Your Payroll NZ is a FREE self-managed online payroll tool for business owners of all sizes. Tax rate estimation tool for contractors.

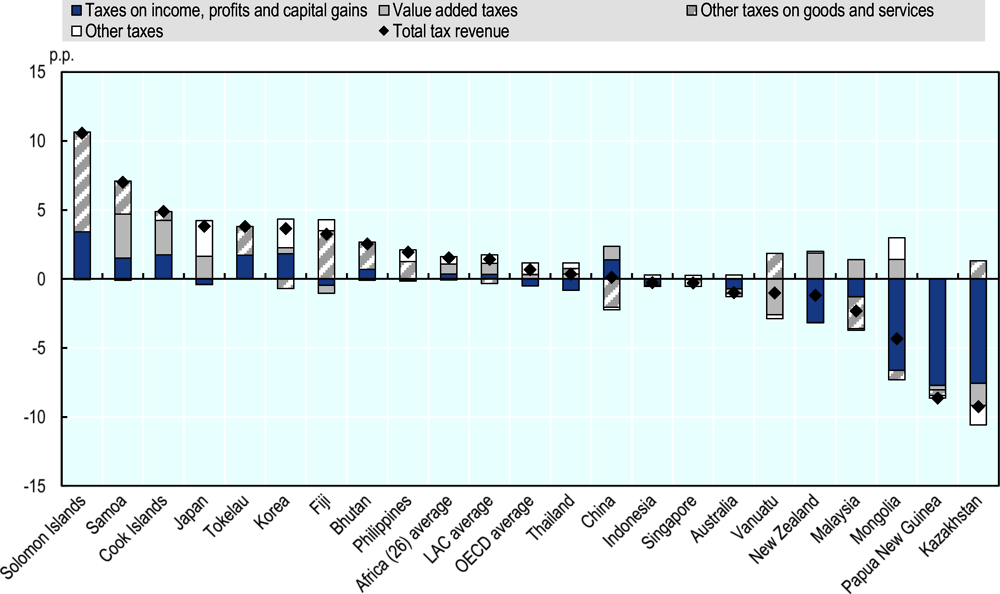

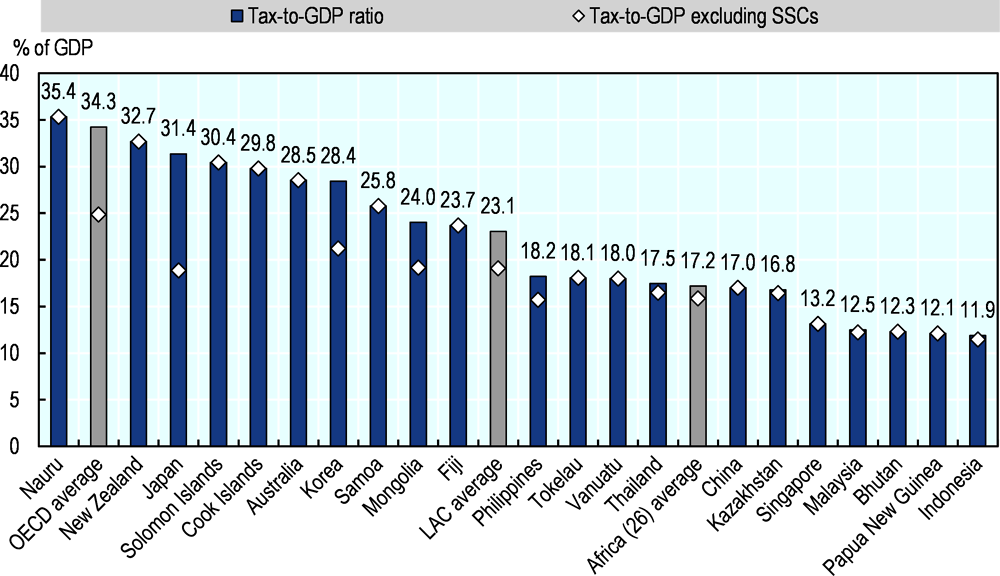

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary

There are specific rules for payroll and taxation in New Zealand depending upon whether your company employs foreign nationals or local New Zealand employees.

