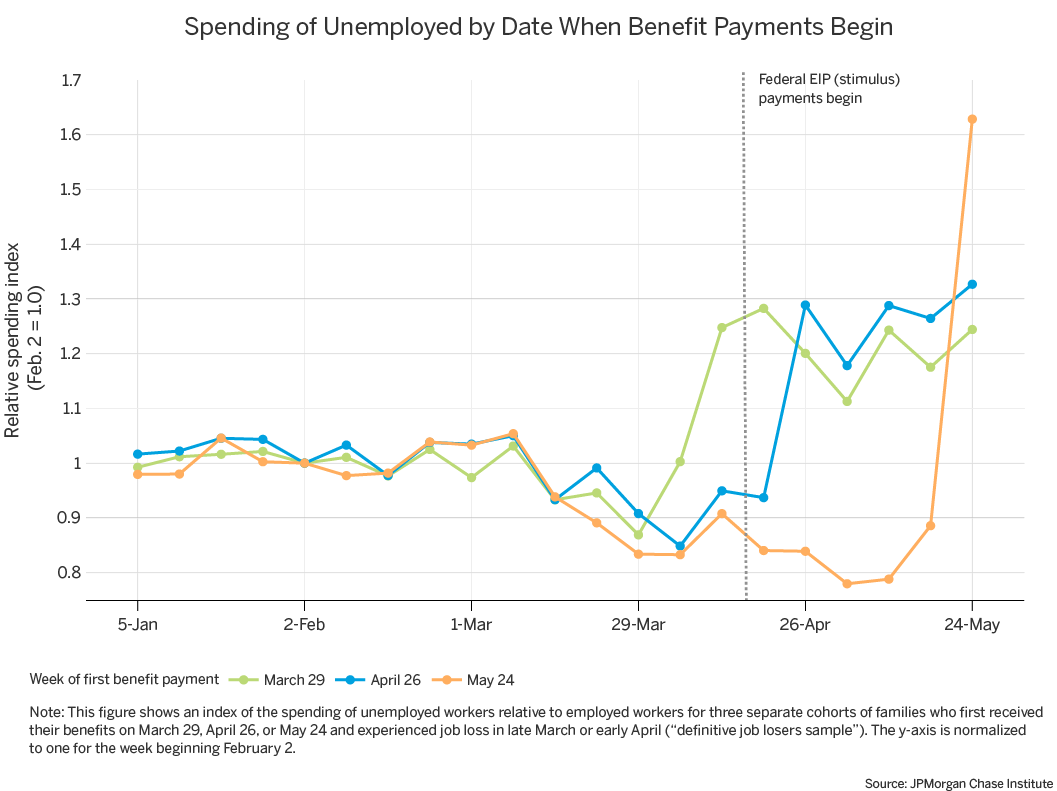

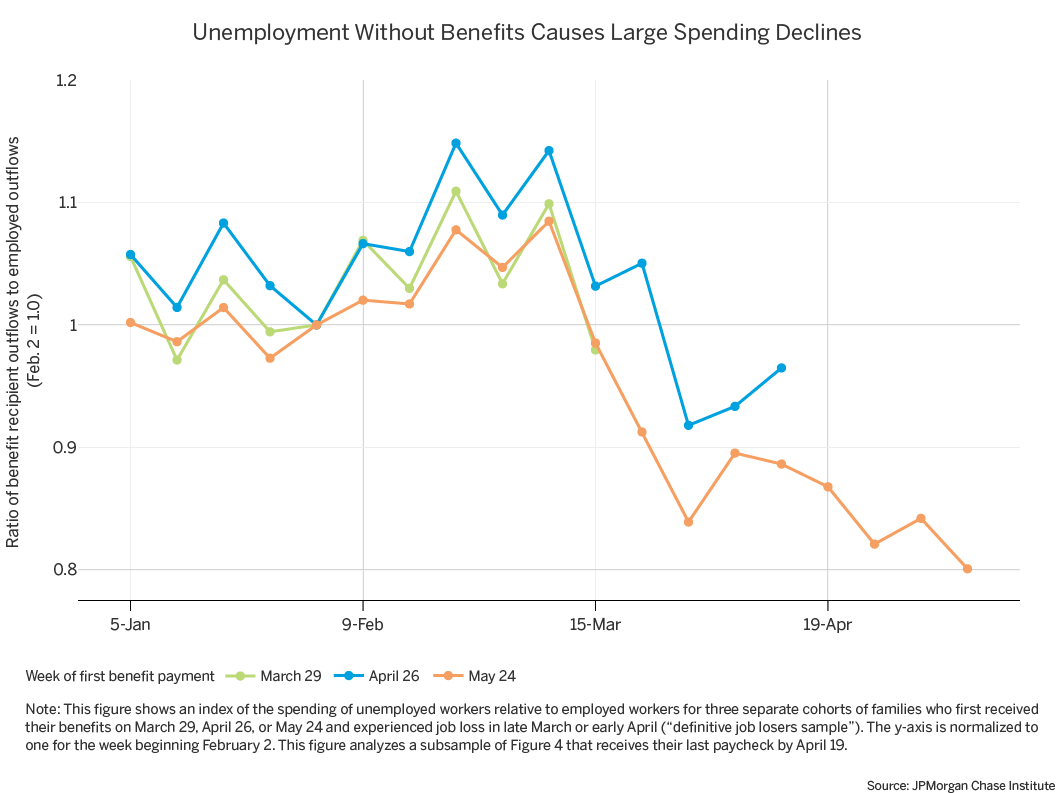

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

![]()

Workers Describe A Painful Wait For Unemployment Benefits During Coronavirus Shutdowns Wamu

Virginia Announces Changes In Unemployment Insurance Program As A Result Of The Federal Cares Act Virginia Employment Commission

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Important Information Regarding Work Search Requirements Virginia Employment Commission

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

02 25 21 Webinar Proof Of Self Employment Employment For Pua Youtube

Pandemic Unemployment Assistance U S Representative Rob Wittman

New Unemployment Program For Indiana

Pandemic Related Unemployment Benefits Slated To End In September

/cloudfront-us-east-1.images.arcpublishing.com/gray/JGRFHB4GZRESXH6ONAXWOIXSRY.PNG)

![[Download] Whatsapp DP Images ✅ Whatsapp Profile Pictures](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiA91BRwYG5DedFYpMdoyylxsS7zbFCp-nDvQYbuzuYq2c7v8fMoiLnw3VXyV-YRCvIGY1X8nIX3nAxfSIrwHCYDZ0C83ldFP3GkIz5MvoeNzH3OXRlfIaDUPEihdaox8BsF71CNfcOp6fn/w680/whatsapp+dp+%25281%2529.jpg)

![[Download] Kiara Advani Images ( ͡◉ ͜ʖ ͡◉)](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjtddeFOE7-u6iQJSDuyR1y3cVV0Q42mVStdcv9uhHNoImH20LndvwKvNr_ohUxLyLkY-dzlglSxmoH-8HmogVd4oOzmhPleHANfajwSHgqhforffJ6yPQy5bN56dd_aTfnskpoDW3Phrue/w680/kiara+advani+images+%25281%2529.jpg)