This an employer-only tax. Currently approximately 44 percent of Iowas ranked employers have a 0000 percent rate.

Iowans Here Is How The 2019 Tax Law Affects You And Your 2020 And 2021 Iowa Tax Brackets Arnold Mote Wealth Management

In most cases youll be credited back 54 of this amount for paying your state taxes on time resulting in a net tax of 06.

Employment tax rates iowa. Employers with previous employees may be subject to a different rate. Tax rate of 225 on taxable income between 3333 and 6664. Tax rate of 033 on the first 1666 of taxable income.

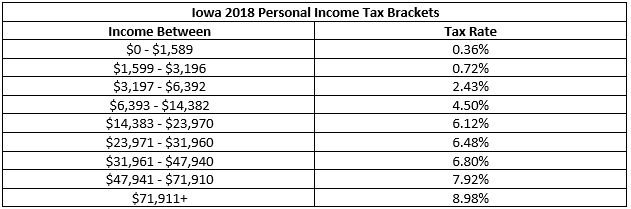

Iowa has nine marginal tax brackets ranging from 033 the lowest Iowa tax bracket to 853 the highest Iowa tax bracket. State Unemployment Tax Rate In Iowa the new employer SUI state unemployment insurance rate is 10 percent on the first 32400 of wages for each employee. Electronic Reporting of Wage Statements and Information Returns.

But it also has one of the lowest bottom rates. This 6 federal tax is to cover unemployment. ARC 5532C was published on.

Rates vary from 0000 to 9000 on table 1 and from 0000 to 7000 on table 8. If federal income tax is withheld on a flat rate basis Iowa income tax is required to be withheld at the rate of 6 percent. The 2020 rates range from 0 to 75 on the first 32400 in wages paid to each employee in a calendar year.

Each of the 21 ranks contain approximately 476 percent or 121 of the total taxable wages reported by the same employers for the four calendar quarters immediately preceding the rate computation date July 1. Each of the 21 ranks contain approximately 476 percent or 121 of the total taxable wages reported by the same employers for the four calendar quarters immediately preceding the rate computation date July 1. Stay up to date with Iowas latest unemployment rates.

Employers How to Obtain a Refund of Iowa Withholding Tax. However if the supplemental wage payment is included with the regular wage payment the two are combined and the withholding tables or formulas are used. Application For Extension of Time to File Iowa W-2 Wage Statements.

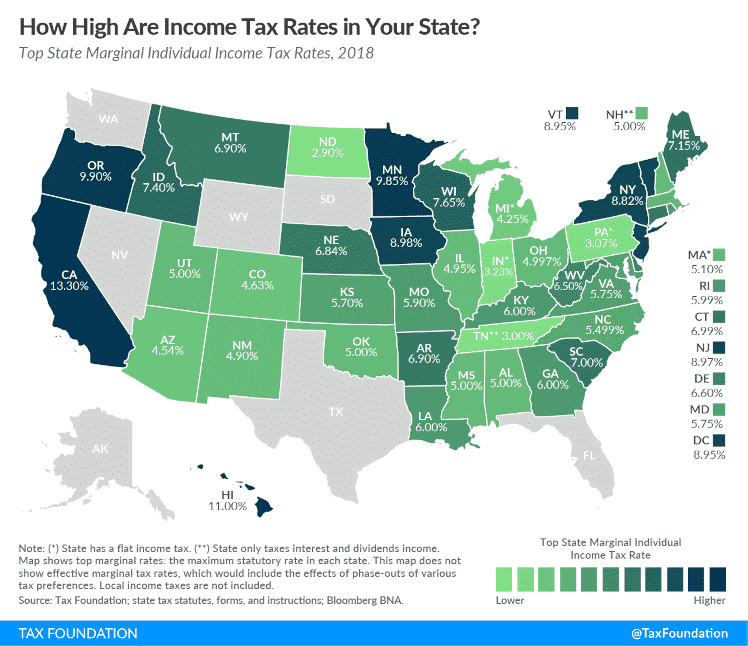

Known for its rolling plains and beautiful cornfields Iowa is home to an income tax system that ranges from one of the lowest income tax rates in the country at 033 to one of the highest at 853. Earners in Iowas bottom tax bracket pay a rate of just 033. View 2020 Withholding Tax Tables.