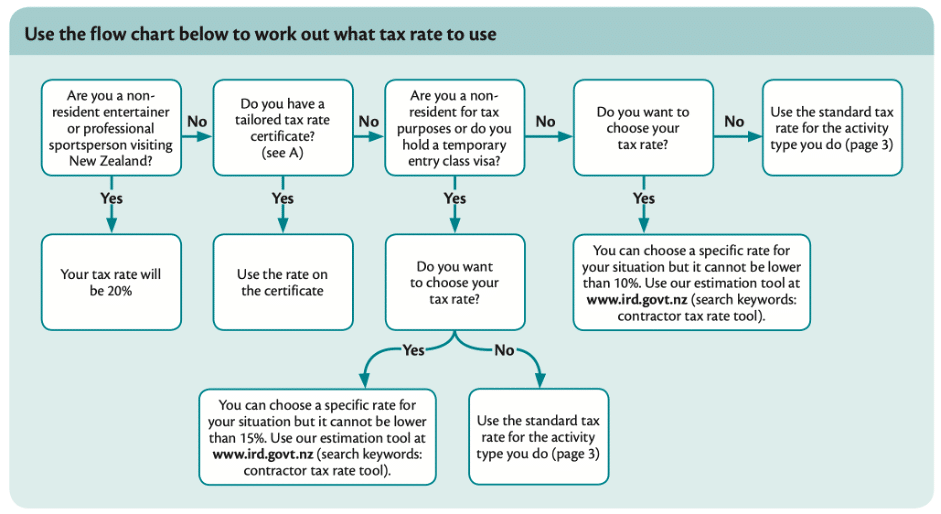

Payroll tax rate nz. All contractors can pick the rate to have tax deducted at. The primary concerns for a foreign company that needs to comply with. Go to this tool.

A solidarity surcharge tax rate is levied on the actual income tax amount. PAYE deductions from salary or wages calculator. Existing employers pay between 006 and 79.

Comparing the New Zealand and Australian tax systems. When a new employee starts or one terminates their. The corporate tax rate in New Zealand is 28.

Our set up fee to process New Zealand payroll is 150 GST plus 20 GST per employee. From 1 April 2021. Employers and employees can work out how much PAYE should be withheld from wages.

Fill out the form. 2020 and 2021. Tax threshold and rate change The IRD has proposed a new tax threshold rate of 39 for income over 180000.

Between accounting bookkeeping refunds payroll and Inland Revenue laws and taxes Your Payroll has years of experience in dealing with any. A new secondary tax code. New Zealands Best PAYE Calculator.

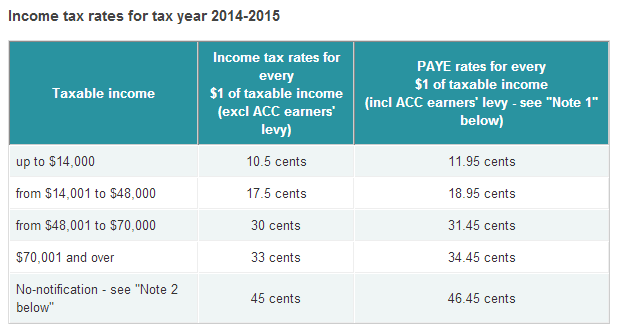

Goods and services tax GST Income tax. The first band is 0-14000105 14000-48000175 48000-7000030 the anything over 7000033 - so your average of 28 is probably about correct. 1 Tax in NZ is at a graduated rate.

It is a Kiwi-owned and operated business based in New Zealand. Our monthly fee is 50 GST plus 20 GST per employee per pay run. For Reference - Income Tax Rates PAYE.

New Zealand Payroll Basic Facts. Types of wage rates. The subsidy paid at a flat rate of.

