The withholding tax for non-residents is collected by the Federal Central Tax Office for remuneration paid after 31 December 2013 and by the Lnder state level administration of the German government for remuneration paid prior to this date. Germany Country Profile - 2020 Germany Country Profile - 2020 Key tax factors for efficient cross-border business and investment involving Germany.

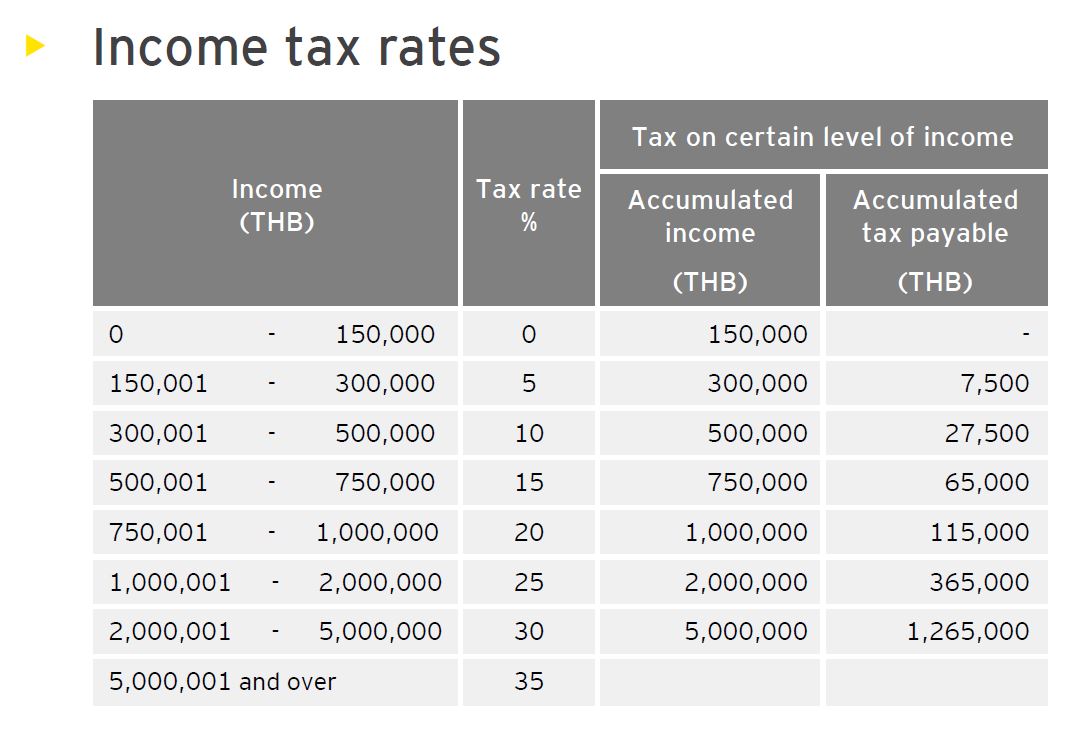

Real Estate Taxation In Thailand Thai Property Group

IP registrable in Germany includes for example patents trademarks and designs.

Germany withholding tax rates 2020. The withholding tax rate on dividends in Germany is 25. Domestic income earned by foreign artists athletes license grantors and directors within the meaning of Section 49 Income Tax Act EStG is subject to limited tax liabilityThis income is taxed using a special procedure the tax withholding procedure defined in Section 50a EStG. Withholding tax rates On dividends paid to non-resident companies.

Surcharges on income tax To improve the economic situation and infrastructure for certain regions in need the German government has been levying a 55 solidarity surcharge tax. In general this Tax Guide does not reflect any COVID-19 tax policy measures. The Federation and the Lnder share the revenue in a predetermined ratio.

The statutory rate is 25 26375 including the solidarity surcharge unless the EU interest and royalties directive applies or the rate is reduced under a tax treaty. Geometrically progressive rates start at 14 and rise to 42. There is no capital gains tax on a property held for more than 10 years.

Tax on loans secured on German property is not imposed by withholding but by assessment to corporation tax at 15 plus solidarity surcharge of the interest income net of attributable expenses. Capital gains on shares are taxed at a flat 26375 irrespective of how long they are held. In principle Germany levies a 25 withholding tax on dividends plus a surcharge of 55 of that tax both on domestic and foreign recipients.

Generally 26375 percent. Solidarity surcharge Solidaritaetszuschlag capped at 55 of your income tax Church tax 8 9 if you are a member of a registered church in Germany In Germany for tax purposes you are either a resident or a non-resident. For the latest developments access the EY Tax COVID-19 Response Tracker here.