Back to Expanded Instructions Index Federal self-employment tax. In response to 2019 HF779 and 2020 legislation HF2461 the Department updated its rules and forms related to powers of attorney and disclosure. New construction employers pay 75.

Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in Iowa for single filers and couples filing jointly. The Iowa Department of Revenue has released updated state tax guidance regarding Iowa Solar Energy System Tax Credits. Sources from the Iowa Workforce Development Department indicate that unemployment tax rates for 2021 will remain unchanged.

Tax rate of 067 on taxable income between 1667 and 3332. This means table 1 collects the most UI tax and table 8 collects the least UI tax. Federal self-employment tax is not allowed as a deduction for federal taxes in this step of the Iowa return see line 17 for partial deductibility as an adjustment to income.

Detailed Iowa state income tax rates and brackets are available on this page. As an employer in Iowa you have to pay unemployment insurance to the state. If youre a new employer congratulations you pay a flat rate of 1.

For single taxpayers living and working in the state of Iowa. Effective for 2021 unchanged from 2020 total tax rates for experience-rated employers will range from 000 to 750. The tax system is made up of nine tax brackets which are dependent upon residents income level.

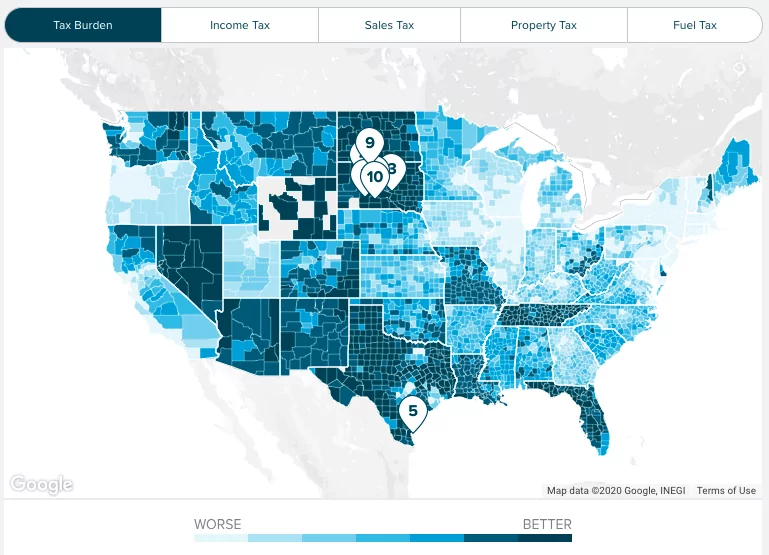

Currently approximately 44 percent of Iowas ranked employers have a 0000 percent rate. The sales tax in Iowa meanwhile ranges from 6 to 7 when including local rates which is near the national average. This chart compares Iowas unemployment rate over the past several months with the national average.

The Iowa law stipulates that UI taxes may be collected from employers under eight different tax rate tables and each tax rate table has 21 rate brackets or ranks. The Iowa income tax has nine tax brackets with a maximum marginal income tax of 853 as of 2021. The tax rate is based on withholdings chosen on the employees W-4 form.

The states income tax system features one of the highest top rates which at 853 ranks among the highest states. If any part of the federal tax payments on lines 31 32 or 33 includes self-employment tax then the self-employment tax must be added back on line 28.

Pdf Sales Taxes And The Decision To Purchase Online

Iowans Here Is How The 2019 Tax Law Affects You And Your 2020 And 2021 Iowa Tax Brackets Arnold Mote Wealth Management