2021 and 2022. New Zealand went through a major program of tax reform in the 1980s. Minimum wage rates apply to all employees aged 16 and over who are full-time part-time fixed-term casual working from home and paid by wages salary commission or piece rates some exceptions.

Previous minimum wage rates. These are outlined in Schedule 4 of the Income Tax Act 2007 and a more detailed breakdown of the activities subject to Tax on Schedular Payments and the rates can be found at the end of this article. Between accounting bookkeeping refunds payroll and Inland Revenue laws and taxes Your Payroll has years of experience in dealing with any.

Income Tax Rates PAYE. Put your details into the calculator. Income Tax in New Zealand.

They refer to it as the Unemployment Insurance Contribution Rate UI. The top marginal rate of income tax was reduced from 66 to 33 changed to 39 in April 2000 38 in April 2009 and 33 on 1 October 2010 and corporate income tax rate from 48 to 28 changed to 30 in 2008 and to 28 on 1 October. For each dollar of income Tax rate.

The Goods and Services Tax GST rate is 15 and is applied to most goods and services bought in New Zealand and some bought outside of them but businesses are able to claim back GST that they have paid out. The amount of tax you pay depends on your total income for the tax year. 58580 for people working 20 hours or more per week full-time rate 35000 for people working less than 20 hours per week part-time rate.

26 rows This is a flat rate and is taxed regardless of whether the contractor is GST registered. The rates increase as your income increases. It is a Kiwi-owned and operated business based in New Zealand.

New Zealand tax residents can pick any rate from 10 per cent up to 100 per cent. Withholding tax statement and payments are due to be paid to the authorities by the 10th of the following month. How does Tax on Schedular Payments impact on payroll.

Are you using NZ Payroll not Essentials Payroll. A state-operated social welfare system provides benefits during sickness unemployment disability and retirement and is funded by general taxation. Income up to 14000.

There is no social security payroll tax. About Your Payroll. Calculate your take home pay from hourly wage or salary.

Debt help - debt is everywhere in New Zealand and our guide walks you through the options available. The typical penalty awarded for the late submission is a maximum 10 of the assessed tax. KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE.

Here is a very basic comparison between the New Zealand and the Australian tax systems to assist you to conduct a Trans-Tasman business. New York Payroll Tax Rate Example New employers pay 313 in SUTA for employees making more than 11100 per year. If youre an employer fill in the details for each employee.

The subsidy is paid as a lump sum and covers 8 weeks per employee from the date you submit your application. Current minimum wage rates. Payroll bureaus Ng tari utu -rrangi.

There are some amendments due to this change which would impact payroll including. There is a minimum monthly fee of 150 GST. New Zealand has progressive or gradual tax rates.

Your Payroll NZ is a FREE self-managed online payroll tool for business owners of all sizes.