The tax authorities can order a WHT of 15825 including solidarity surcharge if ultimate collection of the tax due is in doubt. Withholding Tax Rates 2021 includes information on statutory domestic rates that apply to payments from a source jurisdiction to nonresident companies without a permanent establishment in that source jurisdiction. Germany has progressive tax rates ranging as follows 2021 tax year.

Global tax rates 2021 is part of the suite of international tax resources provided by the Deloitte International Tax Source DITS. Real property tax Grundsteuer. Keep up-to-date on significant tax developments around the globe with EYs Global Tax Alert library here.

The tax rate varies from 7 to 50 depending on the value of the inheritance. How does the Germany Income Tax compare to the rest of the world. A reduced rate of 7 applies to food agricultural products public transport books e-books and magazines hotels short-term accommodation and certain cultural services social services medical equipment for disabled persons and firewood.

Inheritance and gift tax Erbschafts - und Schenkungssteuer If you are a taxpayer in Germany or you are the beneficiary of a German taxpayer you will be taxed for any assets you may receive. Foreign artists athletes license grantors and directors payees can claim relief from German withholding. There is no separate tax on capital gains.

Capital gains are subject to income tax as regular income however. The content of this Tax Guide is current as of 1 January 2020 with exceptions noted. Corporate recipients can obtain a reduction of the withholding tax to 15 even if they cannot benefit from a tax treaty.

Withholding tax generally is not levied on interest except for interest on publicly traded debt interest received through a German payment agent usually a bank convertible bonds and certain profit participating loans. Germany has a bracketed income tax system with four income tax brackets ranging from a low of 000 for those earning under 8005 to a high of 4500 for those earning more then 250730 a year. The tax rate is 15825 15 corporate income tax plus 55 solidarity surcharge thereon.

To this rate a solidarity surcharge is applicable bringing the total amount to 26375. Non-resident companies in Germany can benefit from a refund for this tax if they qualify for this exemption and if they do the refund value can be of 40. There is no capital gains tax on a property used as a private home.

Https Www Walderwyss Com User Assets Publications Ct20 Chapter 33 Switzerland Pdf