Tax Withholding For Pensions And Social Security Sensible Money

Why Is Overtime Taxed At A Higher Rate How Are The Rates Determined Quora

Who Pays Taxes In America In 2019 Itep

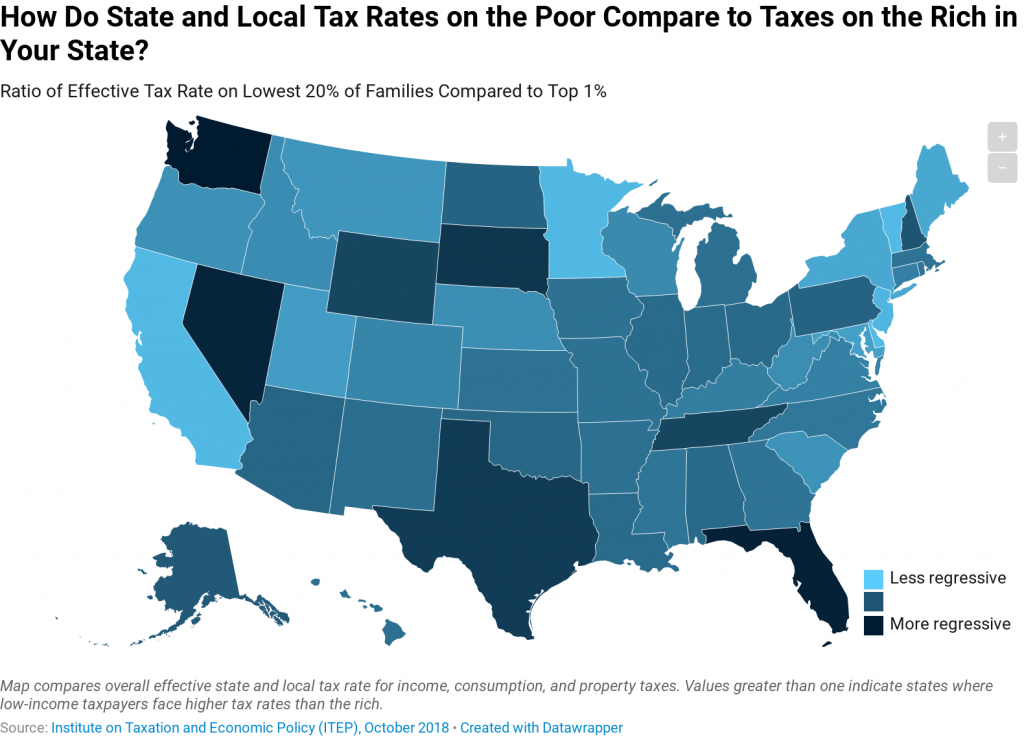

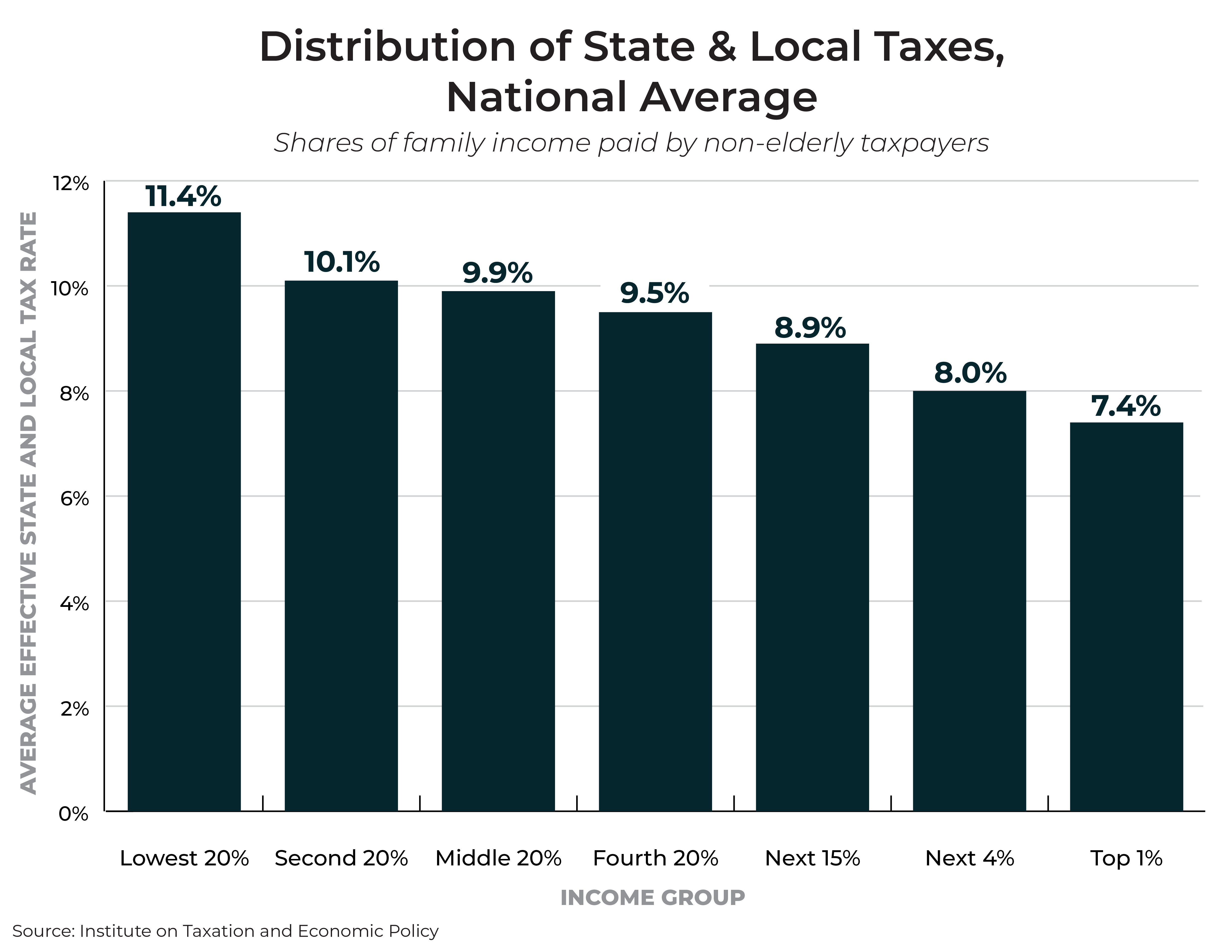

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep

Wisconsin Income Tax Calculator Smartasset

Iowans Here Is How The 2019 Tax Law Affects You And Your 2020 And 2021 Iowa Tax Brackets Arnold Mote Wealth Management

Ag Payroll Iowa State Extension Iowa Payroll Iowa State

Calculator How Much Must You Earn At A Job In Another State To Maintain Your Quality Of Life Best Places To Live Cheapest Places To Live States In America