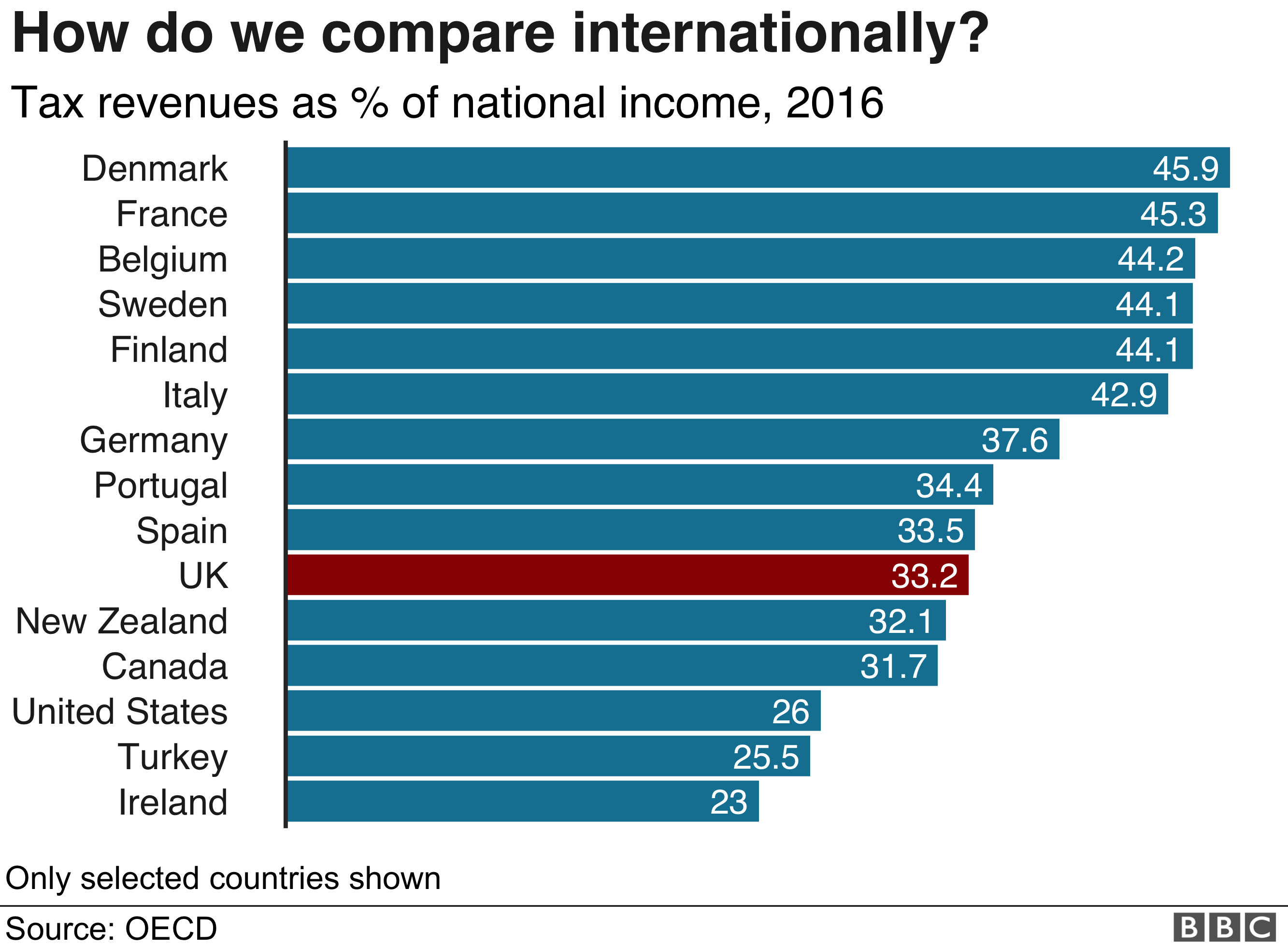

General Election 2019 How Much Tax Do British People Pay Bbc News

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary

Personal Income Tax Reform In New Zealand Scoop News

Https Eml Berkeley Edu Saez Course Labortaxes Taxableincome Taxableincome Attach Pdf

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Income Tax In New Zealand Moving To New Zealand

Contracting And Withholding Tax Kiwitax

Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asian And Pacific Economies 2020 Oecd Ilibrary

Which Country Has More Taxes Canada Australia Or New Zealand Quora

Tax Accountant Tax Rates Income Tax Tax Facts Nobilo Co

Experienz Immigration Nz Immigration Advisors Experienz Immigration Services Ltd

How To Calculate Foreigner S Income Tax In China China Admissions

Https Eml Berkeley Edu Saez Course Labortaxes Taxableincome Taxableincome Attach Pdf

Another Study Confirms U S Has One Of The Highest Effective Corporate Tax Rates In The World Tax Foundation

New Zealand Tax Codes And Rates Your Refund Nz

More Than 40 Of Millionaires Paying Tax Rates Lower Than The Lowest Earners Government Data Reveals Stuff Co Nz