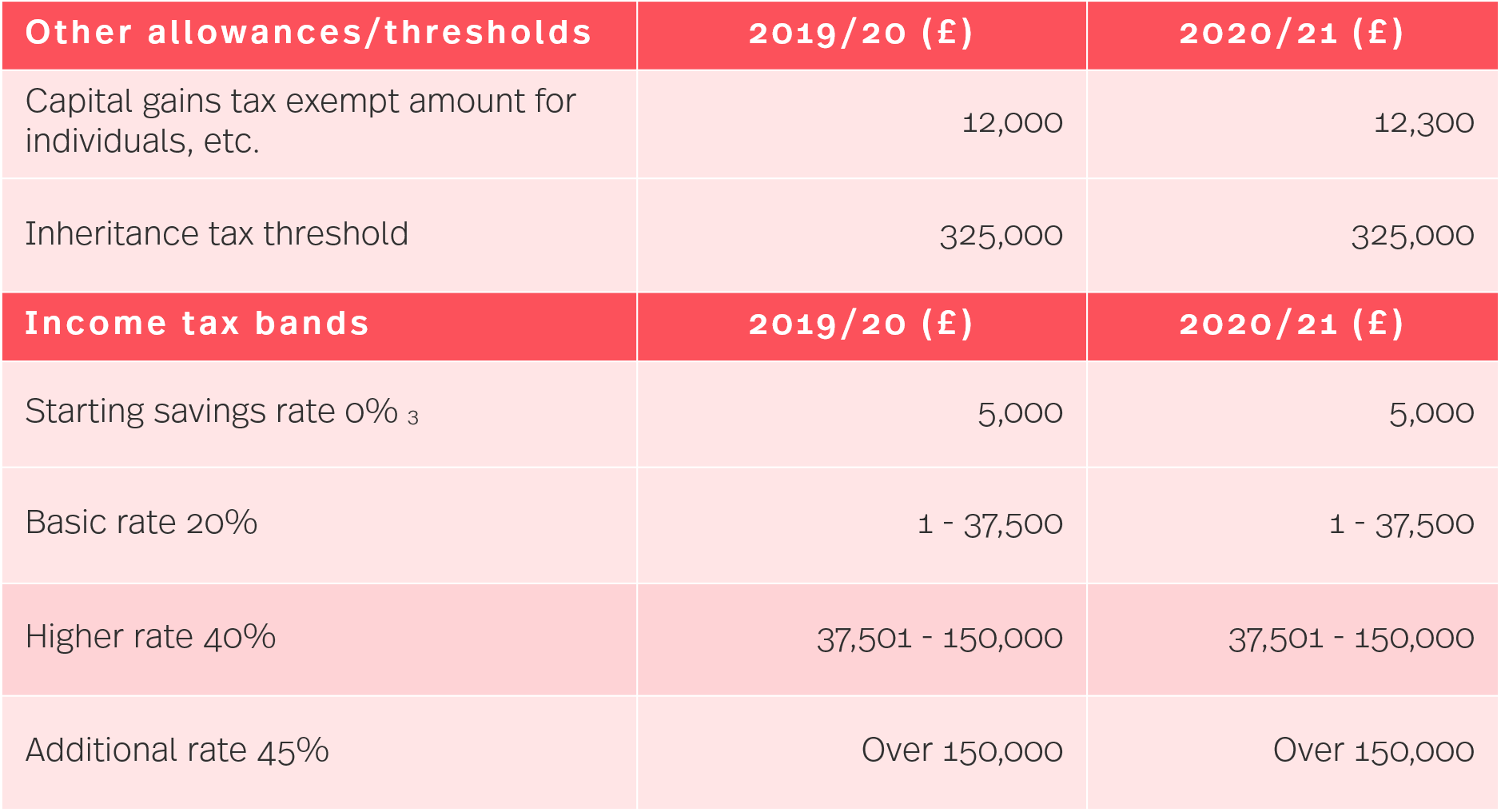

Simmons Simmons Hmrc Tax Rates And Allowances For 2020 21

Income Tax Slab Current Tax Rates Brackets For Fy 2020 21

Simmons Simmons Hmrc Tax Rates And Allowances For 2020 21

Infographic Of 2020 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Global Corporate And Withholding Tax Rates Tax Deloitte

Individual Income Tax In Malaysia For Expatriates

Payroll And Tax Services In Malaysia Tax Services Payroll Taxes Payroll

France S 2020 Social Security Finance And Income Tax Bills To Introduce Significant Changes Ey Global

Budget 2020 Affordable Homes Get Tax Holiday Boost Income Tax Tax Payment Tax Attorney

Https Assets Kpmg Content Dam Kpmg Rs Pdf 2020 05 Rs Sb Tax Card Eng Online 2020 Pdf

Https Www2 Deloitte Com Content Dam Deloitte De Documents Country 20services 20group Monthly German Tax News Update June 2021 Pdf

Reduce Tax Burden On Intellectual Property Assets No More Tax

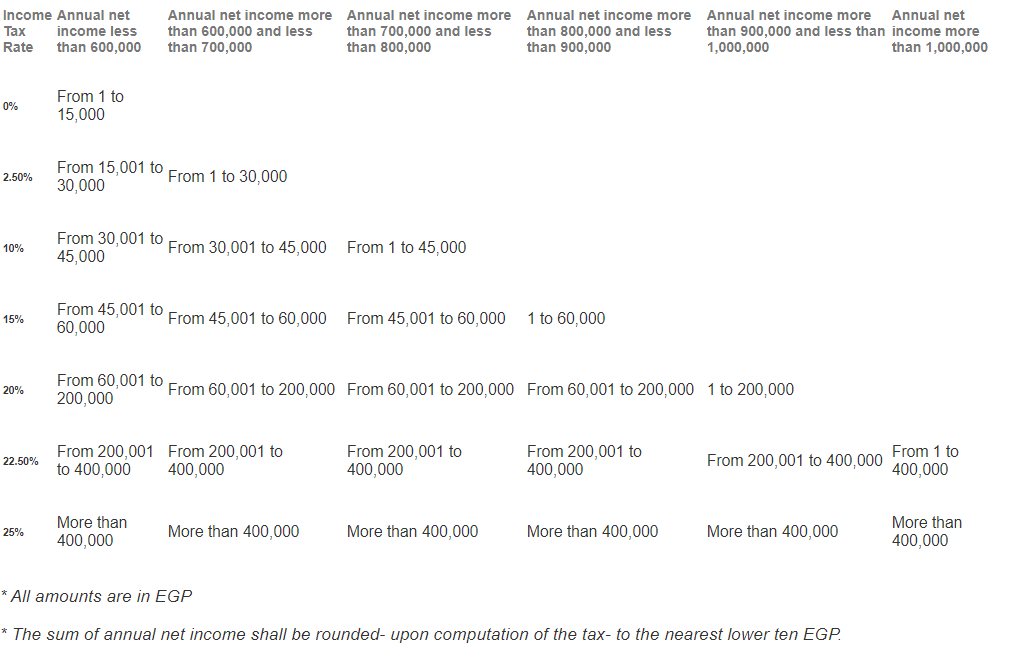

Egypt Amends Progressive Individual Income Tax Rates And Penalties Applicable On Tax Return Differences Ey Global