States With Highest And Lowest Sales Tax Rates

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

Sticker Shock Iowa S High Corporate Tax Rate Deters Growth Tef Iowa

The Implications Of The Tjca S Large Increase In The Estate And Gift Tax Exemption Are Complex And Affect Estate Estate Planning Income Tax Federal Income Tax

Fairness Matters A Chart Book On Who Pays State And Local Taxes Itep

2021 Federal State Payroll Tax Rates For Employers

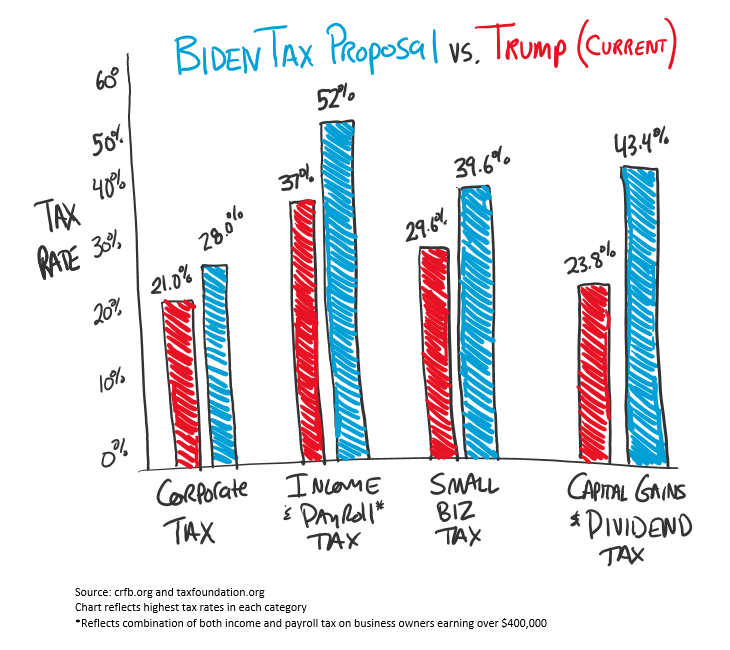

The 2020 Election Tax Comparison Trump V Biden Wes Moss

Income Tax Changes For 2019 Ag Decision Maker Iowa State University Extension And Outreach