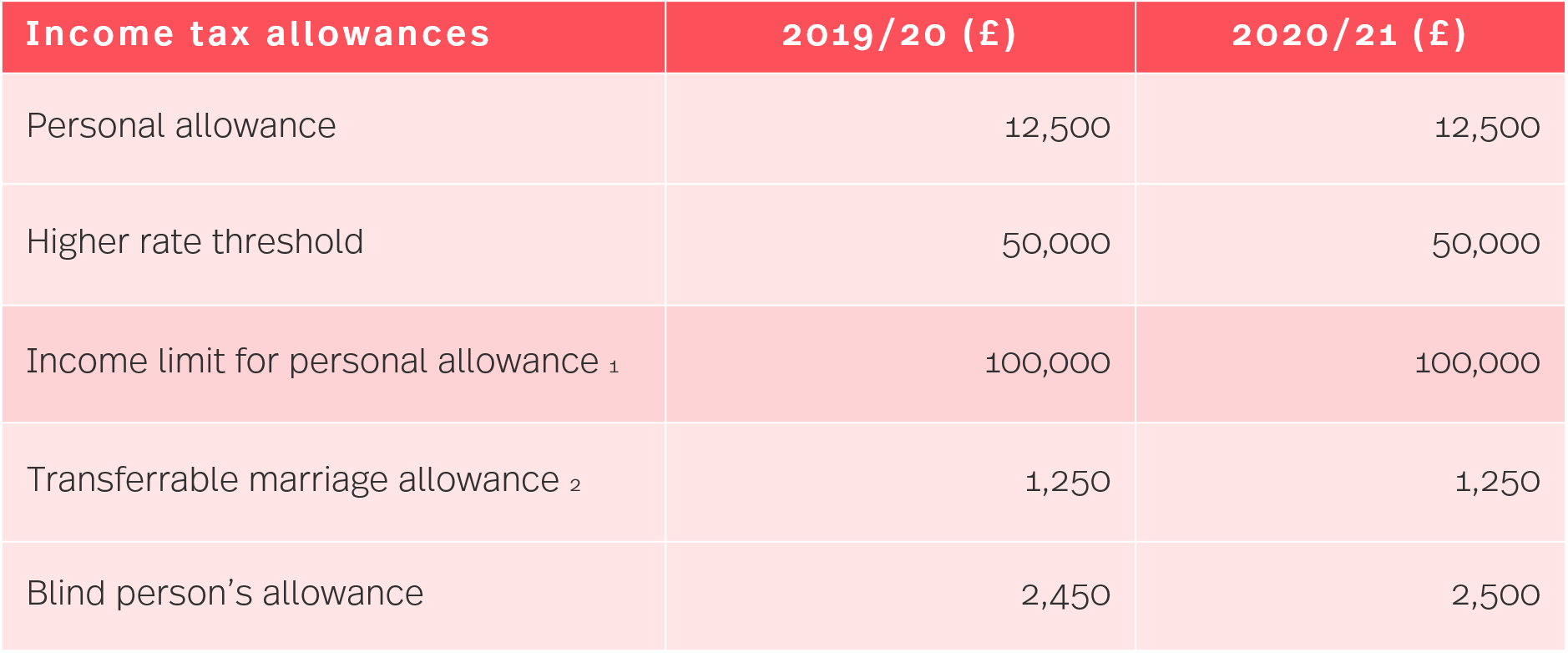

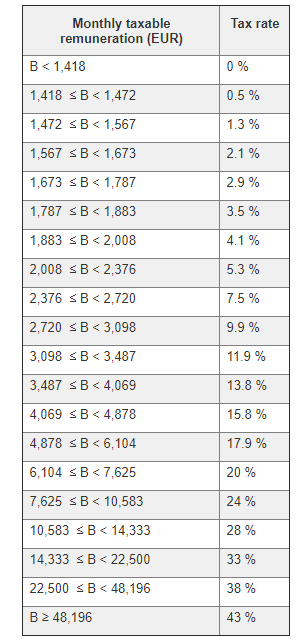

France S 2020 Social Security Finance And Income Tax Bills To Introduce Significant Changes Ey Global

Bulgaria Business Attraction In The Eu No More Tax

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

![[Download] Whatsapp DP Images ✅ Whatsapp Profile Pictures](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiA91BRwYG5DedFYpMdoyylxsS7zbFCp-nDvQYbuzuYq2c7v8fMoiLnw3VXyV-YRCvIGY1X8nIX3nAxfSIrwHCYDZ0C83ldFP3GkIz5MvoeNzH3OXRlfIaDUPEihdaox8BsF71CNfcOp6fn/w680/whatsapp+dp+%25281%2529.jpg)

.jpg)